Deep Dive: How To Boost Consumer Spending Based On Evolving Ordering, Payment Preferences

Online food ordering and delivery has come a long way since Pizza Hut became the first company to sell a physical good over the internet 27 years ago. More recently, digital food ordering soared 783 percent between the beginning of the pandemic and July 2020, according to one report. Another poll found that 46 percent of consumers expect these new dining habits to continue at the current rate even after the pandemic has subsided.

The large QSR chains that went digital long ago have managed to weather the storm of the last year with minimal revenue loss. Digital sales are doing so well that they are even projected to comprise 54 percent of limited-service and quick-service business in four years, up 70 percent over pre-pandemic estimates. Starbucks CEO Kevin Johnson told investors during its fourth-quarter earnings call that the coffee giant’s digital relationship with its customers, investments in its mobile app and the addition of drive-thrus have been key to maintaining sales through the pandemic.

Starbucks is not alone. Panera’s digital infrastructure has protected it from pandemic-driven revenue losses. The fast-casual chain introduced its digital ordering and payments offering seven years ago, and it added curbside pickup features within a week of the COVID-19 pandemic’s U.S. start. Fast-food giant McDonald’s received more than 90 percent of its sales from drive-thru orders during the second quarter of last year, proving how beneficial these features can be. The burger chain also reduced the time spent waiting in drive-thru lines by nearly 30 seconds with the implementation of menu boards that leverage artificial intelligence (AI). Digital channels and contactless options have become nearly essential to staying afloat in the restaurant industry as more than 60 percent of restaurants express plans to invest in mobile channels.

Consumers are ready to see greater contactless payment acceptance, too. One study found that 67 percent of retailers accept touchless payments and that 56 percent accept payments from mobile wallets. Ninety-four percent of respondents that implemented contactless payments said they expect the increase to continue. The pandemic has also motivated consumers to try digital and contactless payments for the first time, with 19 percent of U.S. consumers saying they completed their first in-store digital payment in May 2020. In this month’s Deep Dive, PYMNTS examines these and other trends in consumers’ evolving ordering and payment preferences and details how the QSR and restaurant industry is working to boost customer spend.

Features Essential To Boosting Customer Spend

Restaurants looking to stay in the black must assure diners that sanitation procedures and technology are in place to help reduce contact with staff. Eighty percent of respondents in one survey said they have avoided ordering from restaurants due to safety concerns. Sixty-six percent of those consumers said that eateries should make the effort to publicize safety precautions to help reassure diners. Another survey revealed that 40 percent of U.S. polled and 39 percent of U.K. respondents would be more willing to dine at a restaurant if they could read the menu on their mobile devices.

Consumers have turned to mobile channels in droves for food ordering and payment, seeking safe and seamless experiences. Half of consumers said they were using restaurant mobile apps more often than they were prior to the pandemic. In addition, 64 percent said they installed at least one app to buy food from restaurants, and more than half of consumers are using buy online, pick-up in-store options.

Offering contactless payment options helps restaurants increase sales, too. Diners who used touchless credit cards spent 30 percent more in the first year of owning their card than those who used swipe cards. This percentage remained consistent whether consumers were in low-, medium- or high-spending groups.

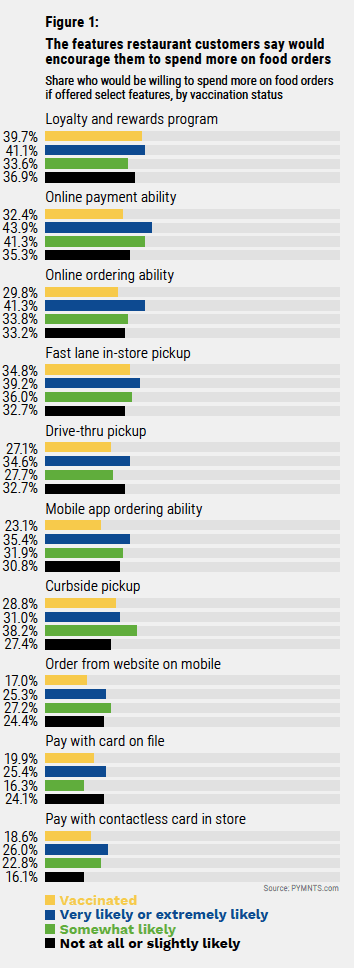

Another way eateries have attracted customers and encouraged existing ones to spend more is through loyalty and rewards programs. Delivering On Restaurant Rewards, a survey by PYMNTS and customer experience platform Paytronix, found that 39 percent of all restaurant customers would likely buy more if their restaurants provided loyalty and rewards programs. These incentives could encourage four out of 10 restaurant customers, 93 million, to spend more on food orders.

A correlation can also be found between vaccination and loyalty and rewards program use, interestingly enough, with restaurant customers who are either vaccinated or highly likely to get vaccinated being the most likely to spend more on their food orders if loyalty and rewards programs are present. Loyalty and rewards programs’ appeal suggests that they will continue to serve as a key differentiator for restaurants that want to engage customers long-term.

Restaurants continue to navigate conditions introduced by the pandemic, but the most successful establishments have adopted many of these features, technologies and initiatives. They appear to have learned that staying competitive and keeping revenues flowing is more possible when eateries stay attuned to customers’ demands.