In today’s digital era, it seems almost quaint that an industry as essential as real estate relies so heavily on paper checks, given current rates of mailbox fraud and other uncertainties such as delivery reliability.

However, the continued use of old-fashioned — some could say outdated — payment methods could have negative effects on all parties involved. These can range from delayed payments due to the check being in the mail to the ensuing late fees that could follow.

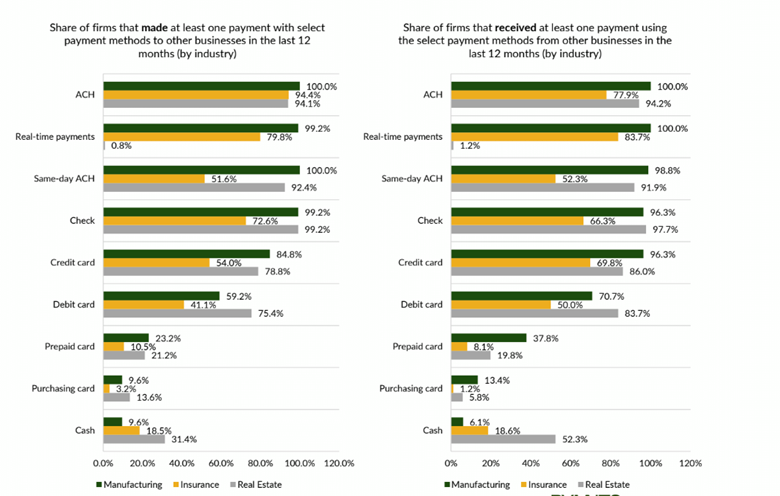

However, as noted in the below proprietary chart created for “Corporate Changes in Payment Practices,” a PYMNTS collaboration with The Clearing House, real estate as a sector has so far been slow to adopt modernized payment methods wholesale. Although nearly all sector businesses surveyed use digital payment methods such as ACH, nearly no real estate companies are either sending or receiving real-time payments.

This is particularly stark, given that nearly all manufacturing firms in our sample have made or received at least one real-time payment in the past year. Real estate firms hover around 1%, instead leading in cash use among the three industries.

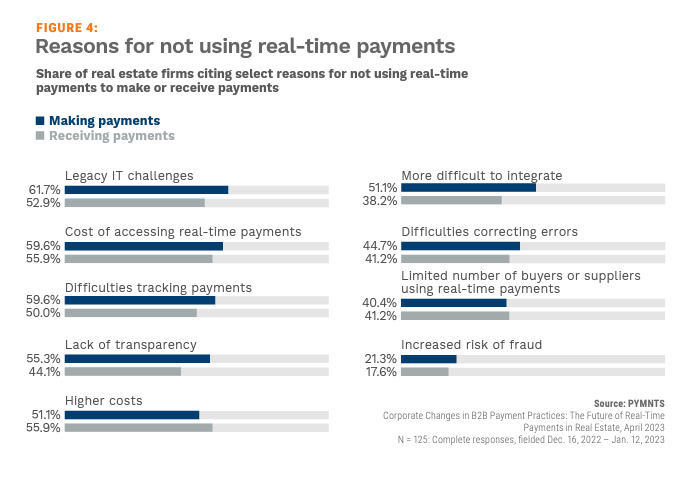

The main reasons for this hesitation to utilize real-time payments may be found in the below chart, created for “Corporate Changes in B2B Payment Practices: The Future of Real-Time Payments in Real-Estate Practices,” a PYMNTS collaboration with The Clearing House.

For 62% of surveyed firms, legacy IT challenges were the top reason cited for their business to not implement making real-time payments. Costs involved were the top reason cited for 56% of real estate firms to not receive real-time payments.

Another driver for this hesitancy could be due to previous transaction limits surrounding the amount of money that may be sent via real-time payment networks. Although these have been raised in recent years, potential users could be working with the assumption that these limits are at their previous lower caps.

However, just because these firms haven’t (or haven’t yet) implemented real-time payments as an accounts payable and receivable option doesn’t mean they don’t want the ability. Ninety percent of firms plan to use real-time payments within a year after being surveyed, with 84% saying paper checks could be replaced with the more modern payment method.

And while modernization efforts may be slow, some leaders realize these efforts have far-reaching benefits.

In an interview with PYMNTS, Adam Feinstein, vice president of product for payments at AppFolio, discussed the benefits for the sector players in going digital, which may include adoption of platforms such as real-time payments.

“Online payments processes can help create new efficiencies and uncover cost savings opportunities, increase security to lower fraud incidents and create a more convenient, modern experience for everyone involved,” Feinstein said.

Given the slow rate so far of modernization adoptions within the sector, it may be some time before real-time payments is taken up by a sizable share of firms. Meanwhile, at least there’s ACH in place for those preferring their payments to be digital.