Payments are the backbone of many digital platforms. But what makes companies like eBay, Tableau and Netflix popular is ease and speed of use.

Unfortunately, platforms that are designed to be seamless are also often attractive targets for fraud. This is even more true for B2C marketplaces.

The Payments 2022 Playbook: Building A High-Performing Payments Team For Fraud Detection examines the growth strategies of digital platforms over the next three years, how payments teams are facing the challenges of fraud detection and how satisfied they are with their current systems.

Companies often get into trouble working around the tension between ease of use and impenetrability for fraudsters. It’s the users who often become the victims in stringent security measures when fraud detection is too broad.

This is why fraud-related costs consume large portions of digital platforms’ budgets—to the tune of 2.2 percent of their annual revenues.

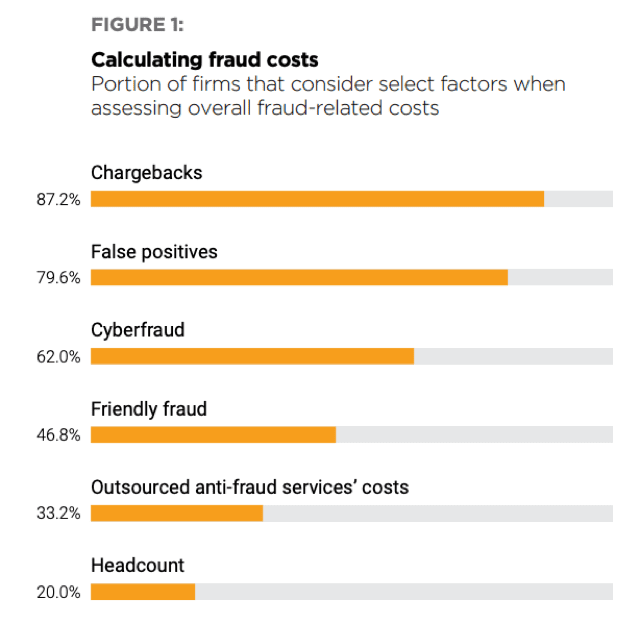

False positives are one of the leading drivers of these costs. Digital platforms weigh false positives to a much greater extent than instances of actual fraud when estimating related losses, cited by 79.6 percent. A lower number (62.0 percent) factored cyberfraud into their overall costs.

