Driven by an inflation-fueled demand for deals, the official kick-off weekend of the 2022 shopping season outperformed events of the past two years albeit with a new bias for more point-of-sale credit and financing and increased reliance on digital channels than ever before.

PYMNTS’ just published survey of nearly 3,100 consumers on Nov. 25 and 26 found that 33% of shoppers who wanted to make purchases over the weekend opted out over cash and credit concerns.

At the same time, the “Black Friday 2022: High Prices Reshape Holiday Shopping Habits” report also found that another 31% of respondents who bowed out said stores were too crowded during Black Friday weekend, reflecting an odd imbalances high prices are creating this season.

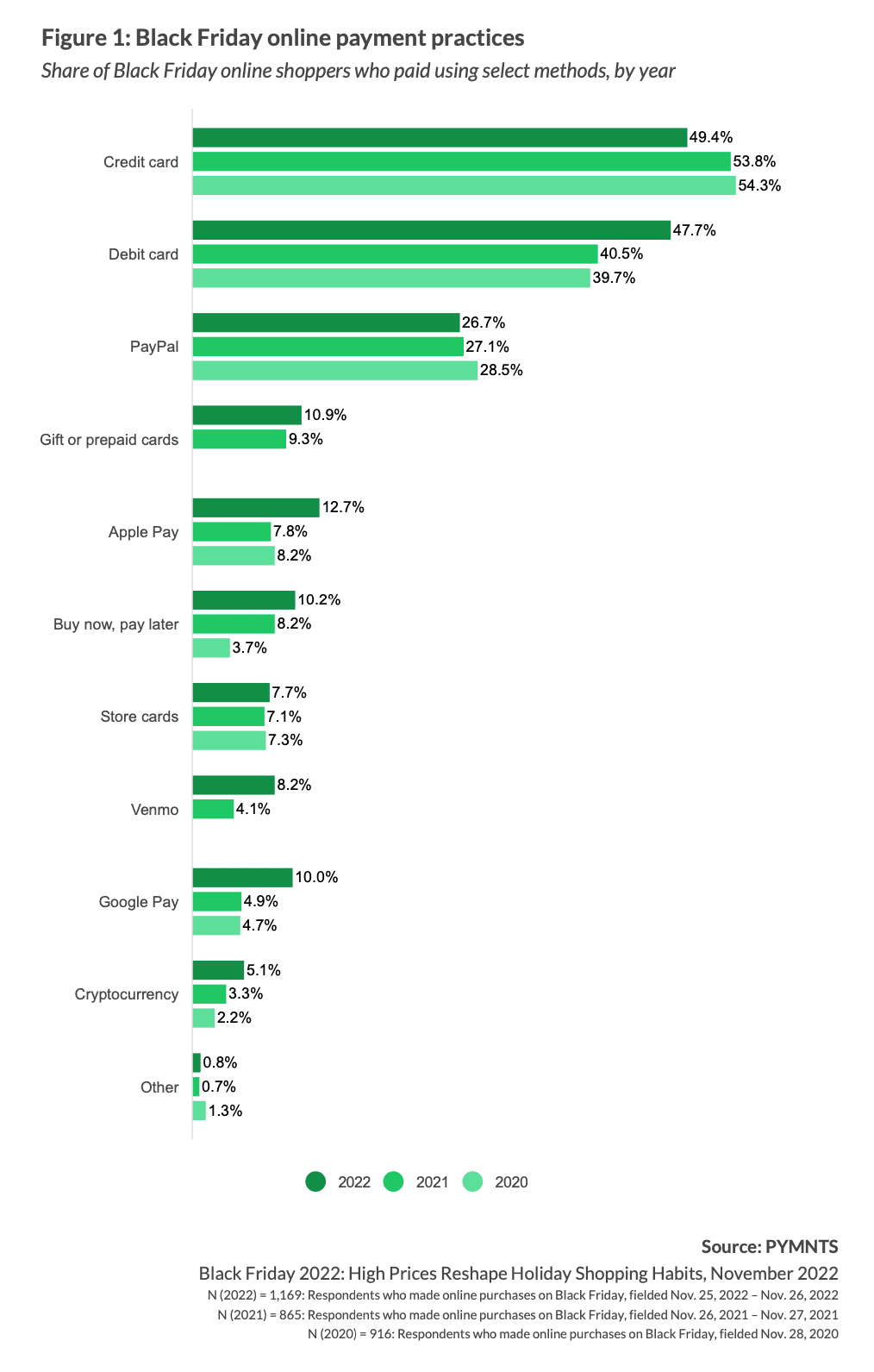

With inflation eating paychecks at historic rates, consumers who did shop turned to financing in droves. PYMNTS data found that almost one-third of shoppers used credit cards, point-of-sale loans or installment plans to pay for their Black Friday buys this year. Those who turned to these options “used them to finance at least half of their Black Friday purchases. This shows how drastically soaring prices have impacted consumers’ shopping experiences,” per the report.

