Balancing household budgets amid rising living costs is a widespread challenge. To streamline finances, individuals residing with partners or spouses are most likely to pool their finances together, with 87% sharing financial information and 76% maintaining joint bank accounts, PYMNTS Intelligence finds.

From the rising costs of housing, food and essential items, effectively managing finances has become an increasingly daunting task for households across the United States, especially with 61% of Americans living paycheck to paycheck as of June. The impact of these rising costs extends across the board, impacting families and individuals alike, irrespective of their household compositions.

In the “Household Finances Deep Dive Edition” of New Reality Check: The Paycheck-to-Paycheck Report, PYMNTS Intelligence took a closer look into the financial habits of consumers living in different household structures, drawing insights from a survey of over 4,600 U.S. consumers.

According to findings detailed in the study, a LendingClub collaboration, there is a correlation between household size, stage of life and financial lifestyle. For instance, consumers living with a partner or spouse reported less financial hardship compared to those living with friends or housemates.

Additionally, those living in larger households, especially those with dependent children, tend to face more financial struggles. In fact, households with young children were 12% more likely to live paycheck to paycheck, pointing to the added financial responsibilities associated with raising a family.

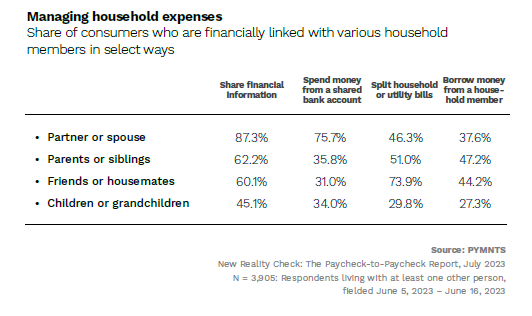

The research also showed that consumers are sharing living costs — even if they don’t entirely merge financial resources — as a strategy to alleviate these challenges. Notably, individuals residing with partners or spouses are most inclined to pool their finances together, with 87% commonly sharing financial information and 76% maintaining joint bank accounts, as per PYMNTS Intelligence data.

Financial connections also extend to children living at home, with 45% of parents sharing financial information with their children and 34% granting them access to a shared account.

“Splitting household or utility bills is the most common financial interaction among those living with friends or housemates, at 74%, followed by 51% of consumers residing with parents or siblings and 46% of those living with a partner or spouse,” the study also revealed.

Additionally, borrowing money from household members is a common practice among consumers to make ends meet, with individuals mostly engaging in this practice with parents or siblings (at 47%) and with friends or housemates (at 44%).

Our data has also found that 31% of consumers received financial support from a household member within the past year. Gen Z consumers lead this trend at 52%, closely followed by those living with parents or siblings at 51%. Individuals in urban areas and those experiencing paycheck-to-paycheck living, at 44% each, also demonstrate higher tendencies to receive such financial assistance.

In contrast, a smaller fraction (17%) received financial support from individuals outside their household. Among this group, those cohabiting with friends or housemates (36%) and Gen Z members (30%) are more likely to receive external financial support.

In summary, managing expenses and adjusting spending habits are crucial for consumers navigating the challenges posed by rising costs and inflation. Amidst these challenges, the significance of budgeting, saving and collaboratively shouldering living costs cannot be overstated. Implementing these tactics empowers consumers to improve their financial well-being and reduce the burden of living from one paycheck to another, regardless of their household size.