Overdraft fees have been a flashpoint of contention in banking for a while.

Critics charge that the fees are a way to gouge consumers for the volatility of everyday financial activity — a way to boost revenues for banks.

Many banks have scaled back overdraft fees, and in some cases have eliminated them altogether.

And yet PYMNTS Intelligence data underscore the fact that these fees can serve a useful purpose, acting as a bridge to avoid the disruption of critical financial services.

In the Consumer Financial Protection Bureau’s (CFPB) report on consumer overdraft and nonsufficient fund (NSF) fees, released on Tuesday (Dec. 19), a quarter of consumers reported that someone in their household was charged overdraft of NSF fees, and, per the CFPB, “only 22% of households expected their most recent overdraft.”

“Our research finds that American families are paying fees they do not expect, even when they have access to cheaper forms of credit,” said CFPB Director Rohit Chopra in a statement that accompanied the report.

And as detailed here, in the report, titled “Overdraft and Nonsufficient Fund Fees: Insights from the Making Ends Meet Survey and Consumer Credit Panel,” the Bureau said that amid those surprises, credit cards are a “cheaper” form of credit. The CFPB also wrote that the “our analysis suggests that the majority of consumers charged overdraft and NSF fees have some credit available on a credit card during the period that they report the fees occurring.”

The same report noted that some consumers appear to use overdrafts often, and the data shows recognition of that activity: In households charged more than 10 such fees in a year, more than half of respondents reported that they expected their most recent overdraft. The CFPB report added that some consumers “appear to use overdrafts often and intentionally.”

While consumers charged more than 10 overdraft fees make up a small share of all consumers, past CFPB research found that they are responsible for nearly 75% of all overdraft transactions.

In households charged more than 10 fees in the past year, 51% still had credit available on a credit card.

Some banks have scaled back or eliminated the fees, or, like Wells Fargo and other banks, have been instituting programs where grace periods occur before the fees set in, in addition to taking a proactive approach to warning consumers when funds are running low. But PYMNTS Intelligence data also underscores the fact — as the CFPB has found — that consumers can use overdrafts deliberately.

The fact remains that overdrafts help ensure that transactions are completed, and consumers make (perhaps critical) payments that they want/need to make.

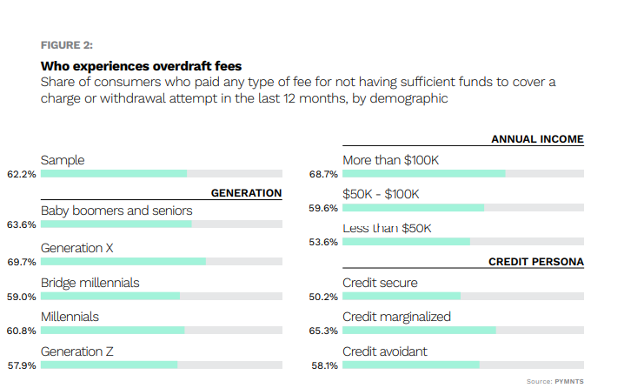

As for the financial impact, as noted in “The Credit Accessibility Series: How Consumers Use Overdrafts,” a PYMNTS and Sezzle collaboration, 62% of consumers who attempted a transaction without sufficient funds were charged some type of overdraft fee, which implies that more than a third were not charged those fees. The data shows that 45% of consumers were charged a flat fee and 27% were charged a percentage of the transaction. The average flat fee consumers faced was $29, and the average percentage charge was 2.9% of the transaction.

The chart below shows that overdrafts are experienced by consumers across all manner of income levels and demographics — including high earners and credit secure consumers.

Though the repeated use of overdrafts may have negative financial impacts (cited by a majority of our sample), so does having a transaction declined outright, the water shut off, or the groceries left in the cart because the “bridge” has not been there to help smooth things over, albeit temporarily.