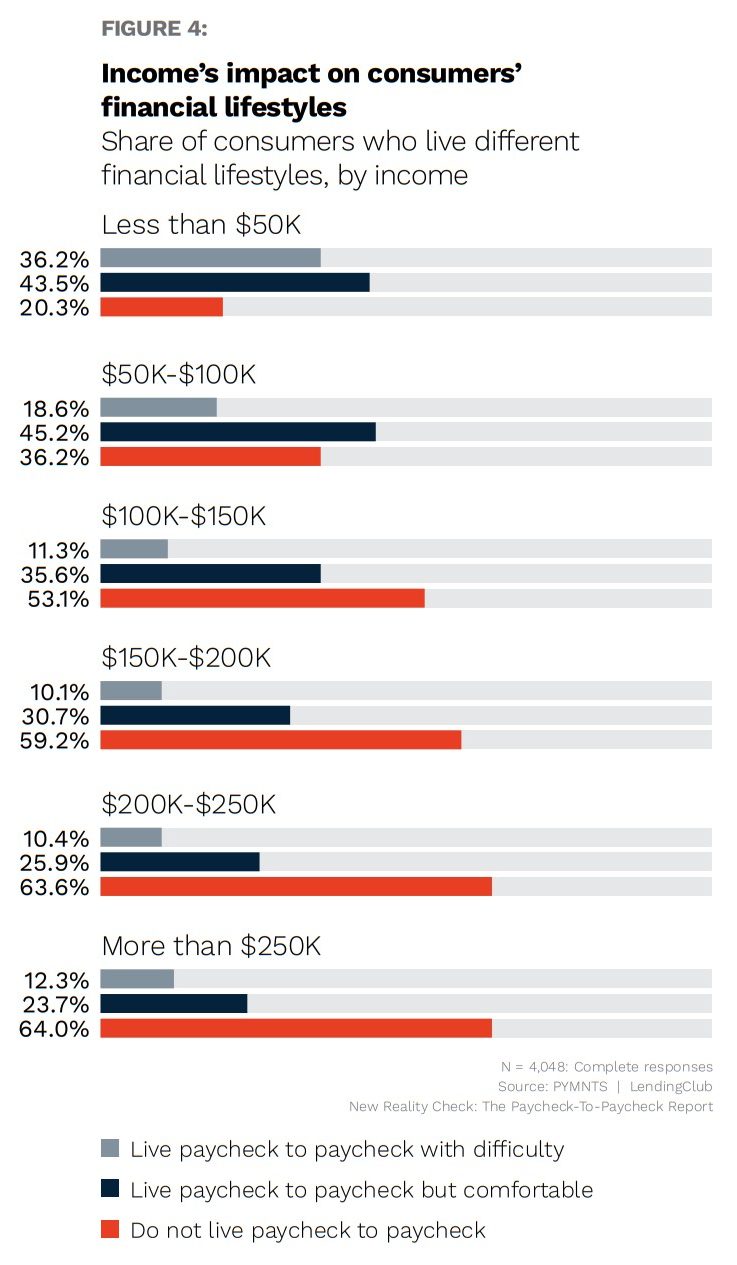

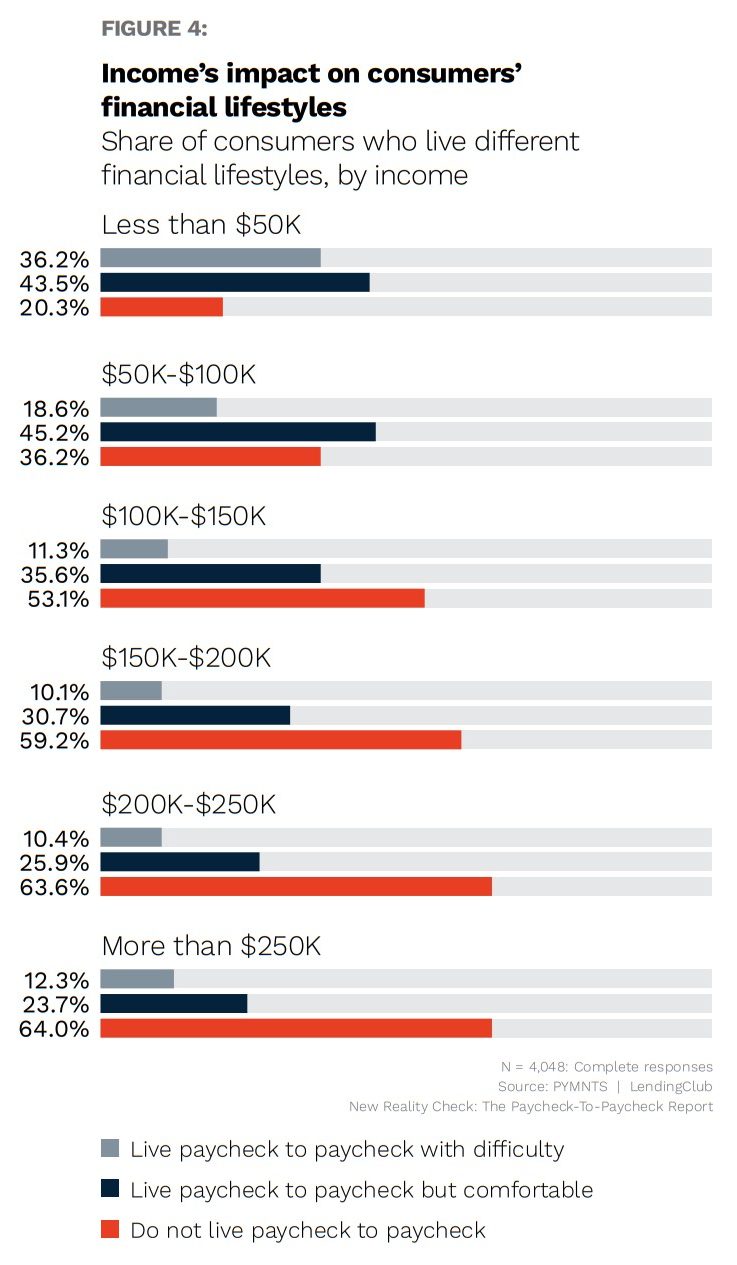

In fact, slightly more than one in three consumers earning more than $250,000 in annual income lived paycheck to paycheck in April, according to “The New Reality Check,” a PYMNTS and LendingClub collaboration based on a survey of 4,048 U.S. consumers.

Get the report: The New Reality Check

The survey found that among those earning more than $250,000, 24% lived paycheck to paycheck but are comfortable, while 12% lived paycheck to paycheck with difficulty.

While 36% of these high-income consumers lived paycheck to paycheck — with or without difficulty — in April, this share was smaller than that of consumers in other income brackets who lived paycheck to paycheck that month.

Thirty-six percent of consumers earning between $200,000 and $250,000, 41% of those earning $150,000 to $200,000, 47% of those earning $100,000 to $150,000, 64% of those earning $50,000 to $100,000 and 80% of those earning less than $50,000 reported that they lived paycheck to paycheck in April.