Advertisement: Scroll to Continue

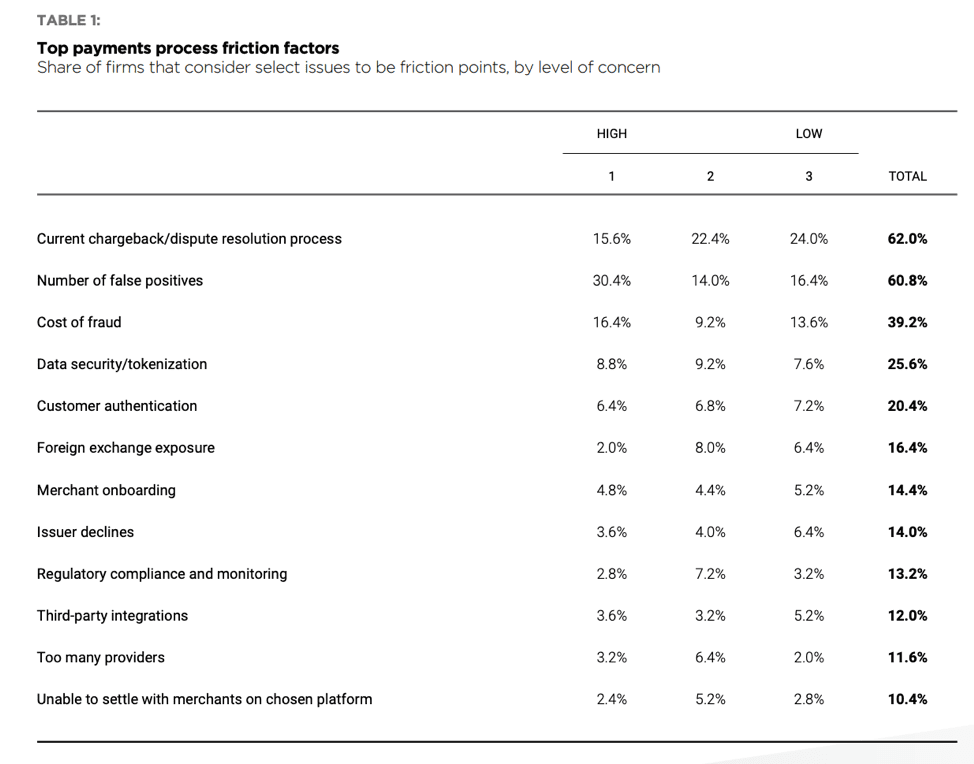

Roughly one-third (30.4 percent) of platforms also consider false positives to be a top friction point in their payment processes. This makes sense considering false positives can directly affect conversion rates.

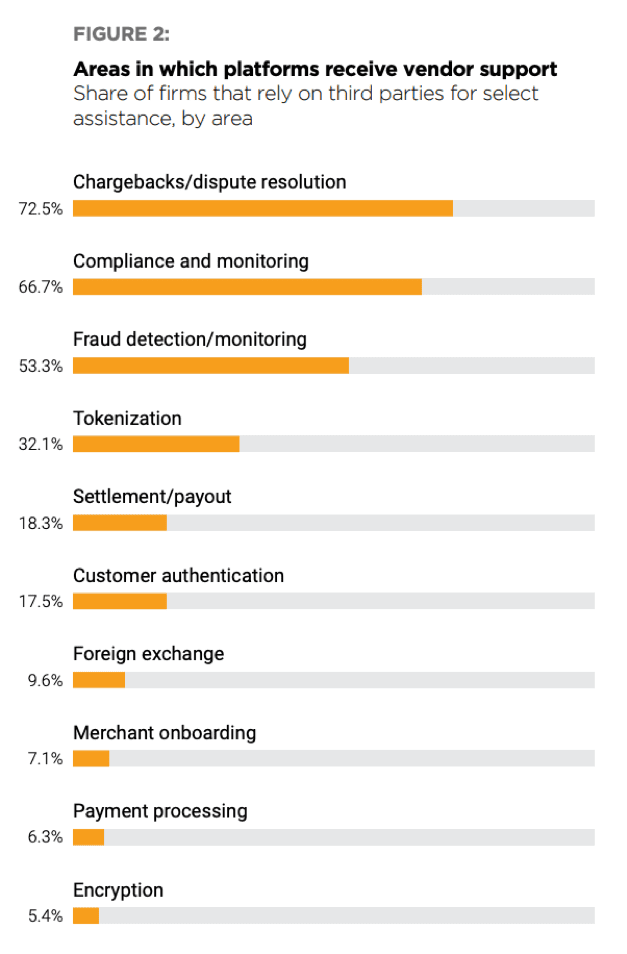

While the largest share (44.8 percent) of platforms had six to 10 employees dedicated to payments, a majority (53.3 percent) used third-party vendors for help with fraud detection and monitoring. This is fewer than those who use vendors for chargebacks and dispute resolution (72.5 percent) and compliance and monitoring (66.7 percent) but far more than for areas like foreign exchange (9.6 percent) and merchant onboarding (7.1 percent).

Most (68.6 percent) platforms intend to increase the size of their risk and fraud teams.

