Knowingly buying fakes is taking hold as a cost-cutting trend among younger shoppers.

As the high price of luxury goods presents a barrier to purchase for many inflation-constrained shoppers, some Gen Z and millennial consumers have embraced buying fakes, or “dupes,” instead, as detailed in a Tuesday (April 25) Financial Times report. The news outlet points to a 2022 EU Intellectual Property Office survey where 37% of respondents aged 15 to 24 had bought at least one fake product in the previous 12 months. Clothing, apparel and accessories were the top categories of counterfeits purchased, with “simply not caring whether the product was fake” among the top reasons behind these transactions.

The FT quotes Chris Beer, of research company GWI, who calls the trend of showing off products that look more costly than they really are “frugal flexing,” and buying knock-offs — and showing them off — is part of it.

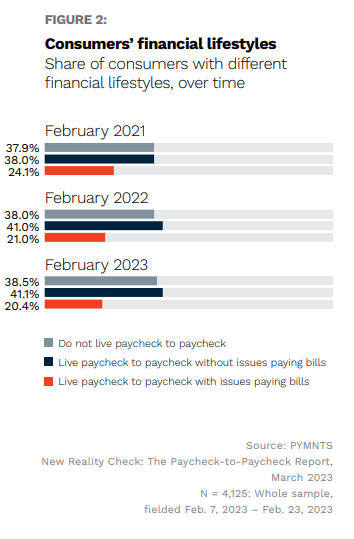

Cost of living challenges are cited as main motivators behind the counterfeit craze, as younger shoppers, like most consumers, are trying to do more with less. This economic reality is illustrated in PYMNTS’ March collaboration with LendingClub, “New Reality Check: The Paycheck-to-Paycheck Report.”

For the more than 60% of consumers in February 2023 living paycheck to paycheck, both with and without issues paying bills, full-priced luxury items may be out of reach, helping explain why trends such as “frugal flexing” are on the rise.

reCommerce Rising

Cost-cutting has also helped drive the resale boom in recent years, with a market expected to grow from $177 billion in 2022 to $351 billion in 2027. Third-party platforms such as thredUP and Poshmark are thriving, and 88 brands launched dedicated resale programs in 2022 alone.

Advertisement: Scroll to Continue

And a number of high-end brands have embraced the reCommerce market in an effort to grow shopper loyalty despite consumers’ financial constraints. Luxury labels, notably Gucci and Balenciaga, have incorporated reCommerce offerings as part of their greater sales strategy, moving forward with dedicated resale platforms in order to keep these purchases in-house. Other brands have since followed their lead toward branded resale, including Oscar de la Renta.

Taking a different tack, French luxury brand Chloé is assisting its customers in preparing items for resale by rolling out a digital ID featuring smartphone-scannable labels that guarantees an item’s authenticity. Rolex has also joined the ranks tapping the resale market to expand its customer base while preserving brand value by certifying its pre-owned timepieces.

The frugal flexing fad could easily continue as the cost of living challenges continue to confound consumers. Be it through reCommerce or dupes, shoppers are demonstrating their desire to look fabulous no matter their budget.