Q4 was a difficult quarter in a difficult year for quick-service restaurants (QSRs), as the pandemic raged on, temperatures grew colder and diners returned to the warmth and safety of their homes. 2020’s restaurant sales fell $240 billion short of expectations, and 2.5 million jobs were lost, according to the National Restaurant Association’s State of the Industry Report. While small restaurants were hit especially hard by the economic downturn, QSRs have also experienced major decreases in sales, closing locations and laying off employees.

Even as consumers cut back on their food spending and opted to stay indoors, one QSR sales channel has become more effective than ever in recent months: loyalty and mobile apps. In the most recent quarter, Taco Bell, Chipotle Mexican Grill and Starbucks all saw digital sales growth driven by record-high loyalty program participation, while McDonald’s, in response to its own digital sales growth, will debut a loyalty program in Phoenix, Arizona next month.

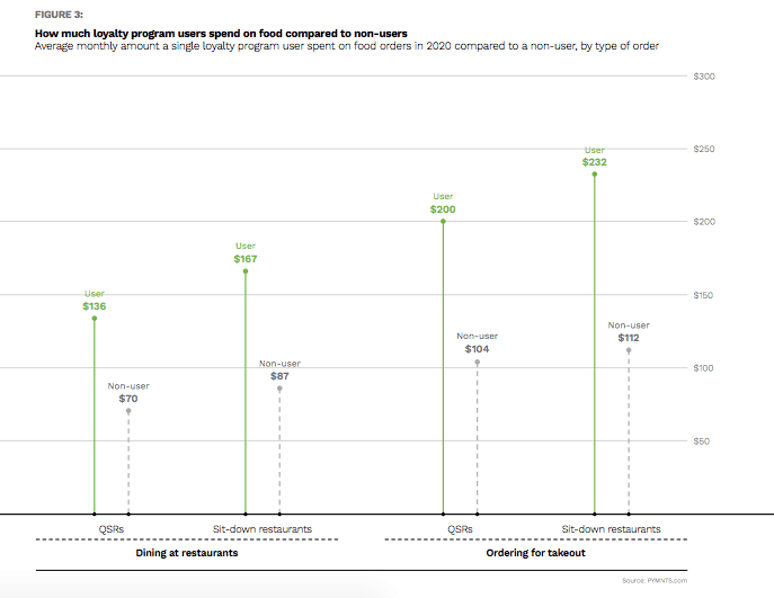

The success of these programs makes sense, given the proven ability of loyalty apps to incentivize spending. As PYMNTS and Paytronix found in last month’s Delivering On Restaurant Rewards brief, the average sit-down restaurant customer who used restaurant rewards programs spent $167 per month on food eaten on-site in 2020, for example — 92 percent more than the amount spent by sit-down restaurant customers who did not use rewards programs. The difference in expenditure is even greater between consumers who ordered takeout from dine-in restaurants. Restaurant customers who ordered takeout from sit-down restaurants and used loyalty programs spent $232 per month on food orders in 2020 — more than twice the amount spent by customers from the same restaurants who did not use loyalty programs.

Despite Taco Bell’s poor performance last quarter, with worldwide system sales declining 3 percent, according to a news release from its parent company Yum! Brands, the chain saw strong digital growth. “We launched a loyalty program with promotions geared toward customer acquisition and adoption,” said Yum! Brands CEO David Gibbs on a recent call with analysts. “All in digital sales mix reached 12 percent for the quarter, and about $1 billion for the full year 2020. We are very pleased with this progress.”

Taco Bell’s loyalty system grants customers rewards points for every dollar spent, and these points can be redeemed for free menu items. The chain promotes personalization by analyzing customers’ favorite orders and offering them novel rewards items they are likely to find appealing. This expands customers’ menu preferences, giving them more reasons to return to the restaurant for different meals.

“My favorite menu item is a cheese quesadilla, for example,” Zipporah Allen, Taco Bell vice president of digital experiences, told PYMNTS in an interview. “So based on my shopping habits, the app could reward me with a grilled cheese burrito to invite me into new products.”

