The COVID-19 pandemic has prompted consumers and merchants to reconsider the mechanism that they use for handling in-person transactions, with many concerned that the virus could linger on point-of-sale (POS) terminal buttons as well as on dollar bills. Cashiers and customers do not want checkout experiences to raise their risks of contracting the virus, after all. These safety concerns are becoming even more important as states begin permitting nonessential businesses to reopen, which will increase the number of brick-and-mortar transactions.

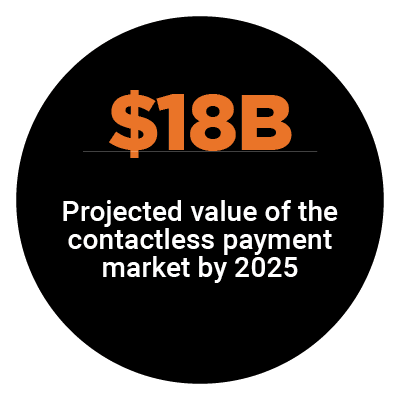

Some governments believe that contactless payments are a relatively safe alternative to cash and traditional credit cards because they spare merchants from handling bills and customers from tapping through POS interfaces. This belief ha s spurred New Zealand and Ireland both to lift value caps on tap-and-go transactions to encourage greater use of the contactless payments. Consumers appear receptive so far, and the market will see whether contactless payments become a habit that continues even after the pandemic ends.

s spurred New Zealand and Ireland both to lift value caps on tap-and-go transactions to encourage greater use of the contactless payments. Consumers appear receptive so far, and the market will see whether contactless payments become a habit that continues even after the pandemic ends.

The May Next-Gen Debit Tracker® details how the pandemic is impacting consumer purchasing, including the methods they use to make their payments as well as what they choose to buy.

Around The Next-Gen Debit World

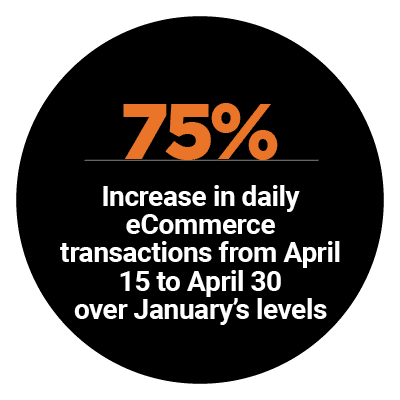

Consumers are putting contactless payments into rotation for their in-person shopping while also directing much of their spending online. The pandemic inspired a surge in eCommerce use, and recent receipt of stimulus benefits and unemployment benefits in the United States pushed online buying even further. A recent study found a 75 percent increase in the average daily number of eCommerce transactions made between April 15 and April 30 compared to the daily average observed in January this year, for example.

The financial hardships and uncertainties caused by the pandemic h as prompted spending to be down in general, however, and many consumers are conserving cash for essentials. That has hit charities particularly hard, with significant numbers of donors canceling their recurring contributions to free up cash for their own immediate needs. United Kingdom-based nonprofits reported that direct debit donation cancellation rates for March were 41 percent higher than those seen during the same period last year.

as prompted spending to be down in general, however, and many consumers are conserving cash for essentials. That has hit charities particularly hard, with significant numbers of donors canceling their recurring contributions to free up cash for their own immediate needs. United Kingdom-based nonprofits reported that direct debit donation cancellation rates for March were 41 percent higher than those seen during the same period last year.

Irish consumers are also spending less, according to the Bank of Ireland. It reported that debit spending fell 25 percent after the mid-March adoption of social distancing measures. Consumers also demonstrated changes in where they were directing their dollars, with streaming services and grocery sectors both seeing major increases.

Find more of the latest headlines in the Tracker.

MoneyLion On How The Pandemic Is Reshaping Consumer Demand

Financial services providers are also paying attention to consumers’ changing needs so that they can best support them. This includes offering many services digitally that they may have conducted in person to avoid potentially spr eading or catching the virus. It also means adjusting offerings to help consumers who are coping with job losses and supporting those seeking to build up financial buffers against potential future crises, according to Tim Hong, chief product officer at digital banking and investment services platform MoneyLion. In this month’s Feature Story, Hong details how offerings like cash advances and long-term investments are becoming critical to engaging customers.

eading or catching the virus. It also means adjusting offerings to help consumers who are coping with job losses and supporting those seeking to build up financial buffers against potential future crises, according to Tim Hong, chief product officer at digital banking and investment services platform MoneyLion. In this month’s Feature Story, Hong details how offerings like cash advances and long-term investments are becoming critical to engaging customers.

Read the full story in the Tracker.

Deep Dive: COVID-19 Shakes Credit Use, Drives Up Grocery Sales

Consumers are facing new financial hardships during the pandemic, with many uncertain how long they will continue to be employed or when they will find work again. This has encouraged consumers to reduce spending overall, resulting in lower credit card spend and fewer applications for new credit cards. Some sectors are seeing a spending push, however, with sectors like grocery continuing to experience higher purchasing levels and debit use showing stronger performance than credit. This month’s Deep Dive examines how consumer purchasing behavior is shifting and what drives shoppers’ choices for the payment instruments they use.

Download the Tracker to read the Deep Dive.

About The Tracker

The Next-Gen Debit Tracker®, a PULSE collaboration, provides an in-depth examination of debit’s changing role in both banking and retail and gives a data-rich, insightful look on how providers can innovate within this area.