Discretionary retailers have been among the first segment to suffer as inflation continues to force customers to cut nonessential spending.

Once-loyal customers are turning into merchant-agnostic deal-chasers, as 56% of U.S. retail shoppers have switched merchants in the name of cost-cutting, and price influences 67% of shoppers’ choice of a large retailer.

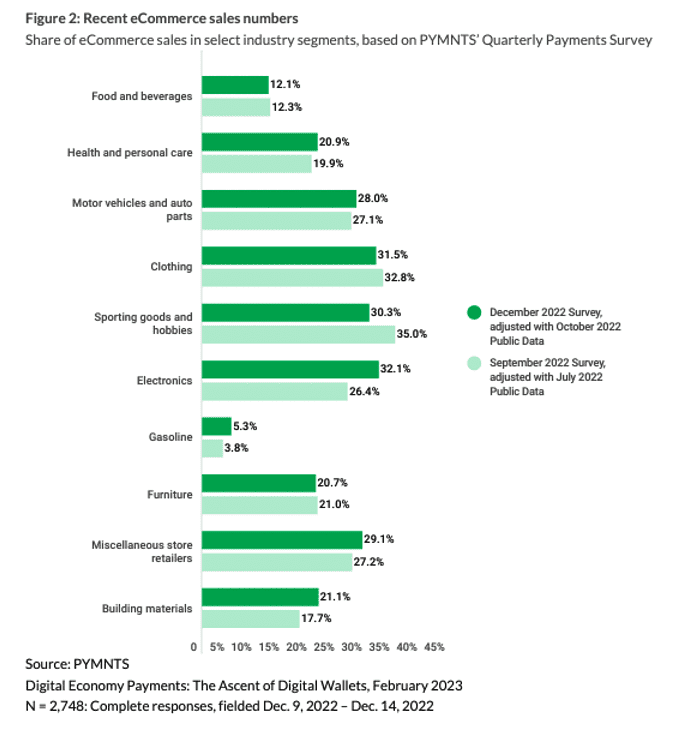

This discretionary spending pullback is visible in stores and online, and across financial lifestyles. PYMNTS’ “Digital Economy Payments: The Ascent of Digital Wallets” details this in the slide of eCommerce sales (historically a deal-chaser haven) by selected sector.

Of spend categories surveyed, the clearest falling under the umbrella of everyday discretionary segments are clothing and sporting goods, and both experienced sales drops between September and December.

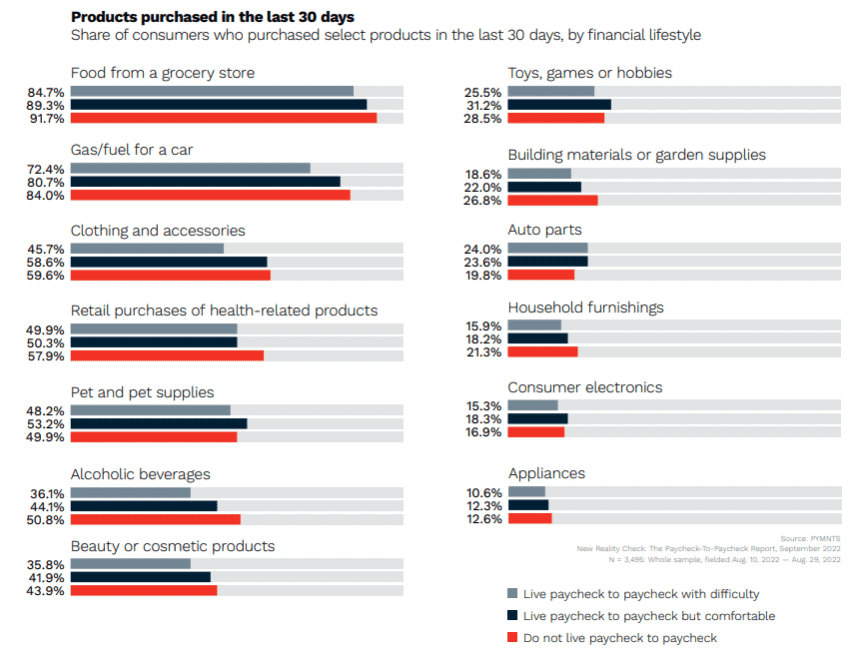

This behavior may also be reflected in what consumers of different financial lifestyles are choosing to spend on, as demonstrated in the PYMNTS’ September report, “New Reality Check: The Paycheck-to-Paycheck Report,” a collaboration with LendingClub.

The data found some variance in category spend by lifestyle, but the differences are much less than one might expect between consumers living paycheck to paycheck both with and without difficulty as well as those not living paycheck to paycheck. The consumers, surveyed in August for this study, showed similar discretionary spend hesitancy as those in the eCommerce sales chart. This suggests that continued economic volatility has most consumers conservatively spending, no matter their financial lifestyle.

There are also anecdotal signs of this spending pullback’s effects. Small merchants dropping free shipping perks are at an increased risk to lose customers, while large retailers are adding fees for faster service. Additionally, the resale market is having a mainstream moment as both buyers and brands embrace the potential of pre-owned items. This has left stores such as Nordstrom, once known for its luxury apparel and top-notch service, instead offering deep discounts to move inventory. To combat this economic headwind, famous brands like Hasbro are decreasing their product lineups.

As deal-chasing increasingly becomes the norm for many consumers, retailers of everyday discretionary items may continue feeling the pinch. However, this inflationary cycle will eventually end, as all cycles do. When that happens, this segment may be the first to recover as consumers spend normally again.