The United States added 4.8 million jobs in June, but economic concerns surrounding the impact of the COVID-19 pandemic are still surfacing. Many workers hired in June were also hired part-time or freelance, indicating a widespread shift away from traditional employment and how U.S. employees want to receive their wages.

Companies and workers alike are searching for payroll solutions that are faster and more flexible, especially during this time of economic uncertainty. This means firms may have to adjust the historic two-week payment cycle to something that better encapsulates the changing needs of today’s workforce, as well as adopting new methods such as early payment, pay advances or on-demand payment that can allow individuals to access this money at speed.

The latest Next-Gen Payroll Tracker® examines how both companies and their workers are responding to the challenges brought to the table by the ongoing pandemic, and more importantly, what this means for the future of how workers want to get paid and how employers will meet this demand.

Around The Changing Payroll Landscape

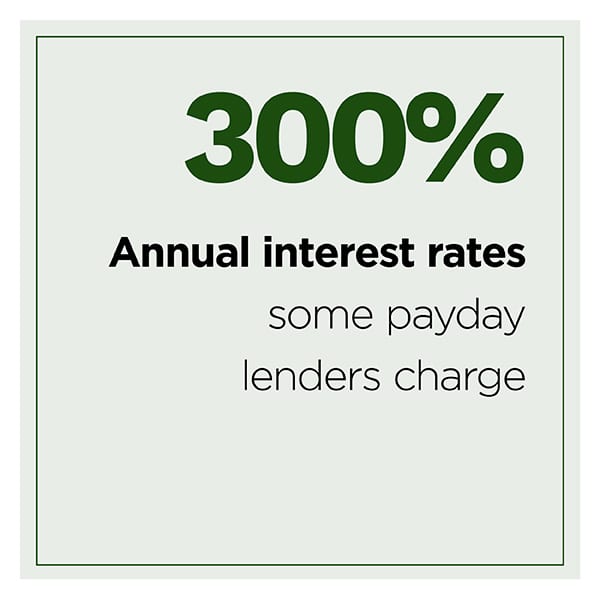

Firms in many countries, as well as their government agencies, have also been making moves to better protect consumers suffering from financial pitfalls. This includes increasing scrutiny on payday lenders in many markets, with the U.S. Federal Trade Commission (FTC) announcing in June that it would be taking a hard line on violations in this industry that seem to take advantage of vulnerable individuals. The FTC also levied charges against one payday lender, alleging the company had stolen millions from individuals through fraudulent or illegal charges attached to their loans. This was followed by regulators in the United Kingdom making shifts to how employees were allowed to receive wages, in hopes it would dissuade them from turning to payday lenders. Both moves are designed to help shield the countries’ residents from COVID-19’s economic impact.

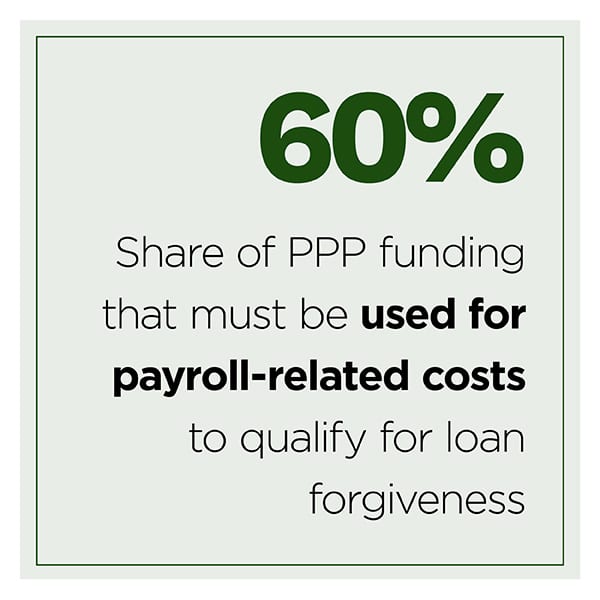

U.S. companies and government bodies are also dealing with challenges and changes to the Paycheck Protection Program (PPP), which many businesses have come to rely upon as a crucial source of funding. These government entities resolved a debate in early June regarding if restrictions attached to this program are strictly in the best interests of these companies as well as their employees, and announced businesses would only need to spend 60 percent of the loans on payroll to qualify for them. The shift also increases the payment terms for the loans, now allowing  companies 24 weeks to spend the attached funds.

companies 24 weeks to spend the attached funds.

Other countries such as Canada are exploring more dynamic measures surrounding the future of payments and work. One town government in Nova Scotia is currently conducting a pilot of the four-day work week, for example. This has risen as remote work has become the norm during the pandemic, with companies now more interested in trying out more sweeping changes to the future of work. The town reports the pilot is currently progressing positively — prospective benefits of this work model include heightened productivity among workers as well as a decrease in overall stress levels.

For more on these and other stories, visit the Tracker’s News & Trends.

Topcoder On Minding Fast And Secure Payments For Tech Contractors

Payroll delays or hiccups are frustrating, but have taken on new weight during the COVID-19 pandemic when many consumers are already experiencing negative financial effects. Individuals who are searching for new work, including freelance work, are thus hunting for jobs that can provide them with their wages easily — and more importantly, consistently, explained Dave Messinger, chief technology officer at Topcoder. This is especially true for those freelancers in more competitive fields, such as computer engineering, programming or other technology-related areas. Offering swift digital payments can help companies searching for these freelancers to seal the deal over competing offers. To learn more about why Topcoder considers easy and reliable payments essential to retaining talent, visit the Tracker’s feature story.

Deep Dive: On-Demand Pay Options For An On-Demand Economy

Deep Dive: On-Demand Pay Options For An On-Demand Economy

The COVID-19 pandemic’s impact is still rippling across the economy, with large-scale changes affecting everything from consumer payments to payroll. Companies are starting to draw inspiration for the future of payroll from the expanding gig economy, where many participants are able to receive wages from on-demand payment solutions. On-demand payments seem especially suited for a post-pandemic world; these solutions enable workers to receive payments immediately instead of waiting days or weeks. This provides clear benefits to individuals during a time when many are attempting to pay down existing bills or debt as quickly as possible, and also helps companies maintain employee loyalty and satisfaction. To learn more about how the gig economy is inspiring the growth of on-demand payment options in multiple industries, visit the Tracker’s Deep Dive.

About The Tracker

The PYMNTS Next-Gen Payroll Tracker® explores the trends and digital technologies changing how firms pay their employees and how this can improve financial well-being.