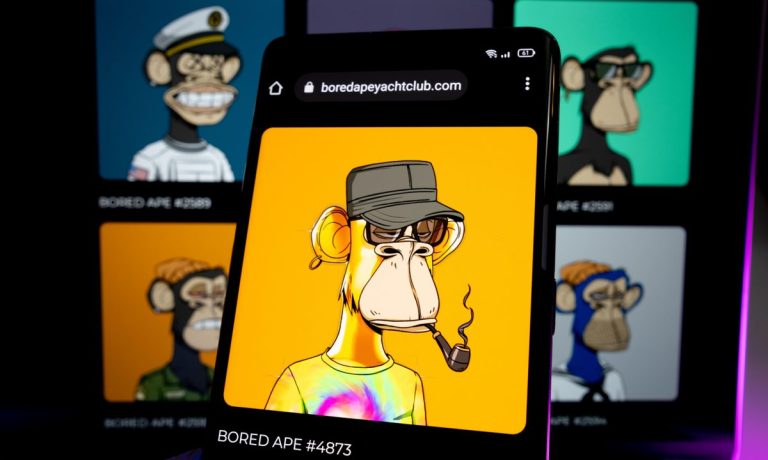

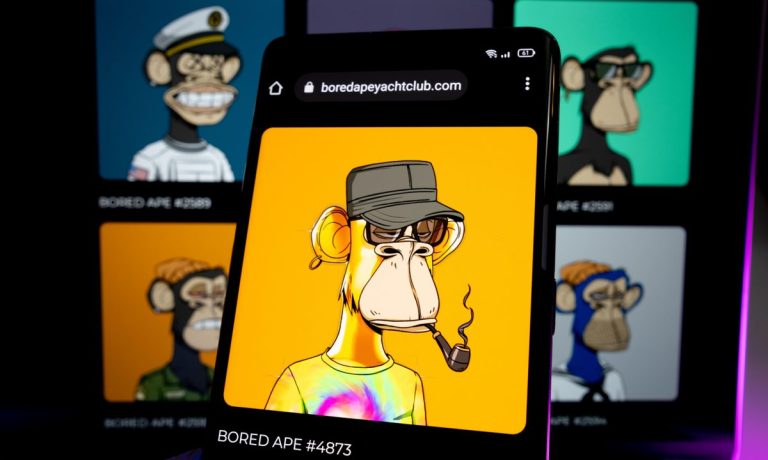

Scorched investors are suing celebrity backers of Bored Ape NFT tokens, claiming they were misled.

The recent crypto cool down has left a slew of retail investors angry and feeling duped by the premise and promise that their once high-flying digital assets would only go up.

A lawsuit filed in Los Angeles is accusing Yuga Labs, the $4 billion company behind popular non-fungible token (NFT) collections Bored Ape Yacht Club (BAYC), CryptoPunks and Meebits — as well as a Metaverse “first mover” — of leveraging celebrity endorsements to pump up sales without having the celebrities disclose their financial relationship to the company.

The class-action compliant reads like a late-night talk show guest wish list.

Diplo, DJ Khaled, The Weeknd, Madonna, Paris Hilton, Justin Bieber, Post Malone, Snoop Dogg, Jimmy Fallon, Kevin Hart and more are all named as defendants under their legal names. So are heavyweights like Steph Curry, Gwyneth Paltrow, Serena Williams and her husband, Reddit founder and venture capital investor Alexis Ohanian. Corporations like Universal Television and Adidas are also included.

A viral video clip from last year of Paris Hilton and Jimmy Fallon comparing their “Apes” on network television has resurfaced as evidence of the public promotion of investments with no warning about risk or suitability.

Advertisement: Scroll to Continue

“In our view, these claims are opportunistic and parasitic,” a Yuga Labs spokesperson told PYMNTS in an email. “We strongly believe that they are without merit and look forward to proving as much.”

Marketing Playbook

For as long as celebrities have been turned to by companies for marketing, there’s been debate over the validity of their endorsements. That’s why disclosing any underlying or pre-existing financial relationship is so important.

It’s also why doing background diligence before investing hard-earned money is always recommended for consumers.

As a still nascent industry, crypto was able to substantially penetrate the mainstream by leveraging a parade of celebrity endorsements and spokespeople. It wasn’t always sunshine and roses for the celebrities involved, however, with some being widely ridiculed for their participation.

To be sure, celebrities make big, and common, targets for lawyers. Most tend to be as wealthy as they are popular, and the need to control and manage their public image could make them more likely to settle the lawsuits brought against them.

The 95-page class-action suit brought against Yuga Labs and its celebrity roster is requesting a jury trial in Los Angeles.

FTX Connection

Yuga Labs isn’t alone in its legal woes. Celebrities who endorsed the collapsed cryptocurrency exchange FTX are similarly being sued for unrealistically hyping up the value of digital assets.

Defendants on this front include Larry David, Steph Curry, Tom Brady and his ex-wife, Gisele Bündchen, among others.

FTX has since been criminally charged as a multiyear fraudulent exercise designed to steal billions of customer funds at scale.

FTX was an investor in Yuga Labs’ $450 million fundraise. The collapsed exchange’s former head of commercial initiatives, Amy Wu, now works for Yuga Labs and is named as a defendant in the lawsuit filed against the company for her role in recruiting the NBA’s Curry as a representative.

Celebrities weren’t enough for FTX. The exchange also donated heavily to politicians using tens of millions of dollars of customer money in an attempt to sway regulators and lawmakers. Bankruptcy lawyers overseeing the unwinding of FTX may reportedly try to claw those funds back, all $73 million of them.

False Impressions

At the core of the lawsuits, and in a way at the core of crypto, is that without disclosing the full extent of the financial incentives behind their behavior, public figures were able to lure investors into purchasing what ended up being losing investments at severely inflated prices.

Of course, consumers are responsible for their own financial decisions. But the playing field must be fair, and the available information complete, in order for them to make the right choices.

It has been both fascinating and unnerving to witness the boom-bust cycle within the crypto and NFT marketplaces and how quickly confidence can ebb and flow. The ability of fast-growing companies, or NFT collections, to capture the public imagination in the blink of an eye and emerge from nowhere as robust, established institutions will likely take its place in the annals of investment history.

For now though, before that chapter is written, the focus remains on cleanup and culpability, and a lot of cases for courts and regulators to review.

For all PYMNTS crypto coverage, subscribe to the daily Crypto Newsletter.