The SEPA Instant Credit Transfer (SCT Inst) continues to gain traction in Europe amid uneven growth across the region.

Introduced in November 2017, the intra-European payments scheme, also known as SEPA Instant, was built on the existing SEPA architecture with the promise of ultra-fast euro payments across the 36 countries within the Single European Payment Area (SEPA).

As part of its mandate, the scheme allows cashless payments of up to €100,000 (about $106,000) to be cleared in 10 seconds or less once a payment service provider (PSP) recognizes it as a SEPA transaction — much faster than the batch processing of regular credit transfers.

And according to the 2022 figures from the European Payments Council (EPC), 61% of European PSPs have already adhered to the scheme, representing a total number of 2,313, with 29 out of the 36 countries currently offering SCT Inst.

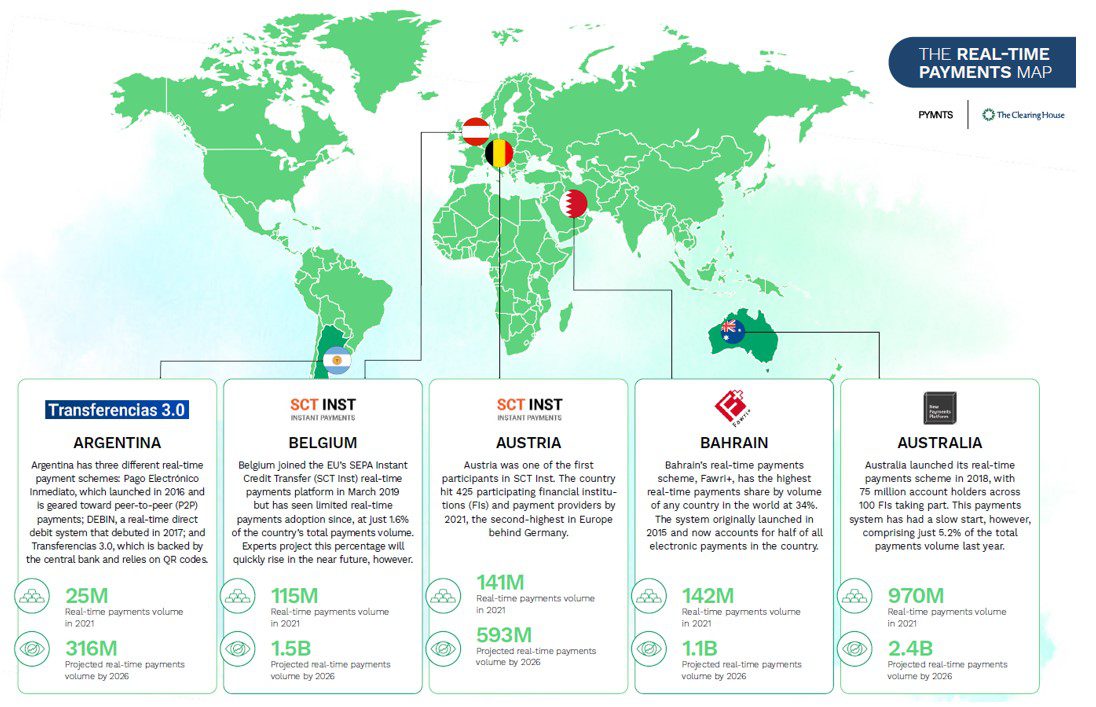

Austria, one of the first participants in SCT Inst, is a front-runner in the European real-time payments space, with an increasing number of participants helping to meet the growing demand from consumers and businesses for quick and seamless cross-border payments.

In fact, according to the latest Register of Scheme Participants from the EPC, the country has hit 443 participating financial institutions (FIs) and PSPs as of this month, which is the second-highest in Europe behind Germany and ahead of France and Italy.

Real-time payments volume in Austria is also expected to hit 593 million by 2026, up from the 141 million recorded in 2021, according to “The Real-Time Payments World Map,” a PYMNTS and The Clearing House collaboration which traces the evolution of countries, merchants and consumers’ use of the payments innovation.

Despite gaining traction over the last five years, including a surge in 2019, rollout of SEPA Instant has significantly slowed since then. In fact, in Q3 2022, real-time payments accounted for less than 14% of all SEPA credit transactions.

In an interview with PYMNTS, Steve Naudé, head of product at Wise Platform, pointed to the low proportion of banks — 5% in Ireland and just 4% in Denmark — offering SEPA Instant as one of the inhibitors of instant payments on the continent.

Moreover, Naudé said the fact that many financial institutions (FIs) charge customers an additional transaction fee for the instant service continues to undermine the success of the scheme, which is not yet covered by the SEPA mandate requiring PSPs to charge the same fees for transactions within the single payment area.

“All institutions should offer this to their customers, and it should be offered at no additional cost,” Naudé said at the time.

The good news is that change may be coming soon. In October of last year, the European Commission (EC) published a proposal aimed at forcing banks PSPs to offer 24/7 instant euro payment services without charging customers an additional fee, PYMNTS reported.

Once the new rule comes into force, eurozone PSPs will have one year to enable the sending of instant payments, while SEPA-connected banks outside of the eurozone will be given additional time to comply to the rules.

Until then, industry players like Lena Hackelöer, CEO at Stockholm-based instant payments provider Brite Payments, are of the view that the EU is already ahead of the curve when it comes to progress made in the global instant payment space.

“If you take a world map and map out where instance schemes for instant processing of bank transactions are already launched or a step to launch and it’s getting better and better — [it’s Europe],” Hackelöer said.

For all PYMNTS EMEA coverage, subscribe to the daily EMEA Newsletter.