When it comes to keeping online credentials and payments safe, consumers trust their banks.

Conducting so much of our daily lives online has risk and friction built into the process. We want quick and easy checkouts, a seamless continuum where our “identifiers” — our online credentials — accompany us from one activity to another.

But then again, we’re leery about putting sensitive data online in the first place. There’s no shortage of headlines detailing the latest hack, and the ever-burgeoning dark web where Social Security numbers and other identifiers are bought and sold for pennies.

In concept and in execution, payments and credentials vaults aggregate payment info and stored credentials in a single, secure place. And in a nod to the seamless commerce so ardently desired by consumers, the vaults automatically update the stored data when that info is changed. By updating without a glitch or a hitch, key pain points — in terms of declined payments or churn — are largely avoided because no one has to manually manipulate data in order to keep card details current.

In the February report “Payments and Credentials Vaults: The Trust Factor,” a collaboration between PYMNTS and FIS, more than 2,100 consumers listed who they trust to provide those vaults.

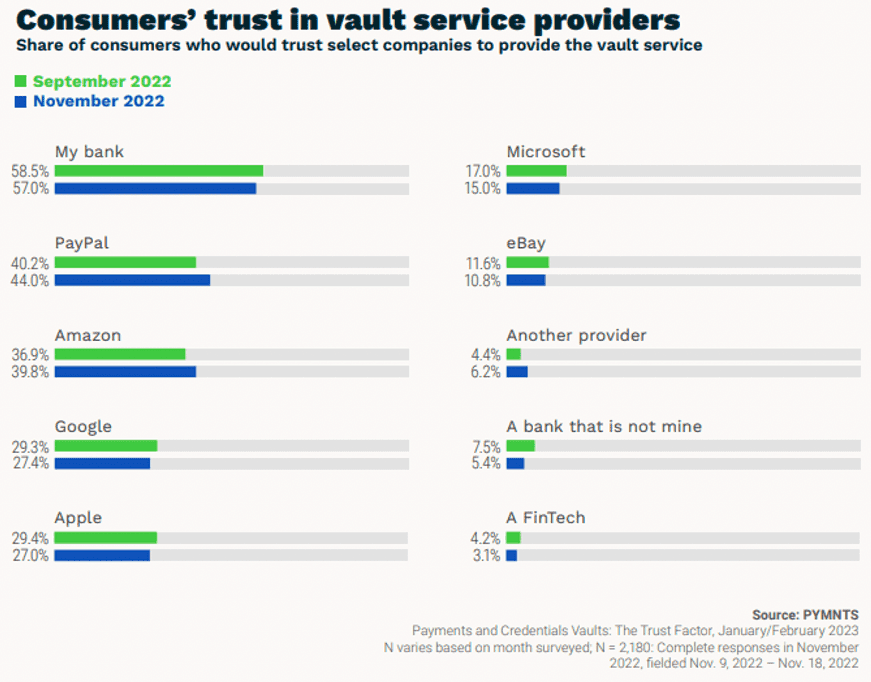

Traditional financial institutions (FIs) lead the pack.

Fifty-seven percent of consumer said they would trust their bank for such a service. PayPal and Amazon were in the second- and third-place spots. Given the fact that so much of our payments activity does indeed cross Amazon’s platform and PayPal’s digital wallets, where consumers and merchants meet by the hundreds of millions, perhaps this is no surprise. Those two tech providers are the only ones we’ve surveyed that have gained ground as trusted sources of vault providers.

There’s a significant percentage of consumers who have proved knowledgeable about, and are interested in using, vaults. As many as 38% of consumers overall said they are highly interested in using a credentials vault.

Consumers who report strong interest in using a vault are willing to grant most merchants access to their information, the study found. The data showed that 69% of highly interested consumers would allow marketplaces to access their information through a vault, but just 27% of consumers with slight interest in vault use said the same.