The pandemic has upended how we order meals at restaurants, how we pay and, ultimately, how we eat. These transformational shifts are, in turn, affecting how quick-service restaurants (QSRs) engage customers as the health crisis limits their in-person dining offerings and forces them to fast-track planned digital innovations.

New developments from fast-casual behemoth Chipotle Mexican Grill illustrate the increasingly digital nature of QSRs’ operations. It recently opened its first digital-only location after reporting that its digital sales grew by 203 percent in Q3 compared to the same period in 2019. Digital revenues represented 49 percent of the chain’s total sales  during the same quarter, revealing that consumers are clearly seeking digital access to restaurants in record numbers.

during the same quarter, revealing that consumers are clearly seeking digital access to restaurants in record numbers.

The December Order To Eat Tracker® examines how QSRs are working to upgrade their digital channels and entering into digital-only services, and how this shift is affecting their customer engagement efforts and bottom lines.

Around The Order To Eat Space

The pandemic is accelerating digital and drive-thru innovations for numerous QSRs, with Taco Bell’s first mobile-only pickup restaurant expected to open in Q1 2021, for example. Research reveals that some consumers will return to eateries after a vaccine is widely distributed, but it is unclear to what extent dine-in service will rebound. Some experts even predict that these shifts will be permanent, meaning there could be long-term implications for restaurants’ customer engagement strategies in the future.

One recent survey found that the United States’ largest QSRs saw 9 percent sales reductions on average in October compared to the same month in 2019, but that restaurants have been preventing far greater losses by turning to off-premises sales during the pandemic. Digital orders grew by 138 percent year over year in Q3, for example. Take out, drive-thru and delivery orders rose by 22 percent over the same period, while dine-in orders slipped a staggering 62 percent.

The recent digital ordering surge is anticipated to continue well after the pandemic ends, with another study finding that digital will represent a majority of QSRs’ sales by 2025. The survey said digital sales will account for 54 percent of these restaurants’ revenues over the next five years, which would represent a 70 percent increase over pre-pandemic estimates. The report also found that there is still room for the industry to grow its digital offerings.

The recent digital ordering surge is anticipated to continue well after the pandemic ends, with another study finding that digital will represent a majority of QSRs’ sales by 2025. The survey said digital sales will account for 54 percent of these restaurants’ revenues over the next five years, which would represent a 70 percent increase over pre-pandemic estimates. The report also found that there is still room for the industry to grow its digital offerings.

For more on these and other stories, check out the Trackers News & Trends section.

Shake Shack On Leveraging AI, ML To Drive Customer Experience

The pandemic has strained fast-casual food outlets, prompting them to increase their investments in technologies that can help them stay competitive and streamline customers’ experiences. Many of these restaurants were already innovating their digital approaches, but the health crisis has forced them to kick these efforts into overdrive. In this month’s Feature Story, Steph So, head of digital experience at Shake Shack, discusses the New York-based burger chain’s increasing investment in digital technologies to improve customers’ journeys as well as its exploration of artificial intelligence (AI) and machine learning to boost its initiatives.

To get the full story, download the Tracker.

Deep Dive: Why Loyalty Programs And Digital Ordering Initiatives Are Key To QSRs’ Success

Deep Dive: Why Loyalty Programs And Digital Ordering Initiatives Are Key To QSRs’ Success