Chipotle meanwhile saw a 177.2 percent year over year increase in digital sales to $781.4 million in the fourth quarter, due in part to its loyalty rewards program, which grew by 10 million users over the course of the year. The program now has about 19.5 million enrolled members, and around 60 percent of these members are active users.

“We have focused on strengthening our creative analytical capabilities by using predictive modeling to ensure that our members feel known and valued as we elevate the relationship with Chipotle,” said Chief Financial Officer Jack Hartung on an earnings call with analysts. “In addition, we reach customers with dedicated journeys focused on welcoming new members, growing frequency and minimizing lapsing behavior.”

PYMNTS featured Chipotle’s industry-leading rewards program in the December Order to Eat Tracker. Nicole West, vice president of digital strategy and product management, explained how localizing loyalty programs and customizing the ordering experience helps the chain capitalize on rising digital sales.

For its part, Starbucks announced changes to its loyalty program last September that expanded rewards to customers paying without a Starbucks card, eliminating a key friction point in growing its membership base. The changes are working. In the most recent quarter, loyalty app usage was up 15 percent year over year, according to the chain’s Q1 fiscal 2021 results, and rewards customers contributed 50 percent of U.S. company-operated sales. Additionally, mobile orders comprised 25 percent of all national company-operated transactions in the first quarter, an 8-point increase from the pre-pandemic share of 17 percent. This digital success improved an otherwise difficult quarter for the chain, as comparable store sales were down 5 percent internationally amid dining restrictions.

“This strong member growth that we’re seeing is not only surpassing our pre-COVID highs, but it’s pushing well beyond,” said CEO Kevin Johnson on a call with analysts. “And you saw the numbers: 22 million active members, that’s up 15 percent year over year. And it’s helping us really fuel the all-time highs that we’re seeing in Starbucks rewards as they convert.”

McDonald’s initially held off on implementing a comprehensive loyalty program out of concerns that it would add wait time at drive-thrus. Given the undeniable success of competitors’ programs, however, the company has decided to pilot its MyMcDonald’s rewards program. The chain told consumers, “You can look forward to a menu and offers based on past orders, plus … rewards tailored to you, anywhere you are.”

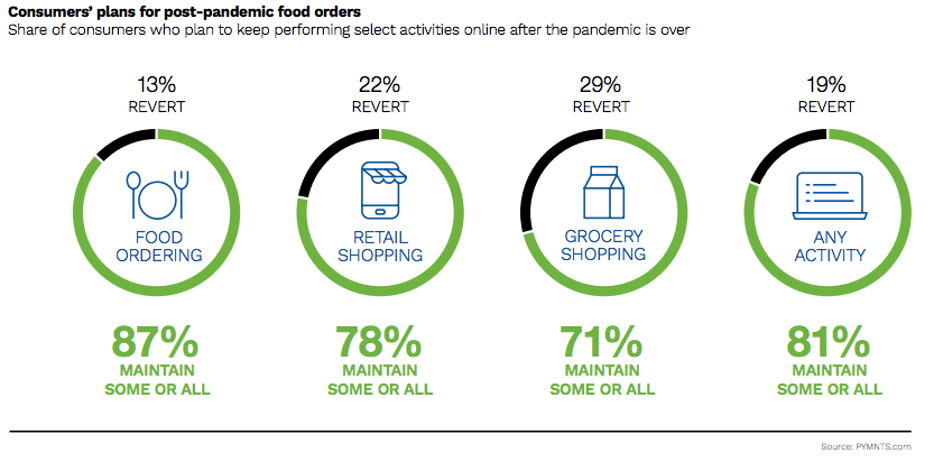

While consumers’ rapid adoption of these apps may have been spurred by the pandemic, given that in-app ordering minimizes contact and time spent onsite, QSRs will likely continue to benefit from increased loyalty program usage in years to come. The December edition of PYMNTS’ Delivering On Restaurant Rewards brief found that 87 percent of consumers plan to maintain their food ordering behavior after the pandemic is over. By investing in building out their rewards apps now, restaurants will be able to increase per-order spending while fostering their base’s long-term loyalty.