The pickup economy — a customer convenience that started as a pandemic precaution — has since found a solidified foothold in cross-channel shopping.

The latest PYMNTS/Cybersource collaboration, “The 2023 Global Digital Shopping Index,” notes that in the past year, 26% more consumers across the five countries studied used buy online, pickup in-store (BOPIS) options in 2022, suggesting that consumers appear to favor the method’s certainty and cost-effectiveness.

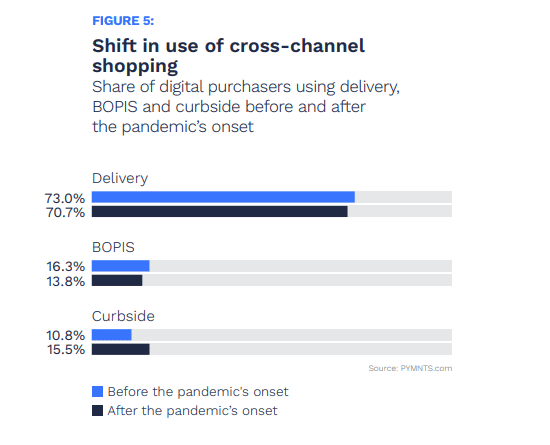

The U.S. ranks first globally when it comes to consumers using pickup options (BOPIS and curbside), as 37% more consumers used pickup for their most recent purchase in 2022 than in 2021. This represents 16 million additional shoppers using the option in the U.S. alone. This year’s growth is only part of the picture, too — previous PYMNTS/Cybersource studies on global digital shopping have illustrated an upward trend of consumer BOPIS adoption since 2020.

One reason that BOPIS continues to be a popular eCommerce option is another pandemic-related holdover: supply chain issues. Plaguing every sector and resulting global slowdowns since March 2020, these are still significant factors driving longer delivery times and sometimes leaving shoppers concerned about whether they will receive items ordered online at all. Supply chain uncertainties have also impacted retailers offering BOPIS, who struggle to maintain consistent inventory data serving the pickup economy.

Another factor behind the rise of pickup options may be increased shipping costs, as merchants have begun either rolling back free shipping or raising the minimum order spend to qualify for the feature. Consumers seeking to cut discretionary costs may well aim to bypass delivery conveniences in favor of BOPIS or curbside pickup.

BOPIS enjoyed particular popularity on Black Friday in 2022, as PYMNTS’ research found that 25% of online orders made on that day were picked up in-store. This was nearly double the rate of the feature being used in 2021 and might be due to giant retailers’ increased offering of the option in the intervening period.

Kohl’s, for example, expanded its BOPIS self-pickup on eligible online orders at all brick-and-mortar locations last summer. Walmart has made its BOPIS option even more convenient to its customers with the recent launch of its “Text to Shop” feature. Connected to customer accounts, the tool allows consumers to checkout via text or the Walmart app.

And in the United Kingdom, retailer Primark’s BOPIS option introduction in November was so popular that the increased traffic overloaded the merchant’s site on launch. Until then, Primark had been the only major U.K. retailer not to offer online shopping. So far, it is continuing to keep its eCommerce pickup limited to 25 brick-and-mortar locations and using BOPIS as a tool to drive foot traffic to its physical locations.

As BOPIS continues to evolve from an optional merchant feature to a needed consumer expectation, retailers that cannot yet support the growing pickup economy — including half of the merchants who have not yet implemented BOPIS — should consider how to best join in — or risk missing out on more and more customers.