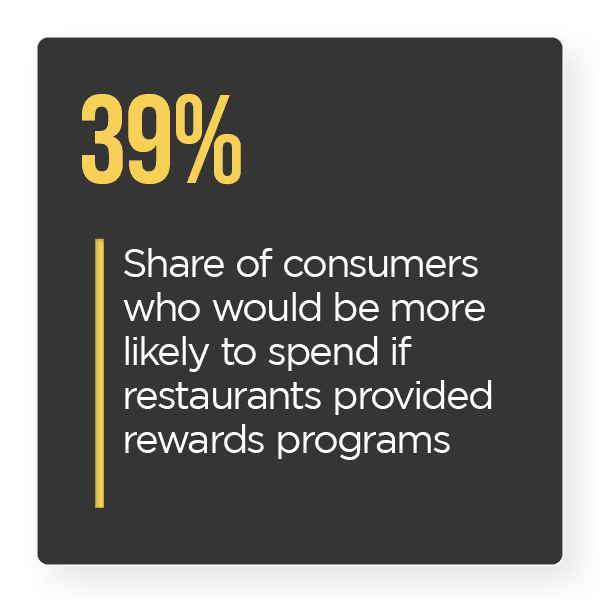

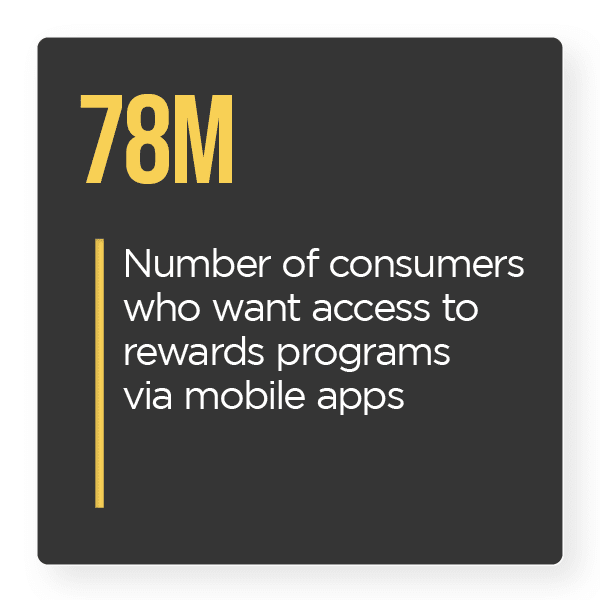

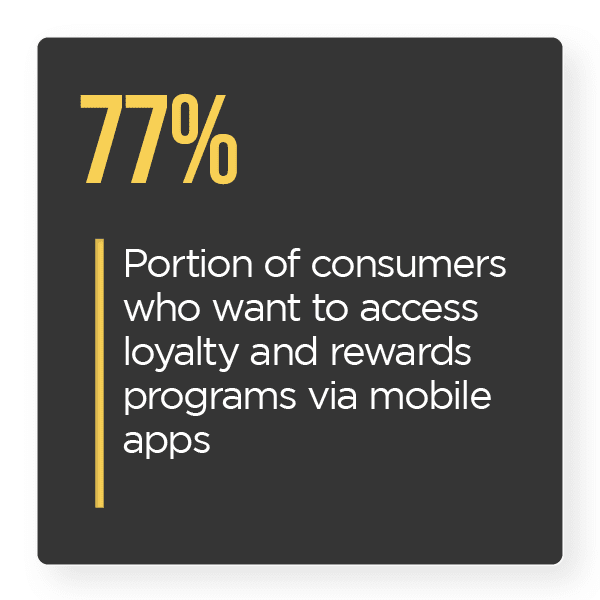

Recent research suggests that two features are key to separating top-performing QSRs from the rest of the pack: loyalty programs and robust digital payment options. PYMNTS’ Restaurant Readiness Index revealed that almost 92 percent of the most successful QSRs provided digital and remote payment options as well as loyalty programs, in fact. This month’s Deep Dive explores how the pandemic has highlighted the importance of mobile ordering and contactless payment and how robust loyalty offerings can also help restaurants engage customers who are taking to digital channels.

Read the full Deep Dive in the Tracker.

About The Tracker

The Order To Eat Tracker®, a PYMNTS and Paytronix collaboration, is a monthly report that examines the evolving restaurant space. The report highlights how fast food, fast-casual and QSR establishments are embracing technology, enhancing loyalty offerings and working with aggregated service providers to offer more seamless in-house and delivery ordering experiences and improve customer engagement.