Younger generations want to know what their financial institutions are doing to secure their transactions.

That’s according to the latest research in PYMNTS’ March report, “Visible and Invisible Security: Perceptions in Digital Banking,” a collaboration with Entersekt. The report found that consumers want to be more involved in protecting their money and identity, even in everyday financial activities.

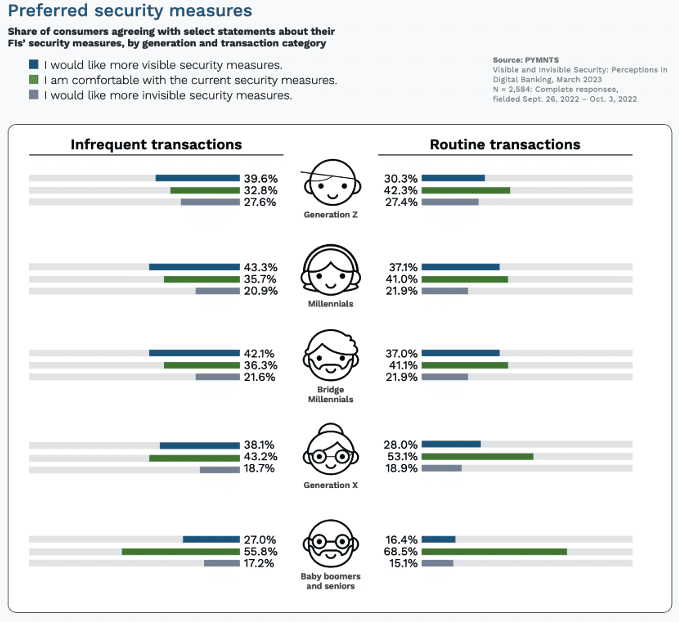

The numbers showed that Generation Z, millennials and bridge millennials in particular all want more visibility into the steps their FIs are taking to protect their transactions, particularly more infrequent ones.

But they also want more peace of mind around more routine transactions too.

Personal information is, well, personal, and consumers want their FIs to protect it better.

Just don’t tell the baby boomers; only 16% of the older generational cohort said they want more visible security measures for routine, everyday transactions. That number bumped up 27% for more infrequent or singular transactions.

The report data showed that retail banking customers more generally are becoming more vocal in detailing their preferences for more user-friendly and secure options for verifying their identity or making payments online.

More than one in three banking customers (36%) said they want their FIs to offer more visible security measures — such as those that prompt a user to act, such as entering a password or using biometric authentication — especially for financial activities or transactions that could be considered high-risk.

Nearly half of consumers (47%) reported relying on biometric authentication solutions in the past month, and 52% said they prefer using it over methods, like multifactor authentication (MFA) or the not-as-trustworthy-as-it-once-was password.

Banks looking to establish a lifetime relationship with younger generational cohorts must embrace this new reality by offering consumers the additional visible security measures they want, as well as by allowing them to customize their authentication experiences according to their increasingly modern preferences.