On the face of it, $349 billion in emergency funding sounds like a lot, but ultimately it was just a start for these firms grappling with the very existential threat posed by the coronavirus.

And now, as found by PYMNTS in its latest study of more than 1,200 SMBs, the loans are viewed not just as “must have” need to navigate the current challenges, but also as tools that can be used strategically, to position SMBs in a post pandemic world.

If they can get the money, that is.

Our data was collected after the first tranche of the PPP program came and went, where $349 billion was doled out within two weeks, and where a backlog of applications had piled up and remains to be processed.

There was, of course, a rocky start that found big banks and other lenders less-than-ready to meet the demand deluge.

Advertisement: Scroll to Continue

Web sites crashed, hobbling the application process. There was confusion about just what the lending program demanded, in terms of documentation, or how the funds should or could be used.

Larger firms such as Shake Shack were able to siphon off tens of millions of dollars that might have otherwise gone to smaller companies arguably more severely impacted by state-mandated shuttering than the big chains.

Right now there’s not much light at the end of anyone’s tunnel. At this writing, only three states had started to tiptoe toward even partial re-openings. And, as has been widely reported, an additional $370 billion in SMB loans has been approved by Congress.

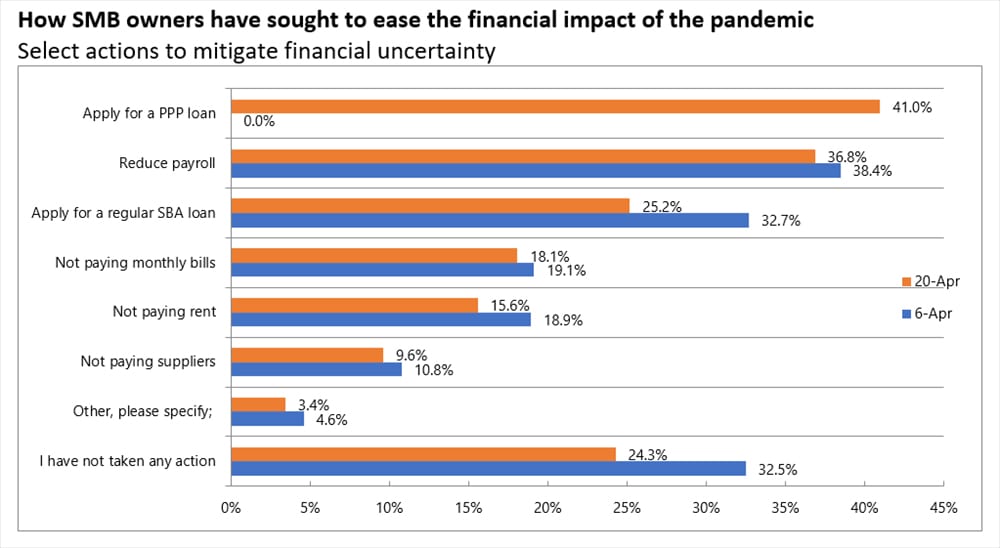

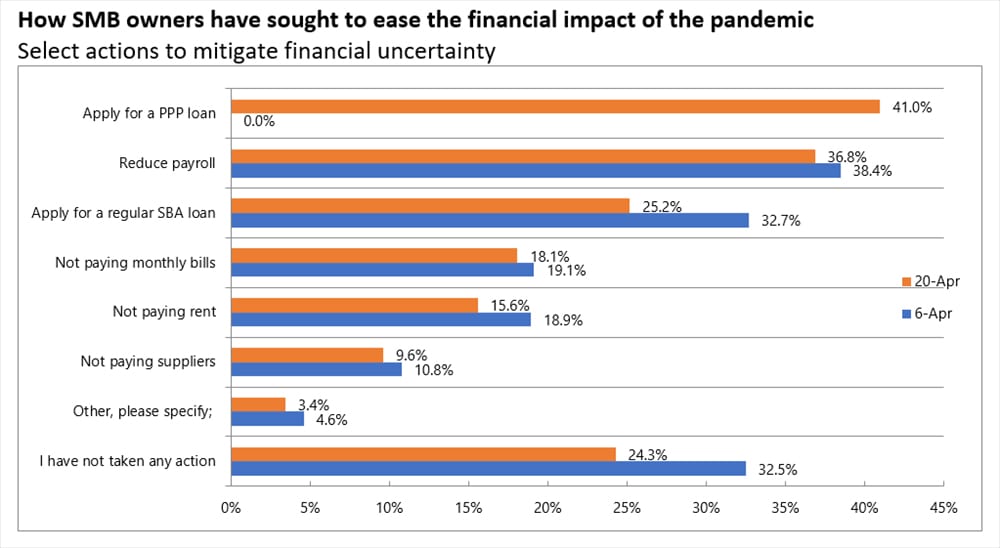

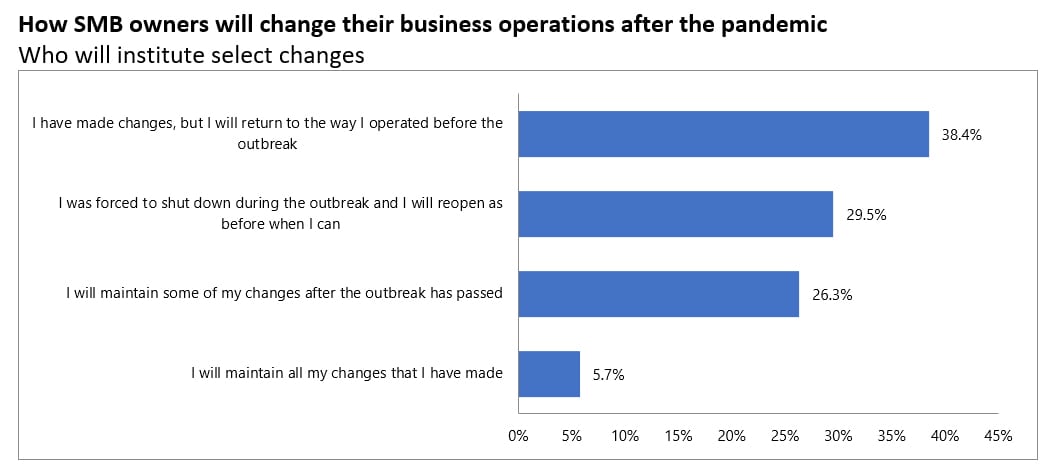

There’s certainly a movement of SMBs doing … well, something to preserve operations as the shutdowns spread out across almost all US states. Almost one-quarter of small business owners decided to take “no action” to mitigate the impact of the pandemic on their businesses.

On April 6, in our previous survey, we found that only 32.7 percent of SMBs had applied for SBA loans — including, but not limited to, PPP loans. But this time around, in the latest April survey, As many as 41 percent of SMBs said they had applied for the PPP loans by April 20.

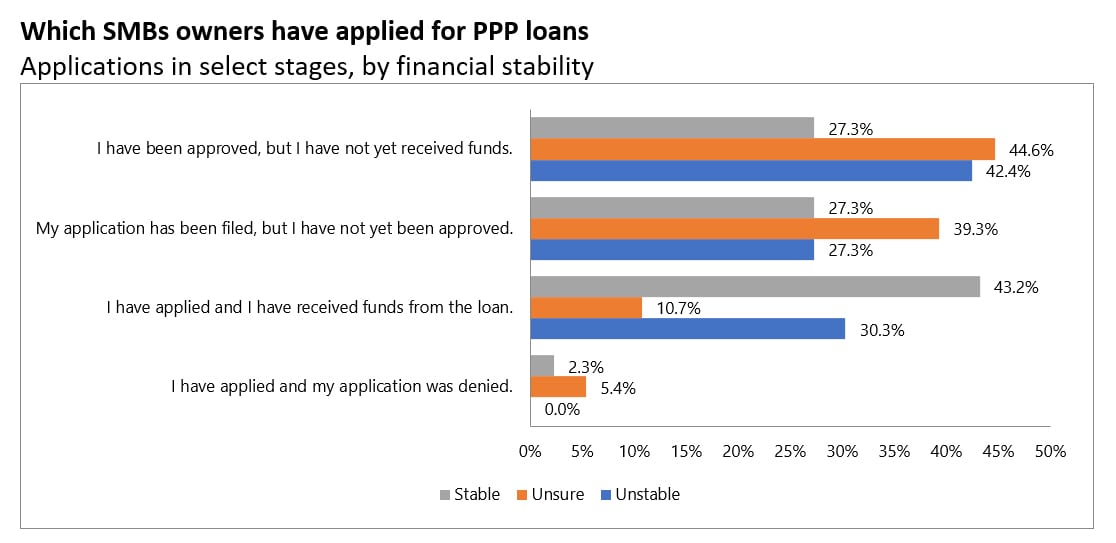

Drill down a bit and you start to get sharper insight into who sent in their applications as the PPP opened up, and who might tap into the next wave of funding.

We’ve noted that business owners, viewing their current and recent cash flow positions, have differing mindsets of how long they can survive with, or without, federal aid — and whether they can survive the pandemic at all.

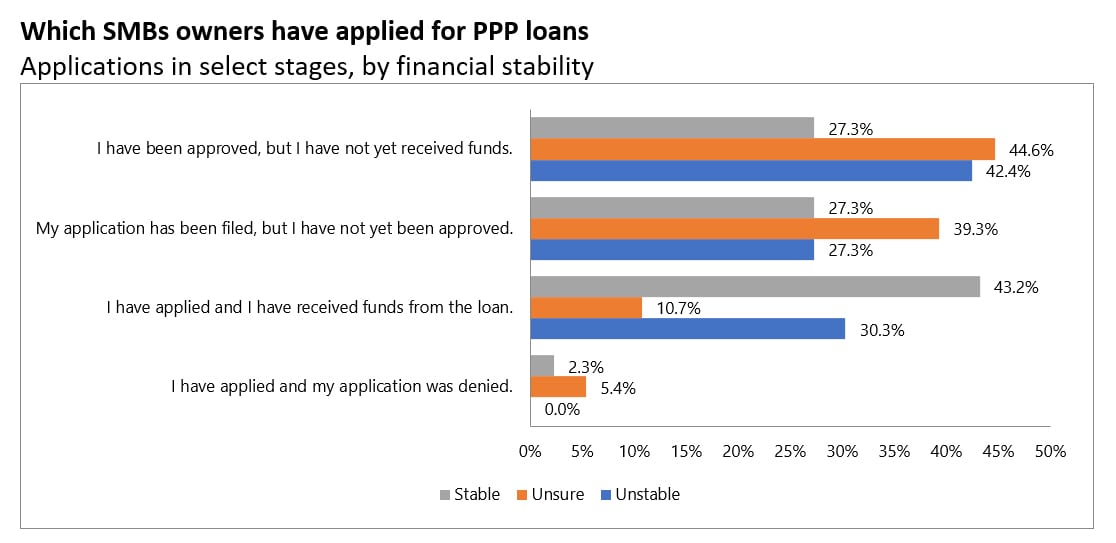

Getting the loans provides at least some measure of confidence: 43.2 percent of SMBs that had already received the PPP loans said they were “sure” they would be able to survive.

