According to PYMNTS Intelligence, 70% of U.S. consumers are more satisfied when shopping with large merchants than they are when patronizing small and medium-sized businesses (SMBs).

But this phenomenon isn’t confined to U.S. shores. As PYMNTS found in the “2024 Global Digital Shopping Index: SMB Edition,” commissioned by Visa Acceptance Solutions and drawing on insights from nearly 14,000 consumers and more than 3,500 merchants across seven countries, this preference for larger merchants is common around the globe.

One reason? Regardless of their locale, today’s digitally-savvy consumers prefer to shop with the aid of digital features and — thanks at least in part to their size and scale — big retailers are better positioned to deliver innovative digital features, such as real-time inventory or price-matching functionalities.

In each of the seven countries we looked at — Brazil, India, Mexico, Saudi Arabia, the United Arab Emirates, the U.K. and the U.S. — retail SMBs lag behind their larger competitors when it comes to offering shoppers the digital shopping features they want.

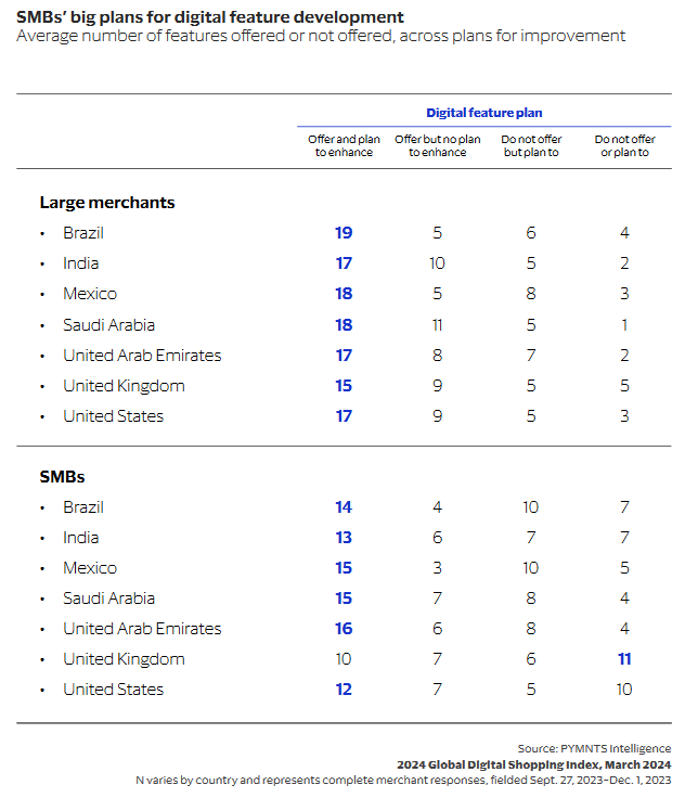

PYMNTS Intelligence researched the top digital features shoppers in each country say they are looking for. We then asked merchants, large and small, to identify those they offered, planned to enhance or had no plans to offer or enhance. Our findings are reflected in the accompanying figure.

While large merchants in Brazil, for instance, lead the pack in currently offering their customers (and planning to further enhance) 19 digital features, Brazilian SMBs lag behind in that they currently offer and plan to enhance 14 features. This pattern plays out in nearly every country we surveyed, with SMBs in the U.K. being the exception. Right now, small, U.K.-based businesses are particularly far behind their counterparts in other countries, offering 10 digital features on average — the least of all seven countries we surveyed — and having no plans at all to offer 11 other features shoppers want.

Though most SMBs have plans to improve most of their features, an interesting trend emerges when looking at future plans: Some SMBs plan to add more features than larger merchants in the next 12 months, suggesting they may realize they are behind and see the need to match larger merchants in the number of features offered.

Many SMBs are slowly achieving this goal. Data shows that, in the last year, SMBs in nearly every country in the survey added between 1 and 4 features they provide, with SMBs in India adding the most. On the flip side, other SMBs (such as those in the U.K.) appear to be more resistant to adding additional features and do not yet have plans to implement additional features.

SMBs have a substantial opportunity to address the gap in consumer-desired features and, by doing so, stand to prosper as a result. By offering customers the digital features they are looking for, they can both bolster existing customer relationships while attracting new ones who now expect those features only from their larger competitors.