Among consumers who pay in installments, PYMNTS Intelligence finds, young shoppers are disproportionately ready to use these options to pay for their groceries.

The September 2023 report “Installment Plans Becoming a Key Part of Shopper’s Toolkit,” a PYMNTS Intelligence study done in collaboration with Splitit, draws from a survey of more than 2,500 U.S. consumers to understand their use of installment plans for common purchases.

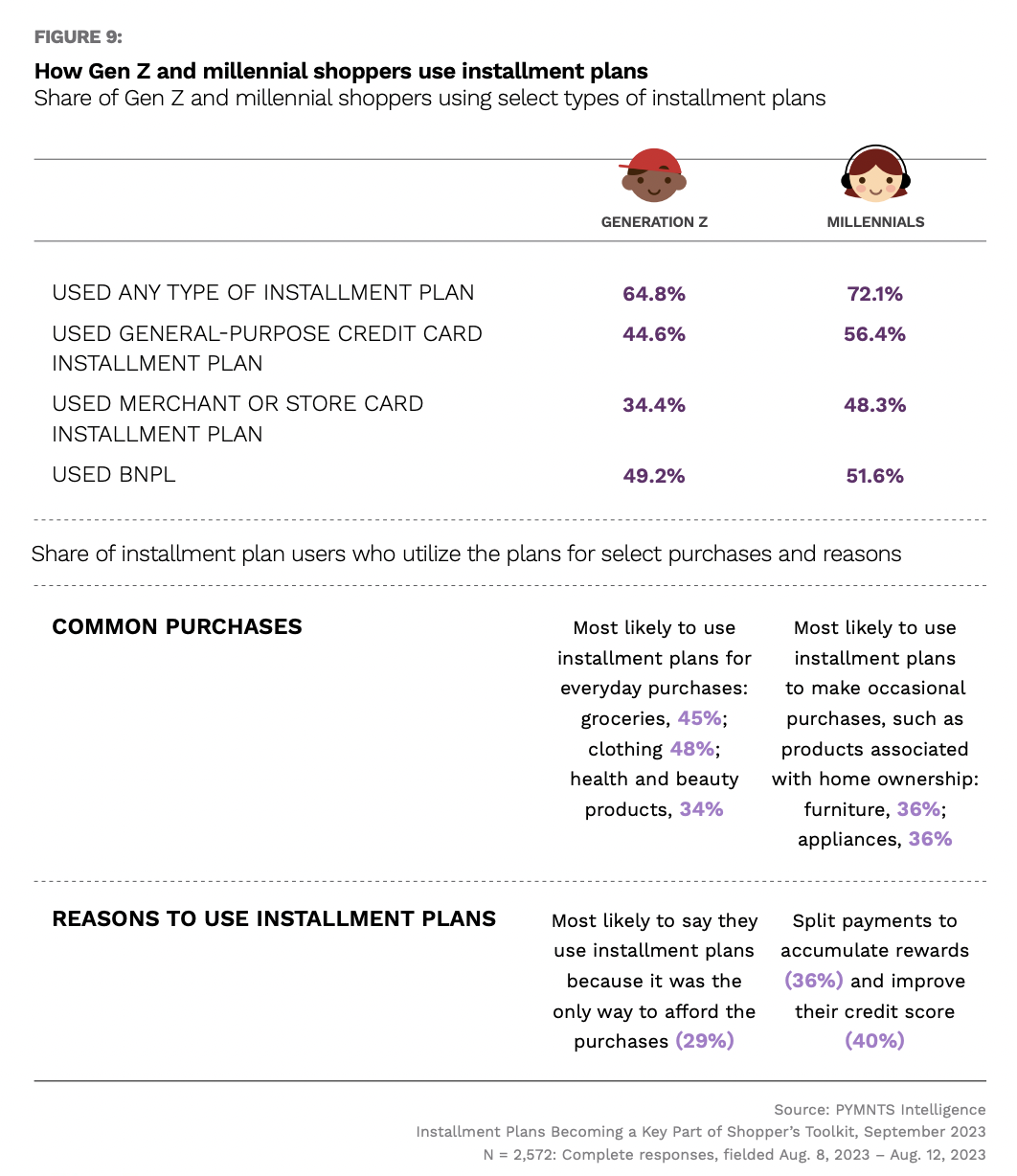

The results reveal that 65% of Gen Z consumers are using installment plans. Among these, a whopping 45% are leveraging these payment methods to purchase their groceries.

Those in the grocery space can be skeptical about the utility of these kinds of payments for groceries.

In an interview with PYMNTS, addressing emerging payment capabilities like buy now, pay later (BNPL), Thrive Market Co-Founder and Chief Technology Officer Sasha Siddhartha expressed openness but noted that such platforms might be more suited for less frequent, higher-ticket sales rather than the frequent, lower-ticket purchases typical of online grocery transactions.

“Today, the ‘other side of the coin’ is shorthand for the opposite side of an issue, topic of conversation or outcome,” PYMNTS’ Karen Webster observed in a recent feature. “It is also a fitting way to frame the conversation about how consumers pay for groceries, and in particular, how they use buy now, pay later programs when doing that.”

Webster cited criticisms claiming that the payment method can exploit cash-strapped consumers but highlighted as a counterpoint high-income consumers’ adoption of installment plans to pay for groceries.

“When the data does the talking, it’s not clear that consumers using this alternative credit product are any different, or using it any differently, than any other consumer who uses a credit card to pay for the groceries in their basket at checkout,” Webster observed.