But timing is everything, and the administrative delays in getting money where it needs to go may create additional headwinds for those business owners who were proactive and applied.

But timing is everything, and the administrative delays in getting money where it needs to go may create additional headwinds for those business owners who were proactive and applied.

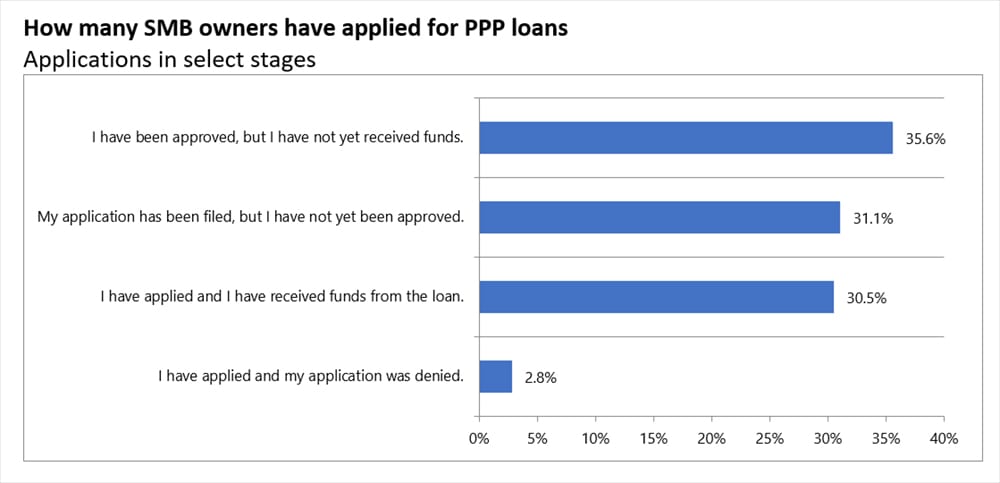

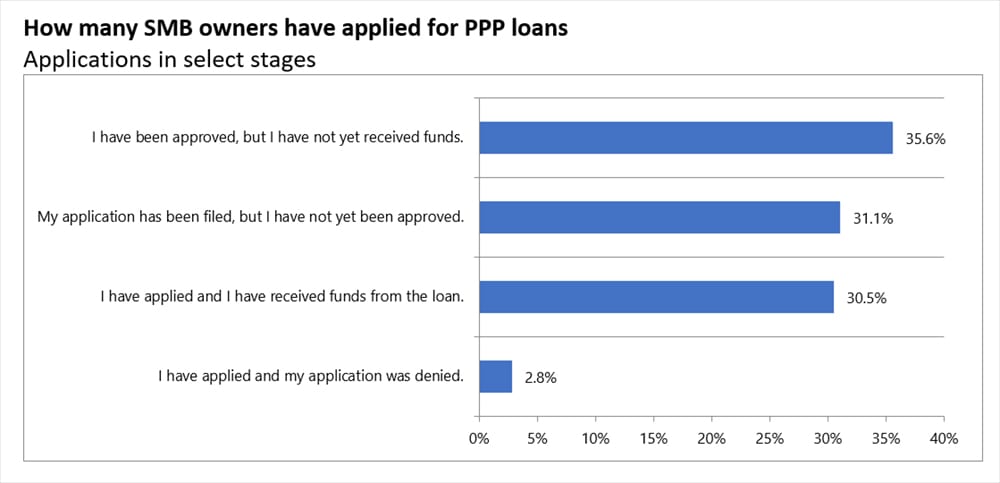

PYMNTS found that a significant number — but by no means a majority — of SMBs that had applied for PPP loans had been approved and received funding.

Another 35.6 percent had been approved and not yet received funding.

And 31.1 percent of applicants were still waiting to hear whether they had been approved.