That includes 45% of paycheck-to-paycheck consumers who leaned heavily on credit and financing to get Black Friday deals, paying for nearly 60% of their purchases in these ways.

Advertisement: Scroll to Continue

Millennials relied more than any group on financing, with 45% of this cohort reporting use of credit, personal loans, and buy now pay later (BNPL) options to finance 51% of purchases.

Payment patterns between online and in-store shopping varied, as expected, but perhaps not as widely as was imagined. For example, our data shows that about 8% of in-store shoppers used BNPL to make their purchases, compared to just over 10% online.

Get your copy: Black Friday 2022: High Prices Reshape Holiday Shopping Habits

If you’re looking for growth, it was in the use of digital payment methods. Our data shows that 13% of Black Friday shoppers going online used Apple Pay this year, up almost 8% (7.8%) over 2021. Similarly, online BNPL and cryptocurrency hit new highs at reached 10% and 5.1% respectively. Additionally, 10% of online shoppers paid using Google Pay, and 8.2% paid with Venmo. “This is twice the share who used these payment methods just one year ago.”

In-store trends were equally eye-bulging, with in-store BNPL use up 41% year over year among Black Friday shoppers in 2022, and in-store Venmo use increasing by 63%. In-store shoppers using Samsung Pay rose by 23%, and even beleaguered cryptocurrency payments spiked by 9.2%.

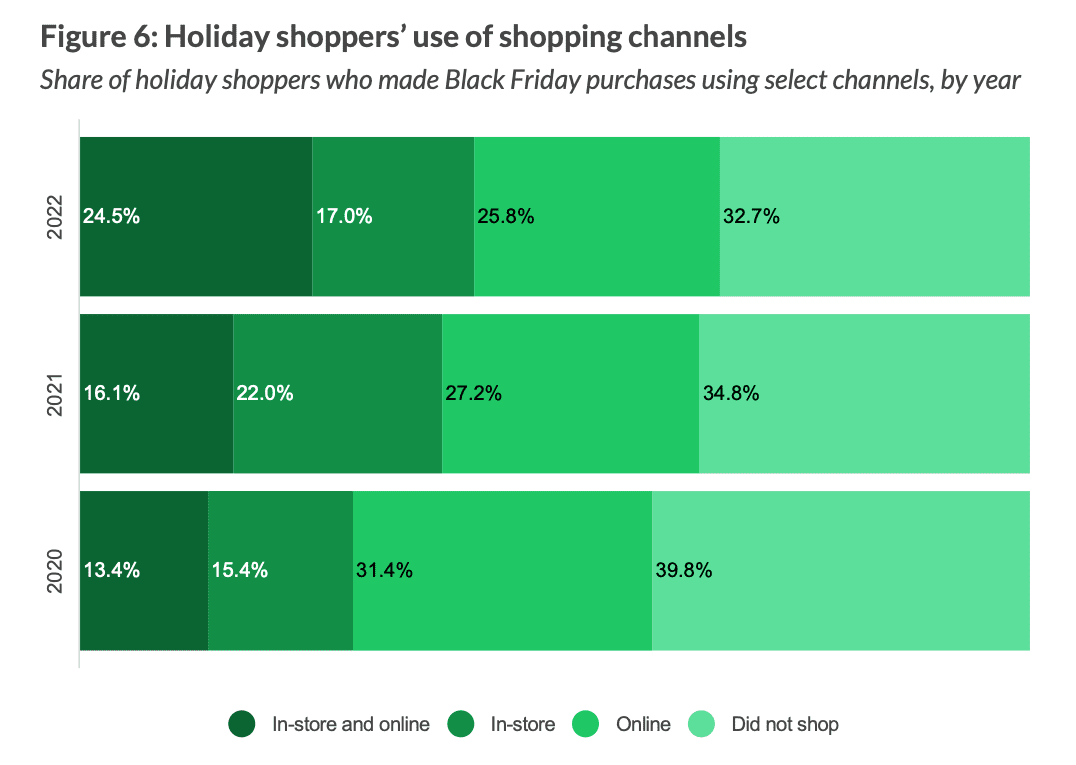

Omnichannel trends were strong as consumers as a quarter of all shoppers mixed in-store and online shopping this year, going where the deals are or just for the experience.

As the study states, “Just 26% of holiday shoppers shopped exclusively online — 7.2 million fewer than in 2021. Moreover, just 17% of holiday shoppers shopped exclusively in-store for Black Friday 2022 — 13.8 million fewer than in 2021. This data shows that it is no longer possible to gauge Black Friday success by either in-store or digital sales; only a holistic, multichannel approach can provide the full picture.”

Get your copy: Black Friday 2022: High Prices Reshape Holiday Shopping Habits

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.