In 2023, U.S. retail sales surged to nearly $7.25 trillion, representing a third of all consumer spending. Dominating this market are two titans: Amazon and Walmart.

A PYMNTS Intelligence report, “New Consumer Spend Data Finds Amazon Way Ahead of Walmart,” explores their ongoing competition, highlighting the shifting dynamics in their battle for consumer dollars.

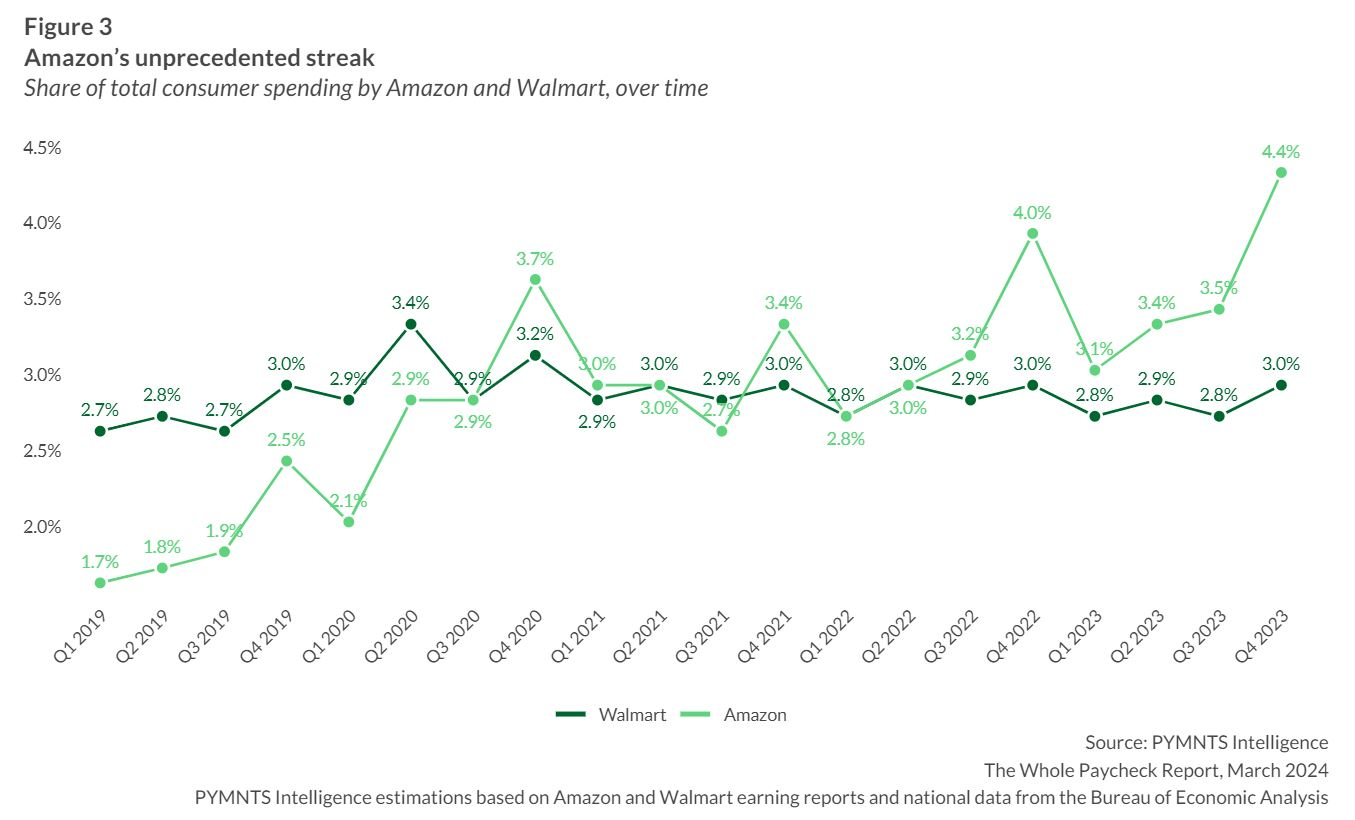

Amazon solidified its lead over Walmart, capturing a significant share of the retail market throughout 2023. Amazon’s gross sales reached $209 billion in the fourth quarter of 2023, representing a 17% increase from the previous year. This growth underscores Amazon’s expanding influence, particularly in discretionary categories such as home furnishings, electronics and clothing. Notably, Amazon now commands 10% of all U.S. retail sales and 4.4% of consumer spending.

Meanwhile, Walmart’s online sales reached $22.1 billion in Q4 2023, accounting for 16% of its total sales. Despite this growth, Walmart’s pace is insufficient to close the gap with Amazon.

While trailing Amazon in overall sales, Walmart remains a formidable competitor, particularly in the food and beverage sector. The retail giant captured nearly 19% of U.S. food and beverage sales in 2023, a significant increase from previous years. This stronghold in the grocery segment reflects Walmart’s continued dominance in non-discretionary spending, an area where Amazon has yet to make a substantial impact despite its acquisition of Whole Foods in 2017.

In other sectors, Walmart has shown resilience. Although its overall growth in sales has been flat since early 2021, Walmart ended 2023 with 7.3% of U.S. consumer retail spending. This performance, while impressive in scale, pales compared to Amazon’s quarterly growth, which has been consistently stronger. Walmart’s stronghold in groceries and household items continues to be a key asset, even as Amazon expands its dominance in discretionary categories.

The competitive landscape between Amazon and Walmart is evolving, as Amazon overshadows Walmart in several key areas. For instance, Amazon’s share of the electronics and appliances market reached 41% in Q4 2023, an increase of four percentage points from the previous year. Walmart, on the other hand, maintained a modest 5.5% share in this segment. Similarly, Amazon has expanded its lead in clothing and apparel, holding 17% of the market by the end of 2023 compared to Walmart’s stagnant 6.1%.

Amazon’s dominance extends to health and personal care items as well. In Q4 2023, Amazon surpassed Walmart in this category for the second consecutive holiday season, capturing 6.6% of the market compared to Walmart’s 5.7%. This shift indicates Amazon’s growing influence even in areas traditionally dominated by Walmart, reflecting a broader shift among consumers toward digital-first shopping preferences.

Whether Amazon will extend its dominance into new categories such as personal care or if Walmart will reclaim ground in these sectors remains a critical question. Although Walmart’s established market positions provide solid footing, Amazon’s ongoing expansion points to a transformative shift in retail that could significantly reshape consumer spending patterns in the future.