PYMNTS’ most recent “Consumer Inflation Sentiment” report examines this issue across age and income demographics as owning or renting on one’s own becomes increasingly out of reach for many Americans. The share of consumer respondents who believe homeownership would be at least somewhat possible for them at some time dropped by 24% over the past two years. This means a projected 18 million U.S. consumers have given up on the dream of owning a house since early 2021.

Challenges exist for renters trying to better their living situation, as well. Only 27% of surveyed renters currently believe it is at least somewhat possible for them to afford a more expensive place, whereas 34% believed the same in 2021. In fact, 35% of renters are considering moving to a less expensive property to cut costs, as rent prices increased 8.3% across 2022, slightly outpacing the average mortgage and property tax rate increase of 7.5%. However, both of those rates surpassed the national average wage increase of 5.1% for the 12-month ending in December, according to the Bureau of Labor Statistics.

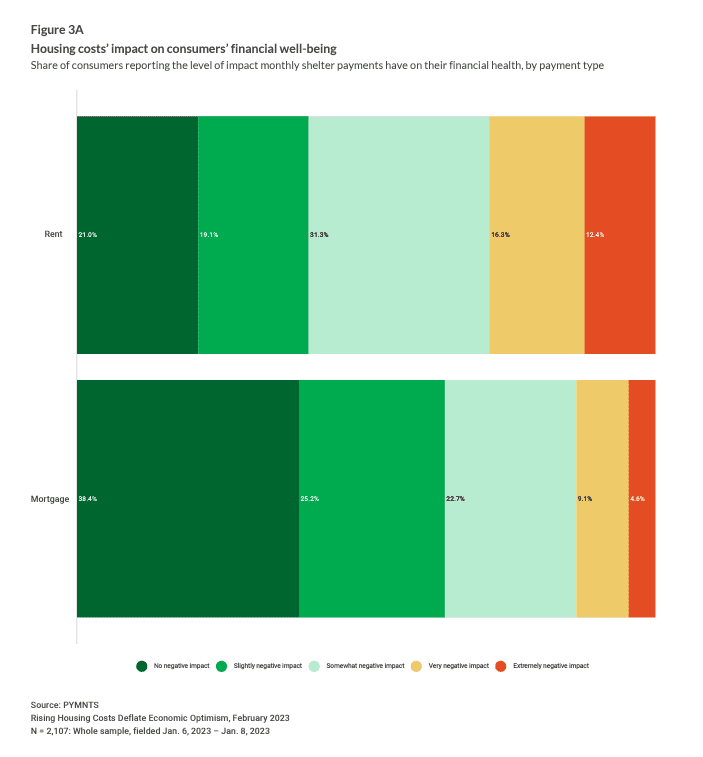

Given this imbalance, it’s no wonder the cost of housing, whether mortgage or rent, is taking a toll on U.S. consumers’ finances.

Renters are twice as likely to say housing costs are very or extremely detrimental to their finances than homeowners paying mortgages. This has led some renters to start GoFundMe accounts to assist with housing emergencies. And although mortgage-holders report housing holds less of a negative impact on their budgets than renters do, nearly 65% of homeowners reported feeling the strain at least slightly.

Fortunately, providers have some solutions designed to give some relief or assistance to potential or current homebuyers and renters. While there’s no easy answer to homebuying or rental concerns, some of these tools could ease the process and find renewed popularity in this sizable market.

Advertisement: Scroll to Continue

Intending to improve long-term financial health, Fannie Mae in September released its Multifamily Positive Rent Payment Reporting program to help renters build and improve their credit history. It allows eligible landlords to share rent payment information with the three major credit bureaus across a vendor network to be incorporated into renters’ credit profiles. This program has to potential to significantly positively impact on-time renters who live in a multifamily home, as these payments aren’t always included in credit scores.

Potential homebuyers have some assistance with programs such as those offered by real estate startup Bilt. Processing $3 billion in rent payments annually, Bilt offers a credit card converting these payments into points towards a down payment on a home. In March last year, Bilt partnered with Wells Fargo to allow customers to earn points and miles on rent payments.

And for more short-term help, Airbnb announced in November that it would let those living in apartments turn their places into short-term rentals. Designed to assist hosts in earning income as the cost of living continues to rise, the company’s “Airbnb-friendly apartments” program is available at 175 properties around the country.

There’s no easy all-in-one solution for the many people struggling under the heavy weight of increased housing costs. But as this nationwide challenge continues, it is almost assured these and other innovative solutions may rise to meet renters’ and homebuyers’ needs.