No Thanks, For Now

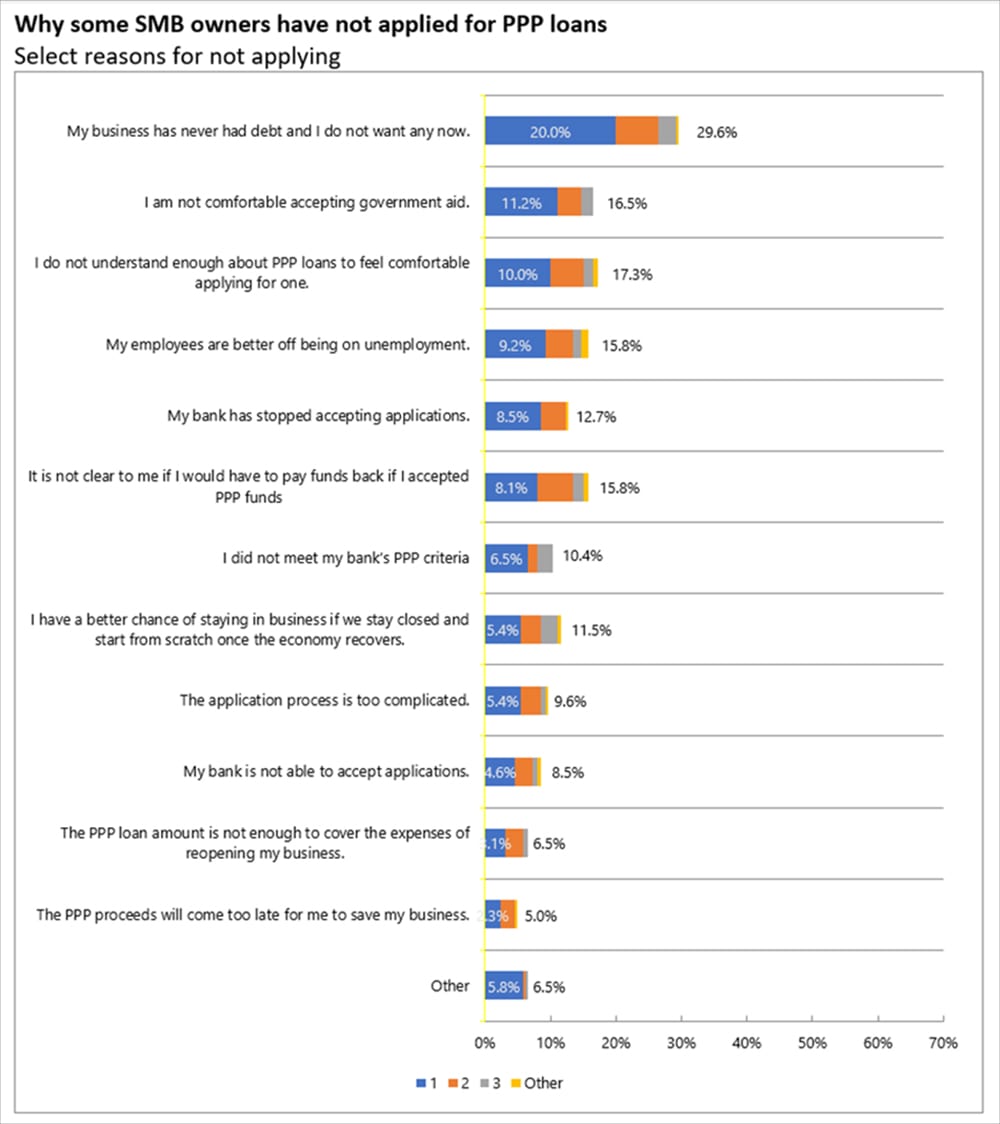

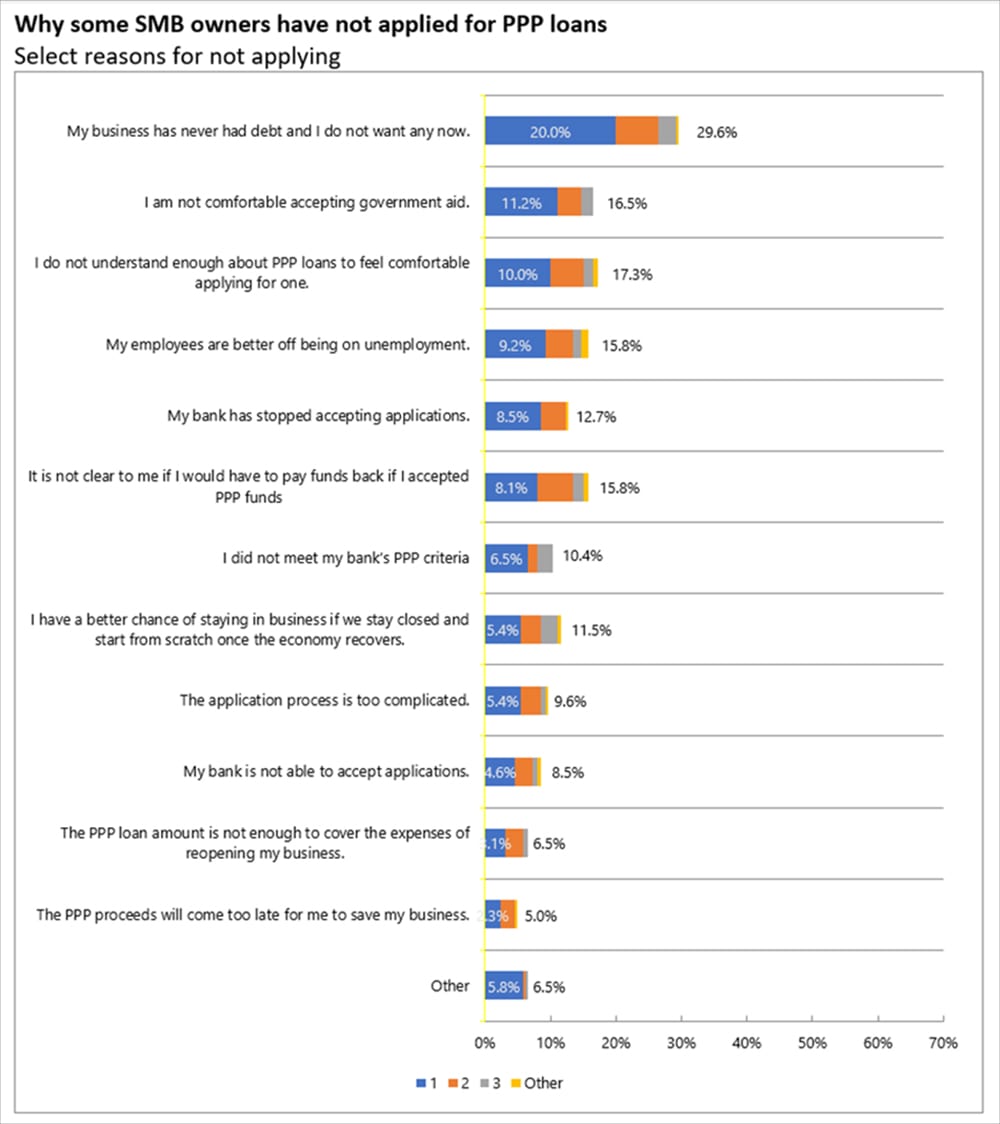

Though there’s been no shortage of headlines detailing the massive scramble to get PPP funding, there exists, of course, a sizable population of firms that chose not to apply for the loans.

Roughly 30 percent of those companies said they’d had no debt coming into the current downturn and did not feel comfortable taking on debt.

