In today’s digital age, security is a top concern for consumers, especially when it comes to financial transactions, regardless of their frequency — be it routine or sporadic.

But while infrequent, high-risk digital transactions often receive the most attention in terms of security measures, online routine financial transactions are still important to consumers, according to findings detailed in “Visible and Invisible Security: Perceptions in Digital Banking,” a PYMNTS Intelligence and Entersekt collaboration.

According to the study, which drew on insights gathered from a survey of more than 2,500 U.S. consumers, nearly 50% of consumers are dissatisfied with their financial institution’s current security measures for routine digital activities and transactions, and 27% said their FIs should do more.

This highlights the need for FIs to provide additional security measures to address consumer concerns — measures that can be categorized into two parts: visible and invisible.

Visible security measures, such as password-based, multifactor and biometric authentication, play a role in consumer perceptions of the safety of their financial information and assets and can enhance trust and confidence in their FIs, per the report.

While passwords have long been the dominant method of authentication, consumers are increasingly turning to biometric authentication. The data showed that 47% of consumers had used biometric authentication for online financial activities in the month before the study, and 52% of biometric authentication users preferred this method over passwords. Additionally, multifactor authentication (MFA) is gaining popularity, with 34% of consumers preferring this method.

When it comes to routine online financial activities and transactions, 30% of consumers expressed a desire for more of these visible security measures when accessing accounts. Similarly, 29% expressed the same sentiment for sending or receiving money, and 27% said the same when paying for goods and services. This sentiment is also mirrored among bill-paying consumers, with 26% showing a preference for more visible security measures when handling bill payments, rent and loans.

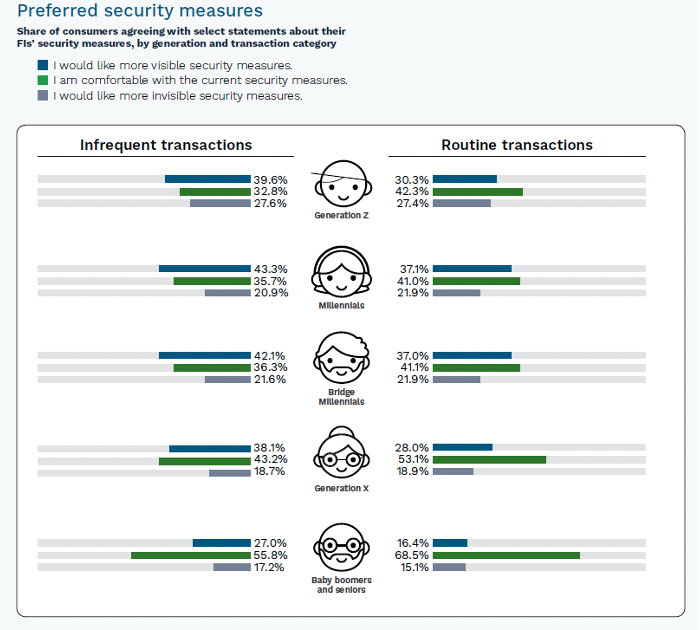

In terms of generational differences, millennials are most interested in visible security measures for routine transactions, with 37% expressing a desire for their FIs to adopt additional visible safeguards. Comparable proportions of Generation Z and Generation X consumers share this sentiment, with 30% and 28% respectively seeking additional visible security measures. In contrast, only 16% of baby boomers and seniors indicated a similar preference.

Examining the data further showed that digital-only banks have disrupted the banking space by offering the innovative security measures that consumers increasingly demand for their financial transactions. Given that 49% of traditional bank customers feel comfortable with their current security measures, legacy FIs must adapt and beef up security measures, particularly visible options, to meet consumer expectations and prevent customer attrition.

Customers increasingly want visible security measures in their everyday digital transactions, and FIs must prioritize meeting this demand to win their trust and satisfaction. Moreover, integrating personalization features and partnering with third-party experts can empower FIs to refine their approach to visible security, per the study, helping them build better relationships with customers and stay competitive in the fast-changing digital banking world.