In Europe, where real-time payments adoption has seen historic growth in recent years, Greece joins countries like the U.K., Sweden, the Czech Republic and Hungary that have developed domestic payment systems to complement the existing pan-European Single Euro Payments Area (SEPA) Instant Credit Transfer scheme, also known as SCT Inst.

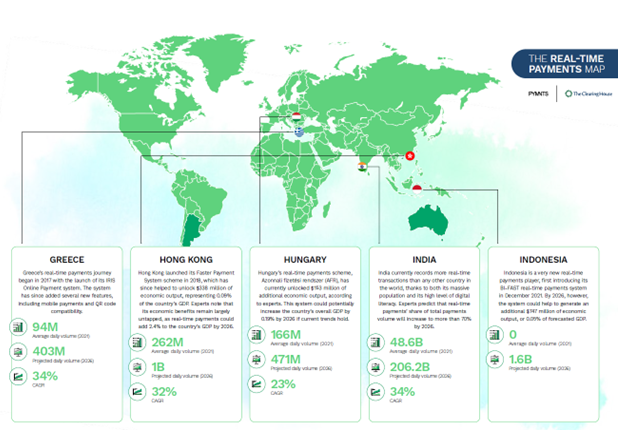

The country’s real-time payments scheme, IRIS Online Payment system, was launched in 2017 — the same year as SCT Inst — and has since added several new features, including mobile payments and QR code compatibility, according to information captured in the April edition of the “Real-Time Payments World Map,” a collaboration with The Clearing House.

With IRIS, consumers can quickly and safely transfer funds to peers and professionals simply using their mobile phone number, as well as pay professionals or online shops through their VAT number or with QR code scanning, respectively.

The PYMNTS report also reveals that daily real-time payments volume in the southeastern European country is set to increase from 94 million in 2021 to hit 403 million in 2026, growing at a compound annual growth rate (CAGR) of 34% between that period.

This growth potential is likely due to the presence of a domestic scheme in addition to the adoption of SCT Inst by a significant number of banks — 23 out of 36 major banks and payment service providers (PSPs) — in Greece, per the latest Register of Scheme Participants from the European Payments Council (EPC).

The huge growth potential of real-time payments in Greece is also captured in ACI Worldwide’s “2023 Prime Time for Real-Time” report, which shows that instant payment transactions in the country are projected to surpass 400 million by 2027.

However, the country’s population has been very slow to adopt instant payments en masse, a trend also seen among several European countries like Belgium, the Czech Republic and France. In fact, according to the ACI report, paper-based transactions dominate Greece’s payment landscape, accounting for more than 60% share of total payments volume in 2022.

For all PYMNTS EMEA coverage, subscribe to the daily EMEA Newsletter.