Enterprise Retail Warms to Real-Time Payments for Vendors

The retail sector increasingly prefers real-time payments for their business-to-business (B2B) payments. Virtually all large firms in this sector used real-time payments at least once in the last year.

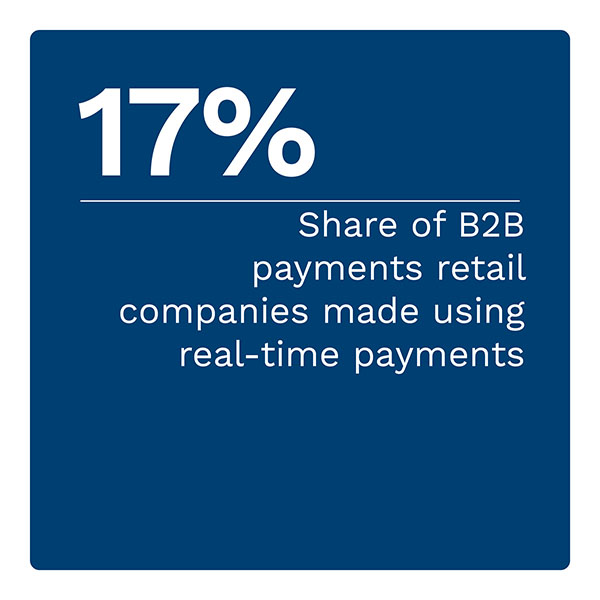

Real-time payments have a robust growth outlook. Real-time payments already account for 17% of all B2B payments retailers made last year. Fifty-four percent of retail firms expect to use real-time payments more heavily in the next year.

Real-time payments have a robust growth outlook. Real-time payments already account for 17% of all B2B payments retailers made last year. Fifty-four percent of retail firms expect to use real-time payments more heavily in the next year.

These are just some of the findings detailed in “Corporate Changes in Payment Practices: A Deep Dive Into the Retail Industry,” a PYMNTS Intelligence and The Clearing House collaboration. This report examines the B2B payments landscape in the retail sector and how the role of real-time payments is evolving. The report draws on insights from a survey of 125 retail executives conducted from June 1 to June 26.

Other key findings include the following:

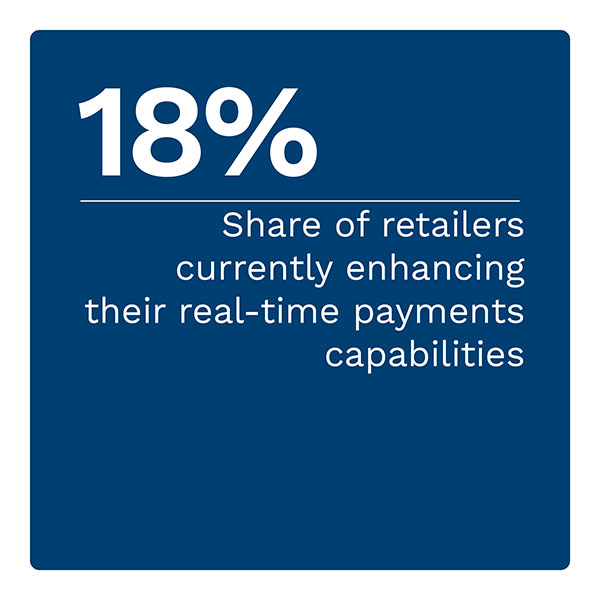

Retail firms plan to improve real-time payment capabilities.

Retail firms plan to improve real-time payment capabilities.

Eighteen percent of large retail firms are enhancing real-time payment capabilities, and 63% plan to do so within the next year. This shows that real-time payments will further outpace other B2B settlement methods in the retail sector in the coming years.

Real-time payments are replacing traditional payment methods, particularly checks and debit cards.

Retail firms widely expect real-time payments to reduce reliance on traditional payment methods. At the top of this list comes checks, with 94% of surveyed retailers saying that real-time payments will replace checks. Large shares of companies say the same about debit card and automated clearing house payments.

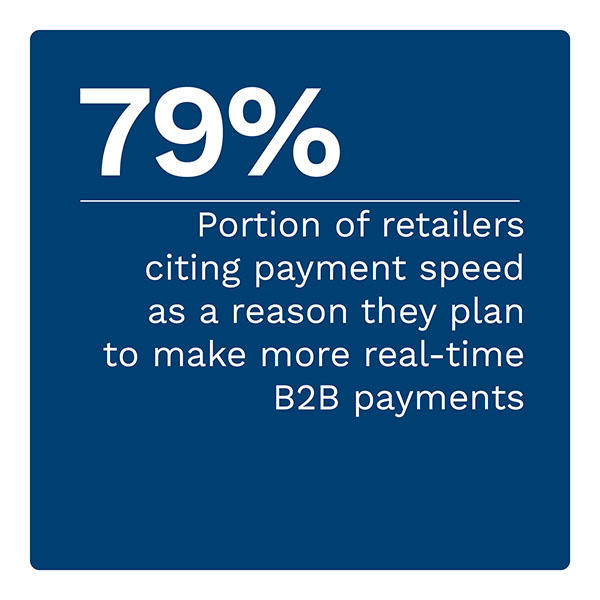

Enhancing buyer-supplier relationships is the most common reason firms expect to increase the use of real-time payments.

Among retailers that expect to make more real-time payments, 87% cite a receivers’ ability to use real-time payments as a determining factor. This underscores the virtuous cycle that will accelerate as real-time payment use and adoption increases. The more their B2B counterparties accept real-time payments, the more firms will ramp up their own use.

The retail sector is undergoing a sea change in B2B payments. Companies must keep pace with these changes to remain competitive. Download the report to learn how real-time payments are revolutionizing retail B2B relationships.