Among the array of unforeseen expenses, medical emergencies take the lead as the most prevalent, averaging $6,200, 13% more than the average unexpected expense. Following closely behind, home repairs stand as the second most common unplanned expense, averaging around $6,000. These sizable and unforeseen financial burdens significantly impact consumers’ financial stability, particularly amplifying the challenges for those who are already credit marginalized.

These are some of the conclusions drawn from “Credit Card Use During Economic Turbulence,” a report by PYMNTS Intelligence and Sezzle. The study was based on a survey of over 2,200 U.S. consumers to identify patterns related to the spike in credit card usage and key drivers for choosing certain card features, highlighting how higher inflation has influenced this behavior.

Further data revealed that nearly 60% of all consumers had a costly and unexpected expense in the past year, averaging $5,500. This amount represented more than half of the average savings balance of these consumers. Gen Z consumers were particularly affected, with seven in 10 facing unexpected expenses that cost almost as much as or more than their current average savings of $3,400.

Credit-marginalized consumers, who already face financial difficulties, are hit the hardest when confronted with emergency expenses. The survey found that 50% of these individuals who have been rejected for credit products at least once in the past year relied on high-interest loans, such as payday and pawnshop loans, to cover unexpected expenses. This is more than twice the rate of the average consumer.

Furthermore, credit-marginalized consumers were more likely to turn to other financing options, such as buy now, pay later (BNPL) and credit cards. In fact, 17% of credit-marginalized consumers used BNPL to pay for their unexpected expenses, while 18% used credit cards.

Advertisement: Scroll to Continue

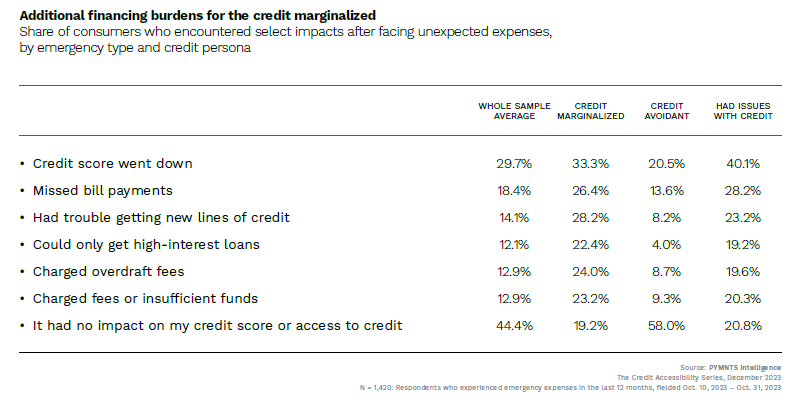

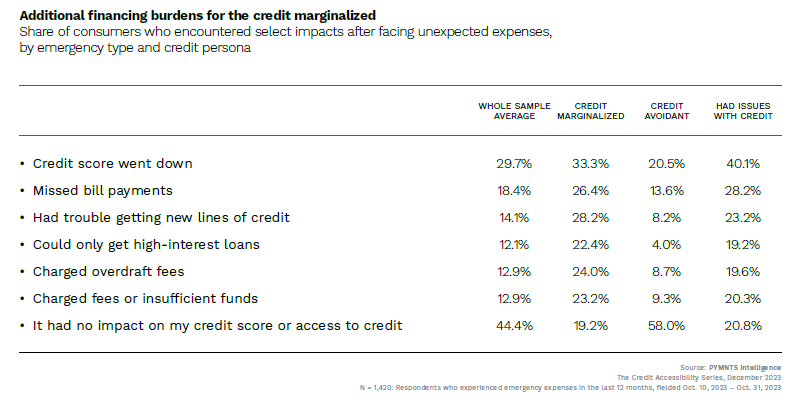

These options provide some relief but can still lead to additional financial burdens, the study showed. For instance, credit-marginalized consumers who faced unexpected costs also experienced further credit issues, particularly a decline in credit scores affecting 33% of consumers.

Additionally, 22% of credit-marginalized consumers were limited to high-interest loans, and 24% were charged overdraft fees due to these expenses. Another 23% were charged bank fees for insufficient funds, 28% had trouble getting new lines of credit and 26% reported missing payments.

In essence, unexpected expenses not only strain finances but also lead to additional burdens for consumers. While external financing offers temporary relief, it often escalates credit problems. To counter this, individuals should focus on building emergency savings and seeking favorable alternative financing.

Access to financial education and affordable credit options can also empower consumers to handle unexpected costs without harming their credit scores.

For example, credit-building apps can serve as valuable tools in tackling mounting debt and boosting credit scores. As noted in separate PYMNTS research, individual with scores of 579 or less — known as deep subprime credit scores — who manage to raise their scores to the near-prime bracket of 620 to 659, can access an additional $44,000 in financing opportunities and slash interest rates by up to 24%.