Another 16.5 percent said they’d not felt comfortable taking on government aid.

Taking It To The Bank — Literally

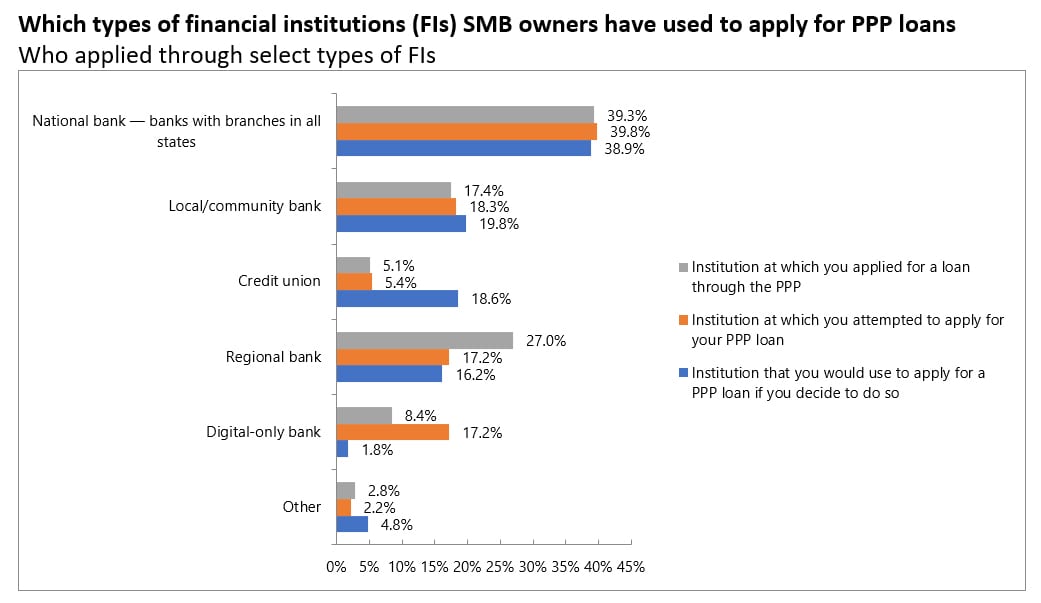

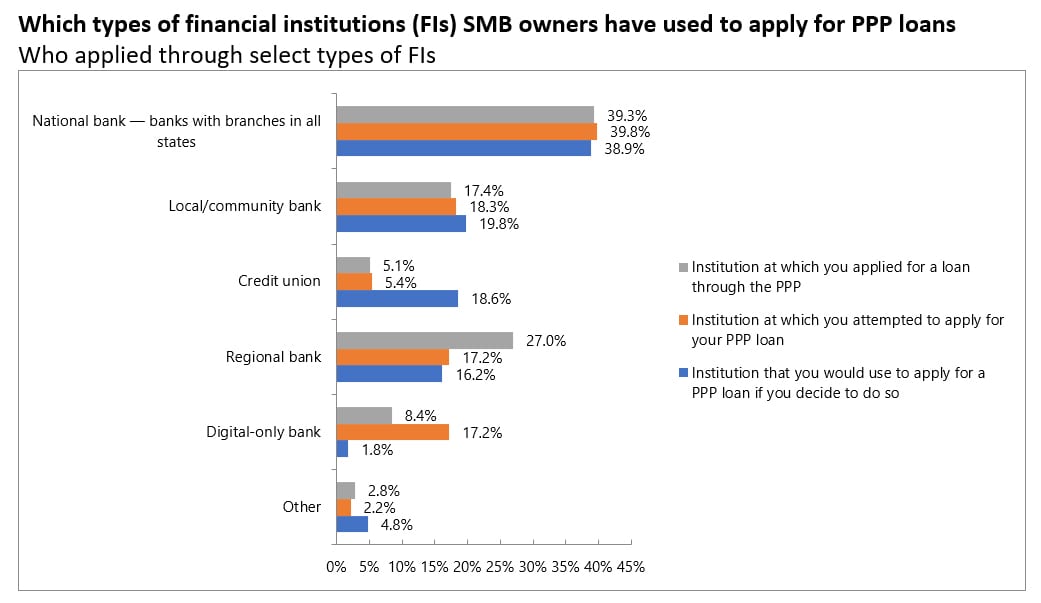

Many of these companies looking for funding went with lenders they already knew and trusted.

Of those that had applied for PPP loans, 39.3 percent said they had done so through banks that had branches in every U.S. state, indicating that bigger, marquee names in financial services were top of mind for these SMBs.

Another 27 percent applied through regional banks. Of those firms that had not applied for the loans, nearly 39 percent of those eying PPP aid said they would do so through national banks. Less than 2 percent of those firms that had yet to apply said they would do so through digital-only banks.

This indicates that the digital upstarts who’d been looking to unseat incumbents have a ways to go before they garner significant share against traditional financial institutions (FIs) in times of crisis.

Hurry Up and Wait?

Regardless of the lending conduits, it may all be a case of hurry up and wait.

