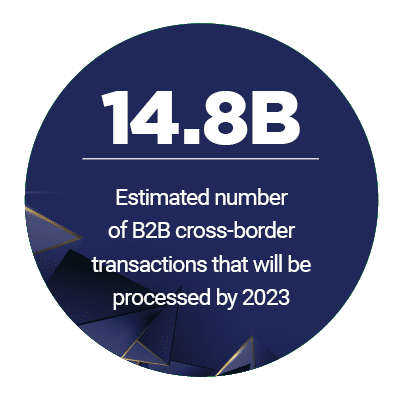

The cross-border payment market is thriving, and trends are expected to continue over the next few years. In fact, cross-border payments are expected to reach $240 billion in value by 2024.

For these transactions to run smoothly, however, communication must remain seamless and secure. Companies separated across borders want payments to be delivered on time so they can meet their payment deadlines, access capital and deliver products in a timely fashion. The new Smarter Payments Tracker highlights the infrastr ucture developments that are making cross-border payment systems faster, more seamless and interoperable.

ucture developments that are making cross-border payment systems faster, more seamless and interoperable.

Around the Smarter Payments World

A group of Nordic banks have selected Mastercard to overhaul its financial services operations for the region. Nordic bank-backed initiative P27 was launched to update the region’s aging infrastructure with a platform that enables real-time payments from different markets. Financial institutions (FIs) that use the platform can also access data that can be used to pursue new revenue opportunities.

In Southeast Asia, FinTech InstaReM recently released a new platform of its own. The platform, which relies on InstaReM’s existing global digital ecosystem that supports payments and remittances, enables companies to more easily issue branded cards without having to obtain multiple licenses. The cards issued through the platform can be used as virtual or multicurrency travel cards and  allow users to earn and cash in loyalty points. The service can be accessed through an API.

allow users to earn and cash in loyalty points. The service can be accessed through an API.

Meanwhile, in the U.K., a collaboration between the nation’s Post Office and Western Union also aims to enhance cross-border payments. Under the agreement, Western Union’s cross-border money movement platform will be able to power international money transfers and payments as part of an integrated service from the Post Office’s digital channel. Users will also be able to access international payment services through an online portal.

Deep Dive: The Road to Real-Time Payments

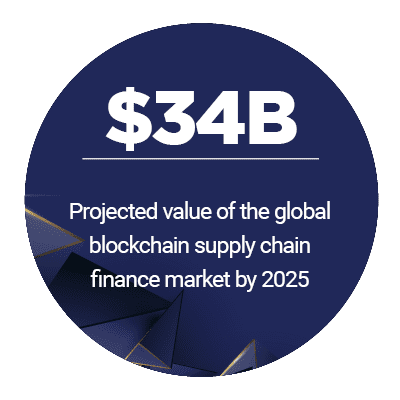

Despite many advancements in cross-border payments, several pain points still persist. Shifting regulations and  emerging technologies are enabling payments to move across borders faster, but it can be difficult to track payments as they move and achieve interoperability between different payment systems across the globe. The Tracker’s Deep Dive explores the frustrations businesses currently experience and how infrastructure upgrades could soon be implemented.

emerging technologies are enabling payments to move across borders faster, but it can be difficult to track payments as they move and achieve interoperability between different payment systems across the globe. The Tracker’s Deep Dive explores the frustrations businesses currently experience and how infrastructure upgrades could soon be implemented.

Making Global Remittances More Transparent

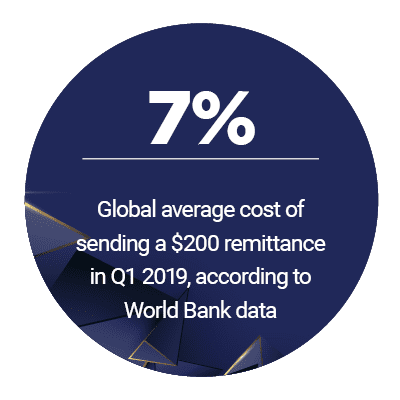

According to the latest World Bank data, roughly $689 billion in cross-border payments was sent last year. But the remittance market can be riddled with frictions, with senders and receivers left in the dark over the state of a transfer and often caught off-guard by fees. In the Tracker feature story, Khun Sarintorn, VP of international remittance business solution head for Thailand-based Kasikornbank, explains how the bank’s collaborations with FinTechs is helping to make overseas transfers more transparent and efficient.

About the Smarter Payments

The Smarter Payments Tracker, a PYMNTS and InstaReM collaboration, is a go-to monthly resource for staying up to date on global payments landscape developments. The Tracker explores how smooth payment flows can offer ecosystems improved speed, security and insights.