Sept. 11, 2020, marks 225 days since the coronavirus was first declared a pandemic on March 11, lasting longer than most of the businesses on Main Street U.S.A. ever expected it would.

Sept. 11, 2020, marks 225 days since the coronavirus was first declared a pandemic on March 11, lasting longer than most of the businesses on Main Street U.S.A. ever expected it would.

When PYMNTS first began studying the impact that the pandemic was having on Main Street businesses, the average respondent expected the pandemic to last 177 days.

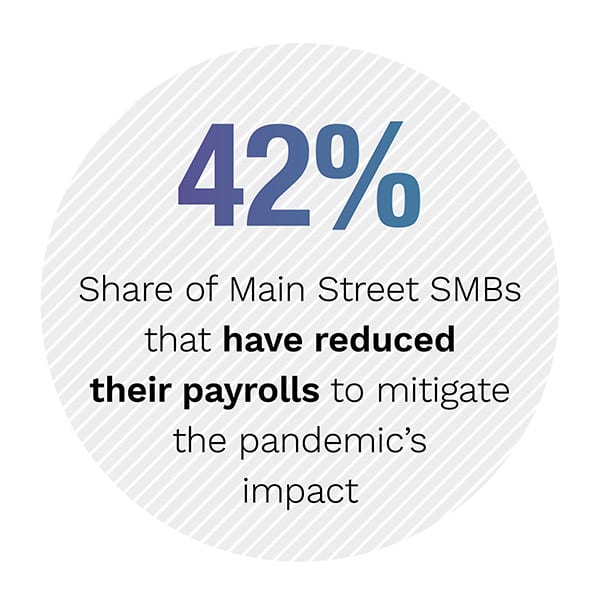

This extended crisis has stretched Main Street to its financial limits. Not only do 75 percent of the businesses on Main Street say they are still struggling with reduced revenue as a direct result of the global health crisis, but many have also been forced to take additional palliative measures to help keep their cash flow in check. This includes 41.9 percent of Main Street small- to medium-sized businesses (SMBs) that have had to reduce their payroll and 26.1 percent that have had to apply for Small Business Administration (SBA) loans.

This extended crisis has stretched Main Street to its financial limits. Not only do 75 percent of the businesses on Main Street say they are still struggling with reduced revenue as a direct result of the global health crisis, but many have also been forced to take additional palliative measures to help keep their cash flow in check. This includes 41.9 percent of Main Street small- to medium-sized businesses (SMBs) that have had to reduce their payroll and 26.1 percent that have had to apply for Small Business Administration (SBA) loans.

So, how are the businesses on Main Street working to mitigate the pandemic’s impact on their finances six months into the crisis?

This is one of the questions PYMNTS set out to answer in the new Main Street’s Six-Month Checkpoint: The State Of Main Street Business Amid The Pandemic report. We surveyed 465 Main Street SMBs across 21 different industries to find out how they have fared since the pandemic began disrupting their revenue streams, and the steps they are taking to help  safeguard their firms from future cash flow shortages.

safeguard their firms from future cash flow shortages.

PYMNTS research shows that many Main Street SMBs seem generally more confident than they did just after the pandemic was announced, in part because more of them are now able to make supplier payments and pay their rent than were able to in June. We found that 7.9 percent are currently not paying rent, compared to 18.3 percent that did not in June. Furthermore, 8.1 percent are not making their supplier payments now, compared to 18.1 percent not making them in June. These improvements provide a glimmer of hope in a prolonged economic crisis.

Many are still skating on thin financial ice, however. Seventy-two percent of all Main Street SMBs do not have access to enough funds to stay open for more than a month if their current revenue streams are interrupted, and 39 percent do not even have enough to stay open for a week if they had to. With the number of COVID-19 cases on  the rise in the U.S., this is looking like an increasingly likely scenario. It is therefore growing pertinent that Main Street SMBs take stock of their financial standing and strategize a long-term crisis plan — not only to help survive the pandemic, but to also prepare for the economy that will emerge after it subsides.

the rise in the U.S., this is looking like an increasingly likely scenario. It is therefore growing pertinent that Main Street SMBs take stock of their financial standing and strategize a long-term crisis plan — not only to help survive the pandemic, but to also prepare for the economy that will emerge after it subsides.

To learn more about the financial straits Main Street SMBs are navigating amid the pandemic, download the report.