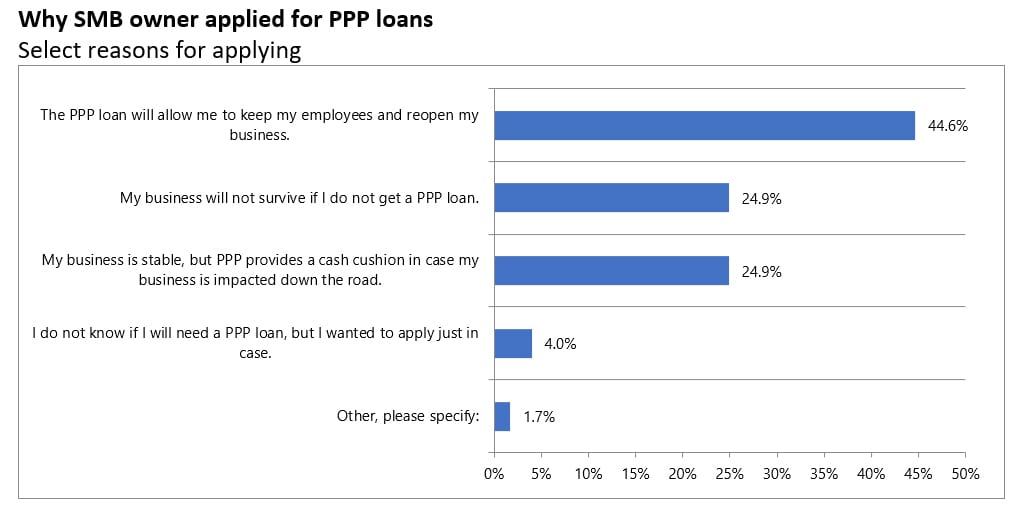

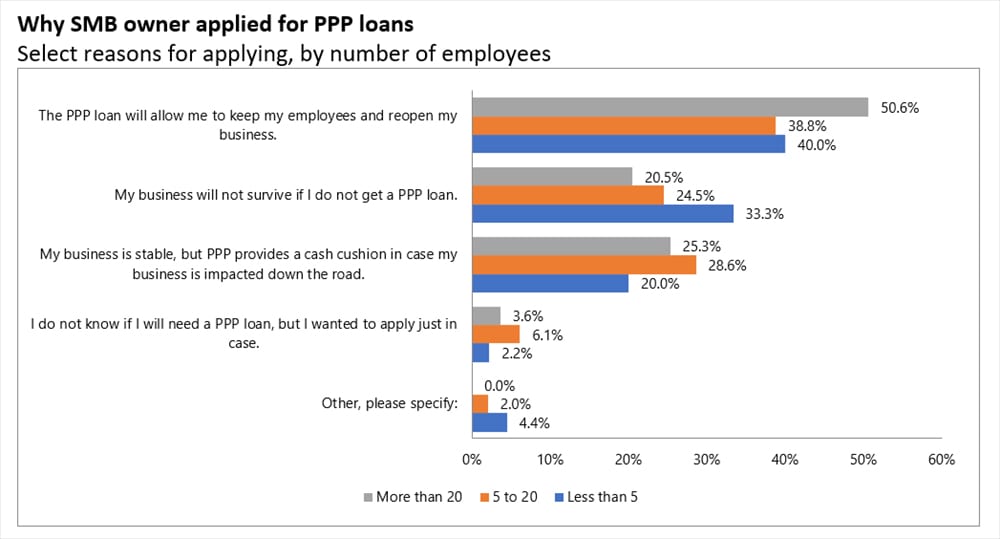

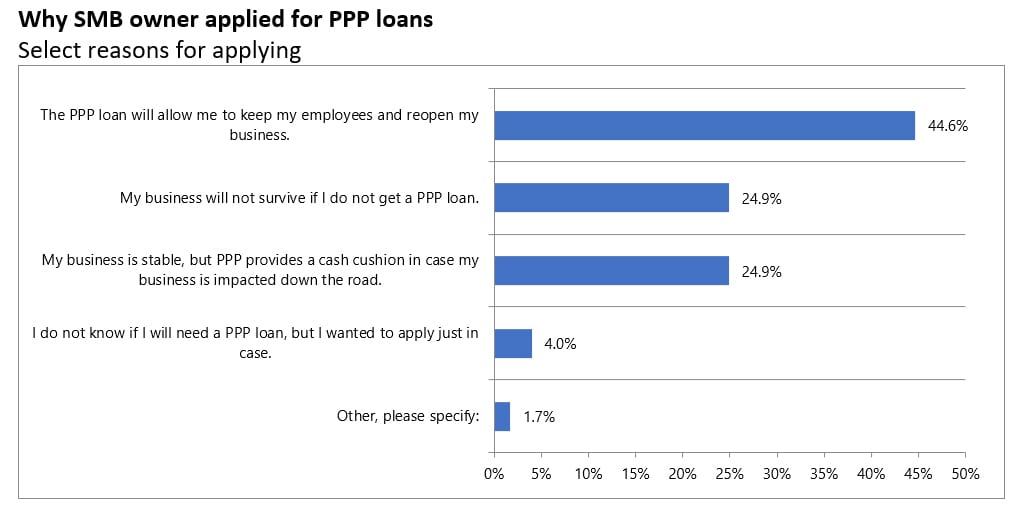

But the clock is indeed ticking. Consider the fact that 24.9 percent of firms said they would not survive if they do not get PPP loans. Many of the SMBs are among the smallest ones, with more than 58 percent of those dependent on PPP for survival employing a maximum of 20 workers.

The PPP is seemingly viewed as a lifeline toward surviving the cash crunch facing SMBs. Applying for a PPP loan stood out as the most common measure taken to combat the headwinds of the pandemic, outpacing other SBA applications (which had garnered applications by only 25.2 percent of SMBs).

Applying for the PPP aid, in fact, eclipsed cutting employee payrolls, which had been a tactic for 36.8 percent of SMBs.

Cutting staff, in fact, has decreased, albeit slightly, as a survival mechanism, down from the 38.4 percent who had embraced that practice on April 6.