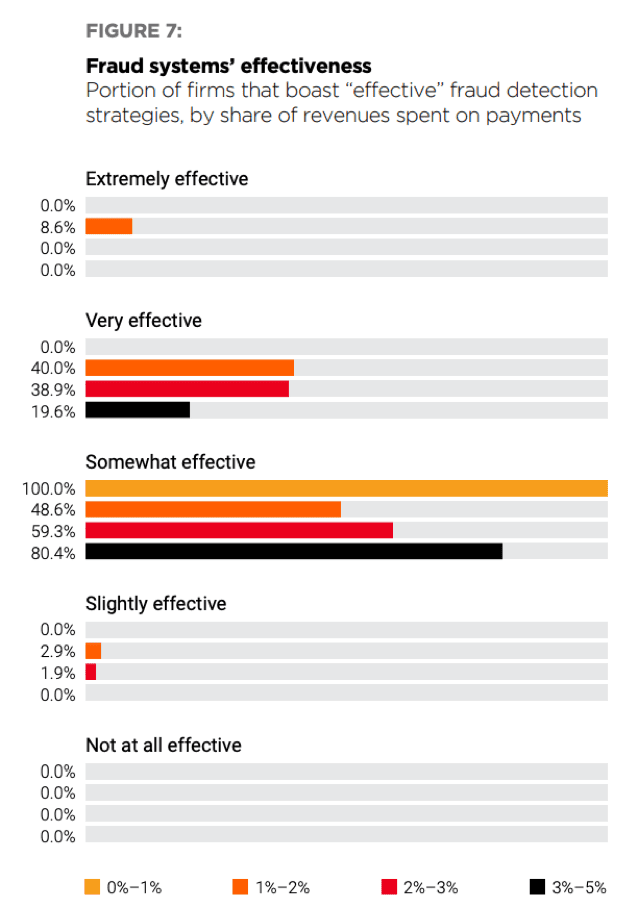

Despite vendor outsourcing and potentially investing in new employees, digital platforms aren’t particularly confident in their fraud operations. Most (62.4 percent) rate measures taken to fight fraud as only “somewhat” effective at best, and a tiny amount (1.2 percent) consider them “extremely” effective.

One counterintuitive finding was that satisfaction with fraud detection capabilities decreased with increased spending on their payment systems. For example, 40 percent of those that spend between 1 percent and 2 percent of their annual revenues on payment processing consider their systems to be “very” effective, while just 19.6 percent of the platforms that spend 3 percent to 5 percent of their revenues say the same.

Additionally, larger teams didn’t correlate with satisfaction levels, either; 39.1 percent of those with three to five employees on their payments teams consider their systems to be “very” effective, as do 32.5 percent of those with 11 to 25.

One theory is that companies that devote more staff and funding to their payment platforms have a more accurate sense of false positives, so have a more guarded view of their systems’ effectiveness.

This implies that digital platforms have to become more strategic in their approaches to fighting fraud, if staffing up and outsourcing haven’t been effective.

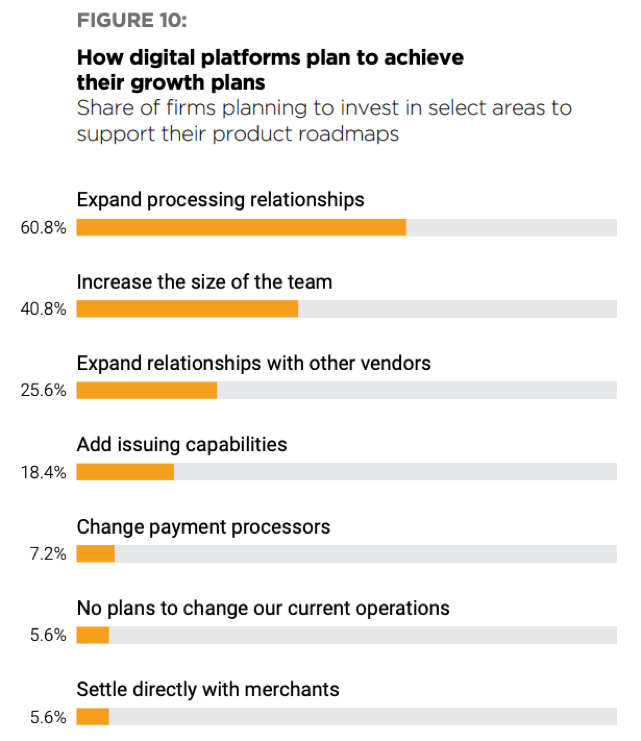

A majority (60.8 percent) consider expanding processing relationships to be at the center of their growth strategies, higher than adding team members (40.8 percent) or boosting vendor relationships (25.6 percent).

The desire to expand processing relationships rather than increasing staff or expanding vendor relationships appears to relate to anti-fraud satisfaction levels. In the study, 64.4 percent of the platforms that are “very” satisfied with their anti-fraud systems will prioritize processing relationships while far fewer (37.9 percent) will boost hiring.

To put a finer point on it, of digital platforms that are confident in their anti-fraud measures, all (100 percent) of those who rate themselves as “extremely satisfied” are focusing on processing relationships.

The idea is to enable more accurate fraud detection through payments processors with sophisticated, machine learning-based anti-fraud systems.