Advertisement: Scroll to Continue

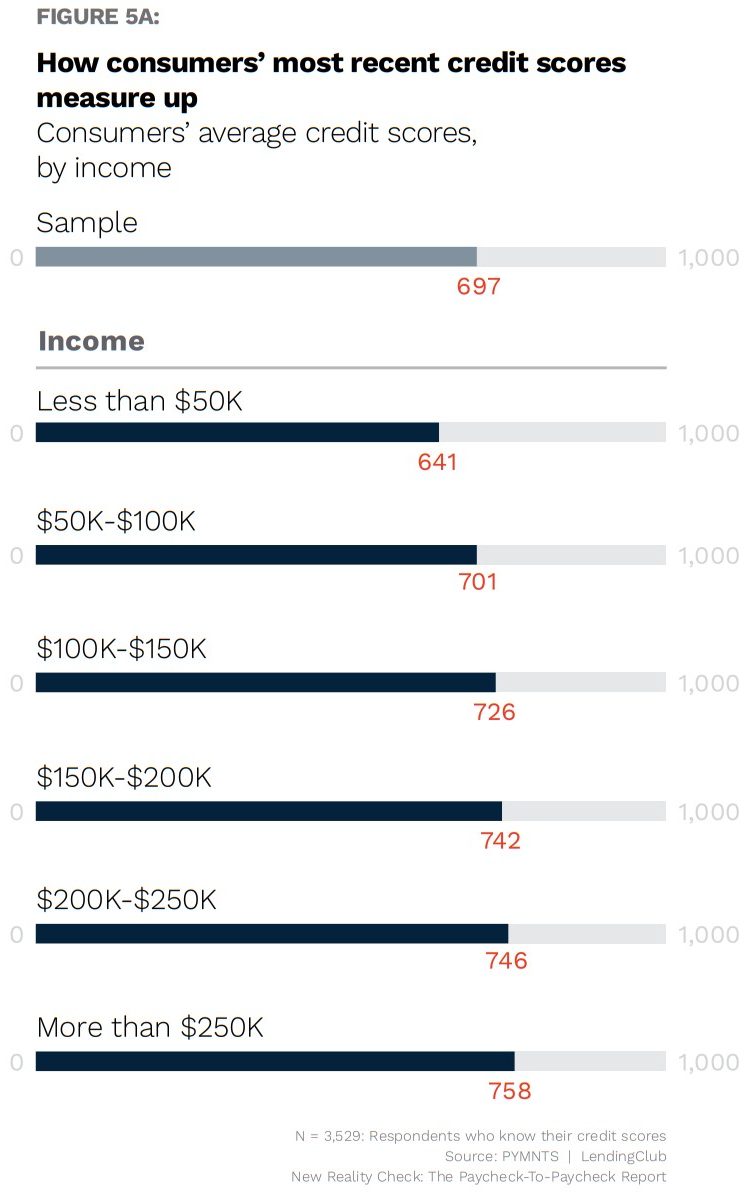

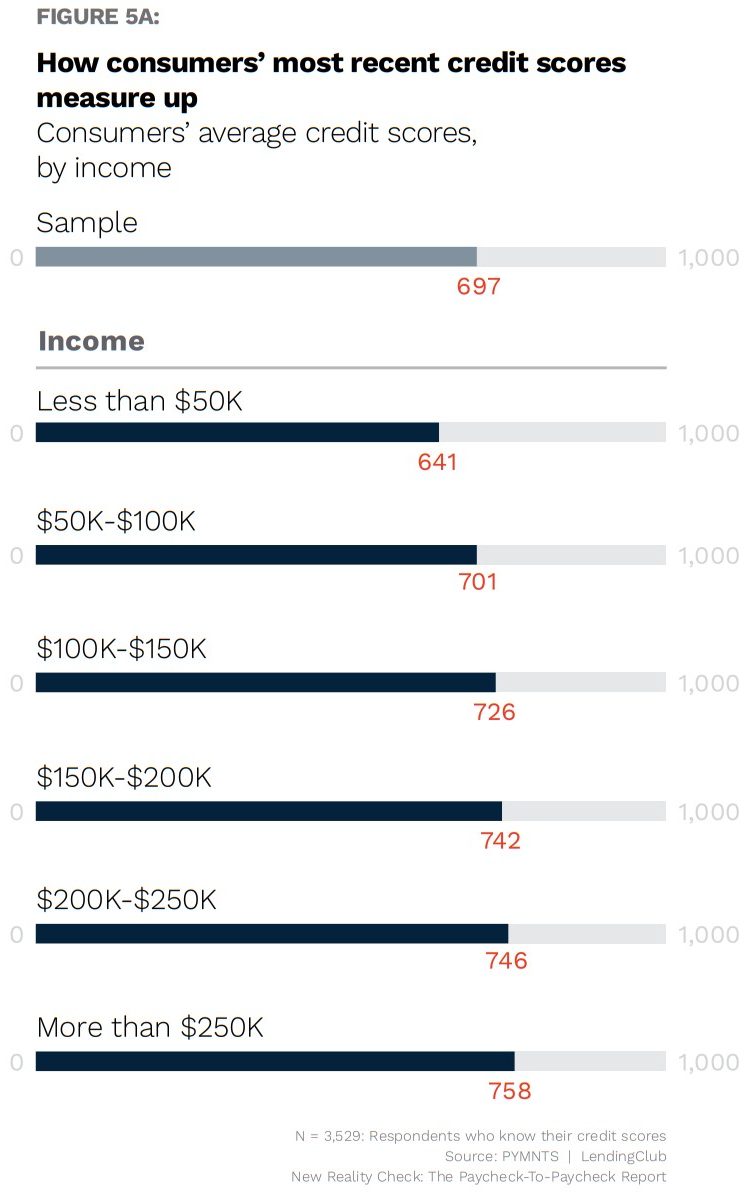

PYMNTS research also found that consumers’ average credit scores tend to increase with income.

The average credit scores of consumers in the different income brackets are as follows: 758 for those earning more than $250,000, 746 for those earning $200,000 to $250,000, 742 for those earning $150,000 to $200,000, 726 for those earning $100,000 to $150,000, 701 for those earning $50,000 to $100,00 and 641 for those earning less than $50,000.

Like many paycheck-to-paycheck consumers, those who report earning more than $250,000 and living paycheck to paycheck remain creditworthy, maintain above-average credit scores and are apt to tap into credit cards and other payment options, such as personal loans, to manage their cash flows.