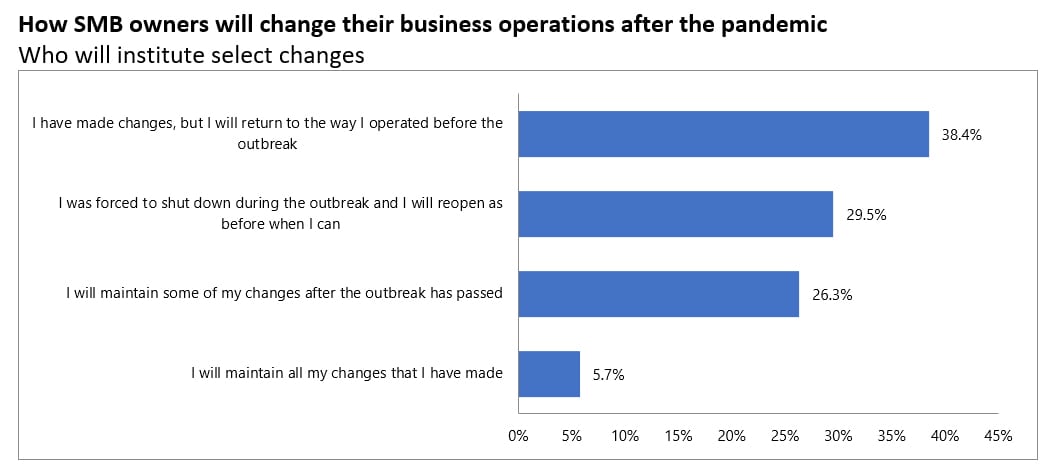

This implies that business owners are aware that running too “lean” now (or cutting staff entirely) may pose a problem once the country starts to re-open more fully. Rehiring workers previously let go will prove a challenge, so having some cash in the proverbial coffers now to keep staffers employed may be a good proactive strategy.

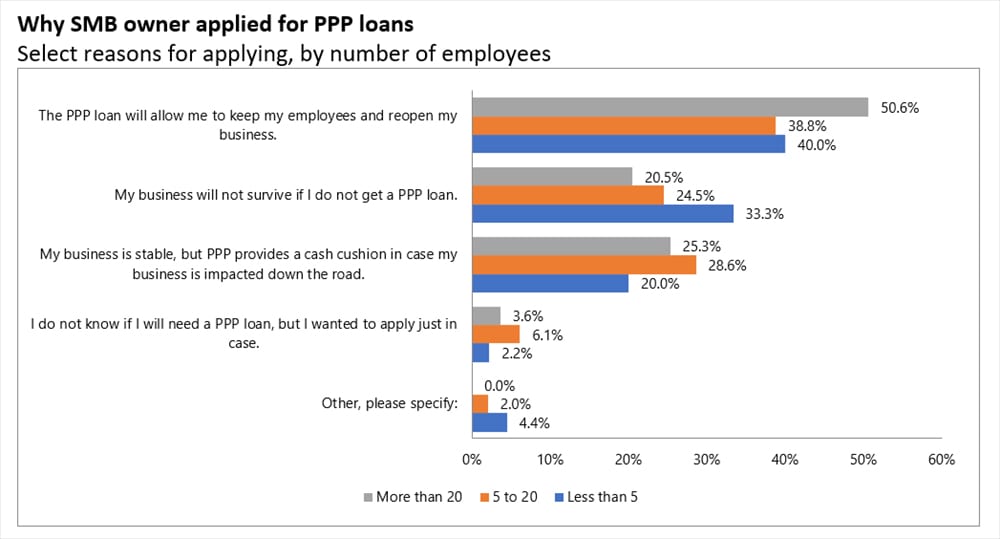

As detailed in this space previously, many SMBs, particularly in the restaurant vertical, face a conundrum. It turns out that the additional unemployment benefits extended by Congress, equating to an extra $600 a week, have given workers comparatively more money than they would earn by staying with their current employers. That’s reflected in the fact that 44.6 percent of those who’d applied for PPP said the loans would let them keep employees and re-open their firms.

Looking Ahead

There are some indications that the PPP loans are being used as a strategic tool. Of the SMBs who applied to the program, 24.9 percent said they applied not because they needed the loan, but because they wanted to have an additional cash cushion in place in case they needed it.

Most SMBs seem sanguine about life on the other side of the pandemic, with 41.4 percent stating they will seek to rehire the employees that were let go, and another 24.3 percent state they’d seek to have employees work remotely.

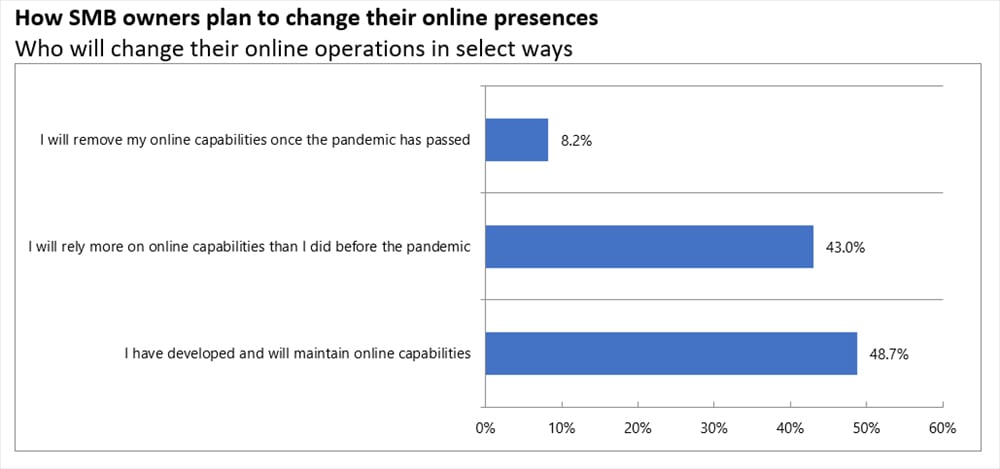

This shift, to remote, perhaps even far-flung work done digitally, speaks volumes to a shift we’ve been observing for months.

