Now comes news that social posts celebrating affluent lifestyles have rendered many consumers — especially younger ones — feeling economically inadequate. They call the condition “money dysmorphia,” and it’s allegedly convinced about 43% of Gen Z users and 41% of millennials that because their lifestyles don’t mirror those of the online influencers they follow, they’re financial failures.

This perception is likely real for many, but blaming Instagram, Snapchat and other social channels ignores the fact that many consumers, regardless of age and income bracket, struggle to cover the costs of housing, groceries, gas and other essentials.

It’s not just cash-strapped younger generations who feel this pressure; a high percentage of older Americans and even affluent consumers say they are struggling as well.

According to the latest edition of PYMNTS Intelligence’s Paycheck-to-Paycheck Report: “Why One-Third of High Earners Live Paycheck to Paycheck,” 62% of U.S. consumers live paycheck to paycheck, including more than one-third of those with annual incomes that exceed $200,000.

The report, which draws on insights from a January 2024 survey of 4,285 U.S. consumers, found that 53% of baby boomers and seniors now live paycheck to paycheck, while 62% of Gen X respondents do so as well. The percentages climb from there as notable shares of bridge millennials (68%), millennials (71%) and Gen Z (67%) all report living from one paycheck to another.

Advertisement: Scroll to Continue

About three-quarters of low-income respondents (those who make less than $50,000 per year) and roughly two-thirds of middle-income consumers (those earning between $50,000 and $100,000 annually) say they live paycheck to paycheck.

But even higher incomes don’t appear to inoculate some consumers from financial pressures. Forty-eight percent of high-income earners (those annually earning more than $100,000) say they live paycheck to paycheck, and, within that percentage, there is a subset of 36% of consumers who earn more than $200,000 each year and still live paycheck to paycheck.

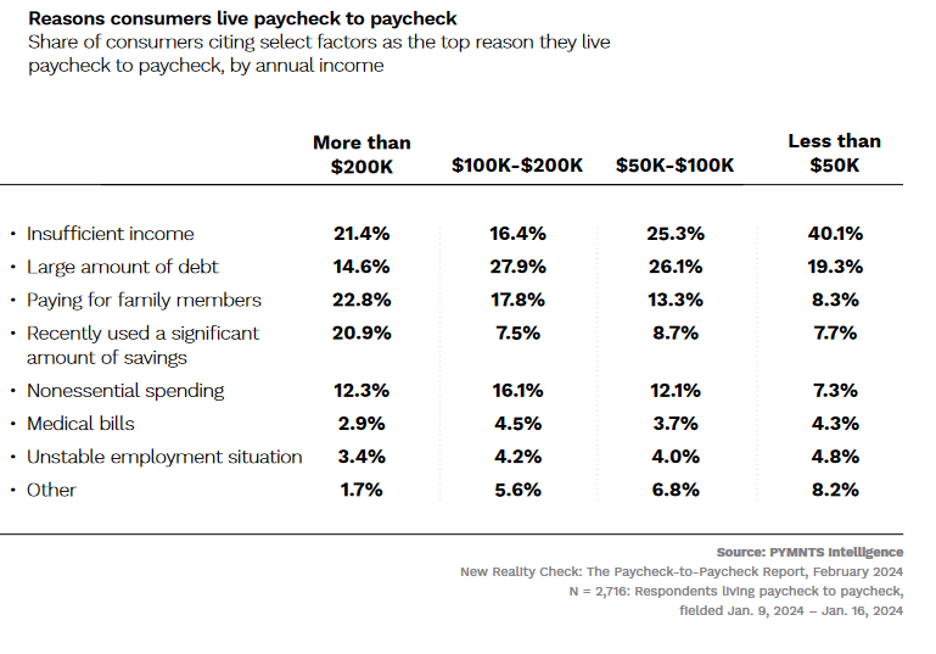

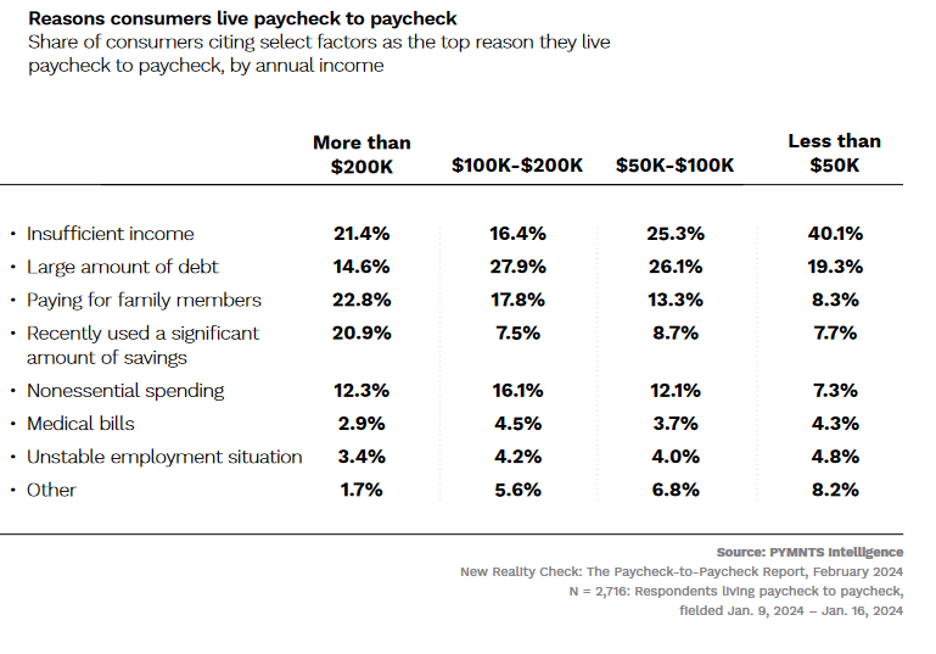

As the chart below illustrates, the reasons consumers struggle balancing their bills vary. For low-income and middle-income consumers, insufficient earnings cause many of their financial worries. The reasons high-income consumers report being financially challenged include nonessential expenses, spending on others and savings-depleting events.

One consistent factor that all groups say hinder their lifestyles is debt.

Nearly 23% of the highest-income earners say family expenses are the top reason they live paycheck to paycheck. About 12% say nonessential spending is their main pain point (as do approximately 12% of middle-income consumers). These two factors, along with the fact they appear to tap into their savings more than any other segment, reveal key differences in financial stressors plaguing the highest earners versus other income brackets. These factors suggest consumers who earn more than $200,000 annually appear to struggle more than others with effectively managing money and living within budgets.

Perhaps not surprisingly, “Why One-Third of High Earners Live Paycheck to Paycheck” found affluent consumers allocate a smaller fraction of their budgets to housing than their low-income counterparts do. Also no surprise: low-income consumers spend less on discretionary items, while high-income earners allocate almost one-third of their budgets to nonessential purchases. And while housing and grocery spending combined absorbs 54% of a low-income earners’ budgets, that combination accounts for only 38% of what those earning more than $200,000 spend.

Given today’s economic uncertainties and recent inflation increases, there is no doubt that many consumers are experiencing money dysmorphia. But, as PYMNTS Intelligence’s recent report concludes, financially stressed high-income earners may well lack the “disciplined habits” needed to offset their perceived financial woes.