The United States federal government issues Social Security benefits to recipients’ reloadable debit cards, for example, thus giving unbanked residents a faster, more secure alternative to receiving payments via paper checks. Merchants are similarly turning to reloadable debit cards to accelerate customer purchasing while retaining consumers who lack digital options.

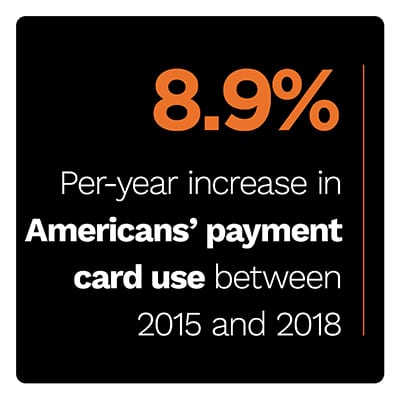

In the February Next-Gen Debit Tracker, PYMNTS examines the growing use of payment cards as well as card security updates that are being made to fend off fraudsters’ ever-more innovative attempts.

Around The Ne xt-Gen Debit World

xt-Gen Debit World

Small and mid-sized businesses (SMBs) are also turning to debit to ease their transactions with other businesses. Business-to-business (B2B) payments are all too often made via slow, costly-to-process paper checks, and software that could help SMBs upgrade their payment flows are often not designed for smaller companies’ needs. However, third parties are aiming to help smooth the payments processes by providing services through which corporate buyers can use cards to pay their invoices and sellers can receive their money via digital options.

SMBs in the United Kingdom are also seeking easier ways to accept payments. U.K. consumers frequently want to make recurring payments via direct debit, but few domestic businesses accept that method, according to a recent report. Banks can help change the tide by joining direct deposit payment rails and offering services specially designed for SMB clients.

Advertisement: Scroll to Continue

Not all SMBs have the funds to develop software that would let them accept debit card payments, however. Accounts receivable (AR) automation company Invoiced asserts that the solution to this problem is not to ask SMBs to create the payments infrastructure, but to provide instead third-party payment processing platforms that can do this for them. The company is offering a service to help SMBs quickly start accepting debit cards through an online payment portal that clients can integrate into their operations.

Find more on about these and the rest of next-gen debit headlines in the Tracker.

Redesigning Payroll For The Fast-Paced, On-The-Go Lives Of Gen Z

Employers are discovering that a sizable portion of Gen Z job seekers would turn down an offer that did not come with the payroll options they prefer. Quick fund transmissions, flexible disbursement schedules and access to financial wellness engagement services are all influential factors in Gen Z’s payroll preferences. These should be key areas of focus for any recruiters looking to hire younger employees, according to Belinda Reany, division vice president and general manager of human resources and payroll services provider ADP. In this month’s Feature Story, Renay discusses the latest research about employees’ changing payroll expectations and explains why disbursements to payroll cards and digital wallets could become especially in-demand.

To read the full Feature Story, download the Tracker.

Deep Dive: The Staffing Agency Case For  Payroll Cards

Payroll Cards

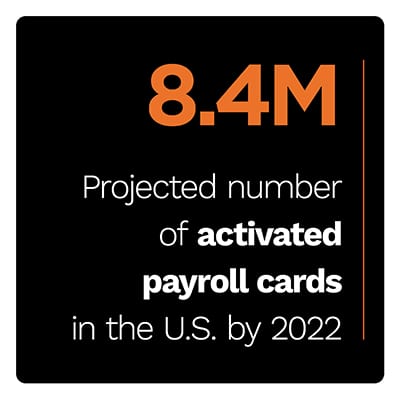

America’s tight labor market is heating up competition for talent among staffing agencies. These companies must recruit and retain workers who they then send out to fill other businesses’ needs for temporary and ad hoc employees. Compelling payroll methods can help staffing agencies stand out when seeking to bring in new hires and convince current employees to stay loyal.

Americans frequently receive their wages via direct deposit, but payroll cards appear to be gaining ground. This month’s Deep Dive examines which demographics use payroll cards, the benefits and limitations of the method and the potential for payroll cards to hone staffing agencies’ competitive edges.

Download the Tracker to read the Deep Dive.

The Next-Gen Debit Tracker®, a PULSE collaboration, provides an in-depth examination of debit’s changing role in both banking and retail and gives a data-rich, insightful look on how providers can innovate within this area.