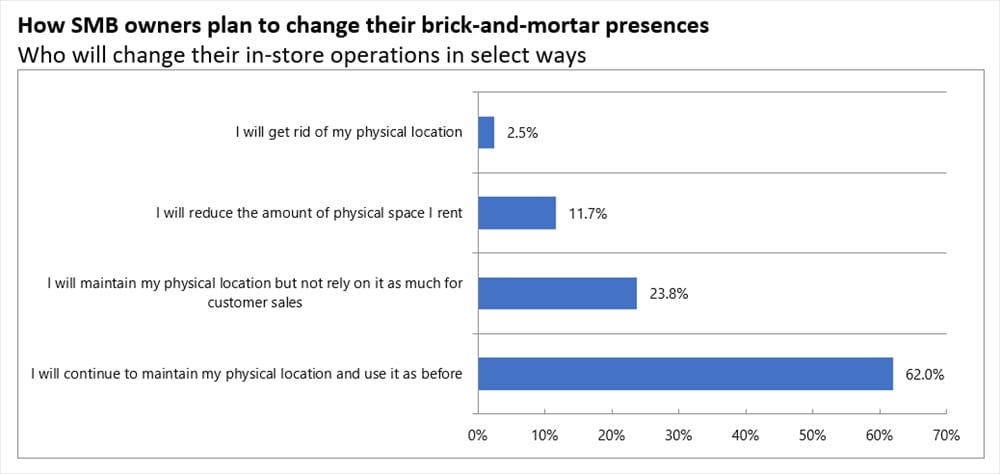

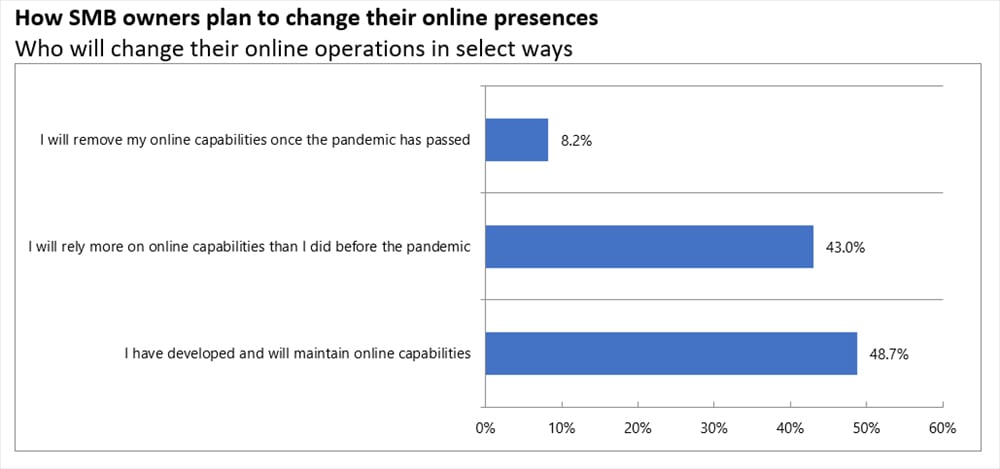

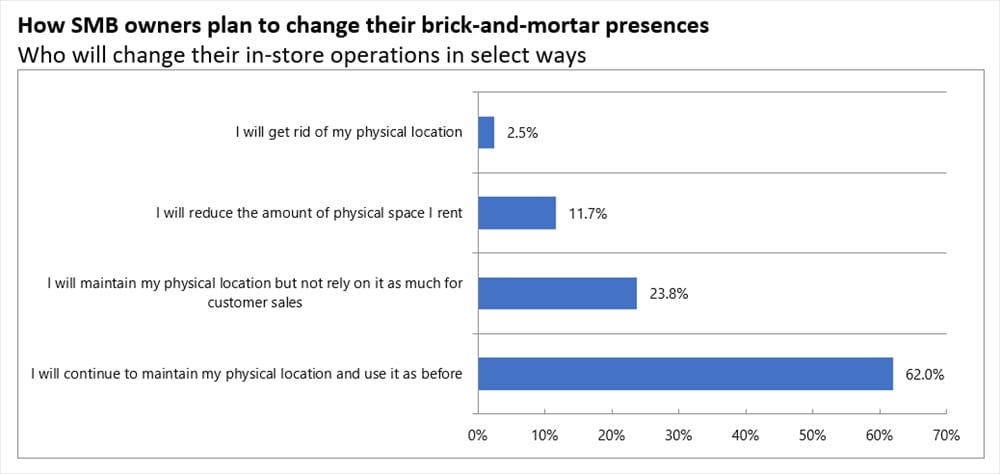

We’re transitioning from an offline to online world. Only 62 percent of firms plan to keep their physical locations and use them “exactly” as they did before the pandemic. About 11 percent will reduce the physical spaces they rent. And 43 percent will rely more heavily on their online operations to generate sales than they did before.

These companies, we contend, are skating to where the puck is headed. After all, as detailed in a separate study, “The Post Pandemic Reset,” millions of consumers will continue to work and shop and order online even after the pandemic ends.

That seismic shift is in the wings, even as SMBs seek the cash lifelines to keep things humming until then.

But timing is everything, and the administrative delays in getting money where it needs to go may create additional headwinds for those business owners who were proactive and applied.

But timing is everything, and the administrative delays in getting money where it needs to go may create additional headwinds for those business owners who were proactive and applied.