This surge in cybertheft and financial scams has prompted regulators, law enforcement agencies and financial institutions to take urgent action to protect consumers, Bloomberg reported Tuesday (Aug. 22).

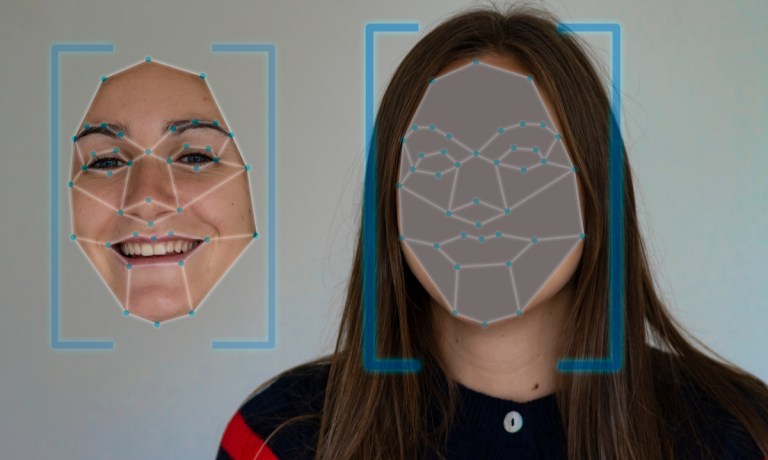

The advent of deepfake technology has given rise to more sophisticated and damaging fraud schemes, according to the report. By using AI to create computer-generated voices that are virtually indistinguishable from real ones, scammers can execute social engineering scams with alarming success rates, exploiting people’s trust and emotions. They also exploit stolen data from the dark web, using social media photos to create fake IDs and masks that can bypass face ID systems.

The proliferation of online banking has provided scammers with fresh opportunities, the report said. As face-to-face interactions decrease, criminals are exploiting vulnerabilities in digital systems to carry out their fraudulent activities. The integration of AI in scams not only increases their volume but also enhances their customization, making them harder to detect and prevent.

Experts in financial crime from major banks have identified the deepfake imposter scam boom as one of the most significant threats to the industry, per the report. Financial institutions face the dual challenge of combating scams while also regaining the trust of customers who have fallen victim to such schemes.

To tackle deepfake imposter scams, banks are investing in defensive technology and educating consumers about the risks involved, according to the report. Surveillance tools are employed to monitor millions of events daily, flagging suspicious activities and blocking potentially fraudulent transactions.

Advertisement: Scroll to Continue

The banking industry is also urging tech companies to take responsibility for the financial scams facilitated through their platforms, per the report. Investment fraud, in particular, has witnessed a surge, with scammers using search engines and sponsored advertising to lure victims. Banks and governments are pushing for new legislation and measures to crack down on online financial scams, given the escalating costs associated with fraud.

PYMNTS research has found that FinTechs, on average, lose $51 million every year to fraud — an approximate median of $400,000 — or the equivalent of 1.7% of their revenue.

With fraud schemes mutating alongside, and enabled by, technology, FinTech fraud is on the rise, having grown 13% in the last year, according to “The Path to FinTech Profitability Must Be Fraud-Proof,” a PYMNTS and Sezzle collaboration.