As grocers look to mitigate inflation-related margin decreases, Sam’s Club is improving its ad offerings.

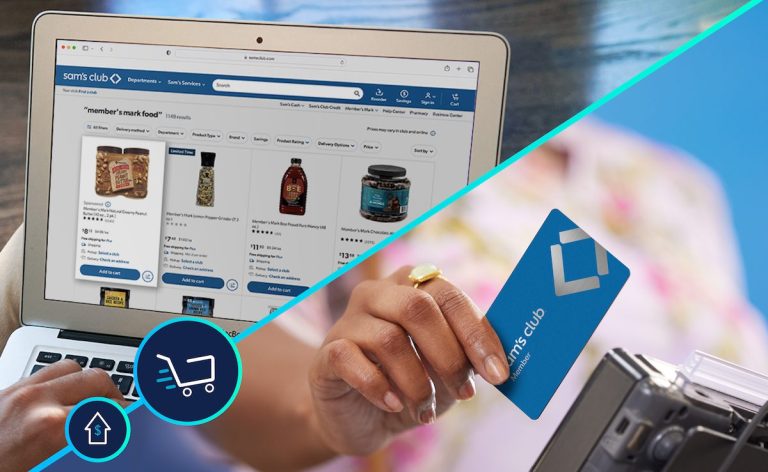

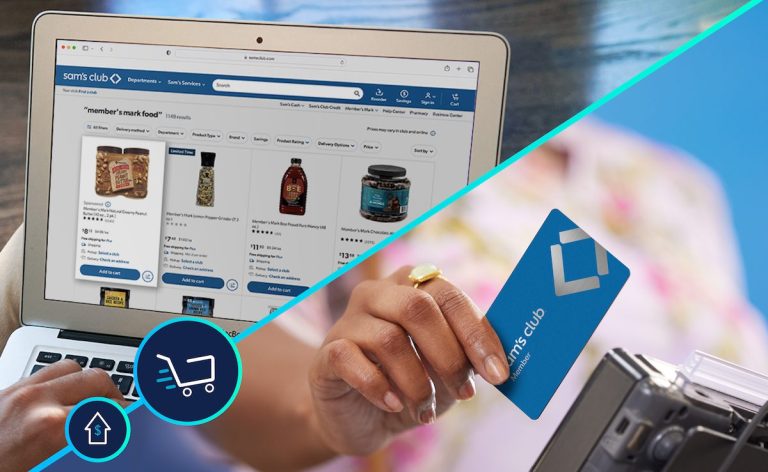

The Walmart-owned membership warehouse club chain announced Tuesday (March 21) that it has made it possible for advertisers to attribute in-store sales to their advertising — search ads and sponsored listings — on the retailer’s digital platforms. This capability enables more effective measuring of campaign effectiveness.

“Sam’s Club [Member Access Platform] is opening up a new era of transparency and efficiency in advertising,” Lex Josephs, vice president and general manager of Sam’s Club Member Access Platform, said in a statement. “Now, because of our unique knowledge of our members, we’re able to offer true closed-loop attribution for both online and offline sales.”

He added that this integration offers “unmatched visibility” for advertisers amid inflation, “when they need to make fewer resources go further.”

Consumers Pull Back Spending

The news comes as rising prices put pressure on grocers’ profits, with shoppers making smaller purchases and removing certain items from their baskets. Research from the study “Consumer Inflation Sentiment: Perception Is Reality,” for which PYMNTS surveyed more than 2,100 consumers in December, reveals that 69% of consumers have made changes to their grocery shopping lists in the last year in response to rising prices, reducing the quantity and/or quality of items they purchase.

Consequently, merchants are challenged to find new ways to bring in revenue from advertisers in a bid to boost their margins.

Advertisement: Scroll to Continue

“We are driving our profit flywheel and improving margins by reducing our digital cost to serve and growing our alternative profit streams,” Kroger CEO Rodney McMullen told analysts on the grocer’s earnings call earlier this year. “[We are] growing digital retail media. … Kroger Precision Marketing is one of our fastest-growing businesses and is well-positioned to win within the U.S. retail media landscape, which is projected to be a $55 billion industry by 2024.”

Earlier this year, the grocer announced a partnership enabling it to bring previously digital-only personalized offers into physical aisles.

In fact, many grocers have investing in their retail media networks to monetize their data, selling insights and ad opportunities to consumer-packaged goods (CPG) brands. In the final quarter of last year, for instance, both Ahold Delhaize USA and BJ’s Wholesale Club announced retail media program launches.

“We’re probably one of the last large [grocers] to actually make this decision,” Peapod Digital Labs Vice President, Head of eCommerce Merchandising / AD Retail Media Bobby Watts explained in an interview with PYMNTS. “There’s been others before us, whether it was KPM [Kroger Precision Marketing] or Walmart Connect, and then most recently last year Albertsons, with their media collective they did. … So, it just felt like it was the right time for us to also make that move.”

Shopping In-Store

In the case of Sam’s Club, the move to enable advertisers to measure their effectiveness with in-store shoppers is key, with the majority consumers continuing to prefer brick-and-mortar for certain kinds of purchases.

PYMNTS’ study “Changes in Grocery Shopping Habits and Perception,” for which we surveyed more than 2,400 U.S. consumers in December, revealed that only 44% of shoppers now make the majority of their purchases in stores across categories. However, that share goes up for certain kinds of items. For instance, 54% primarily shop for fresh meat, chicken or fish in physical stores. Similarly, 53% do so for fresh fruits and vegetables.

“The future of grocery shopping isn’t all digital, just as it isn’t in any other part of retail. But neither is it an entirely physical store experience either,” PYMNTS’ Karen Webster noted in a recent feature. “Consumers, all consumers, see the physical grocery store experience as a smaller slice of how they shop for groceries.”