New Report: How Online Marketplaces Can Capture The $129 Billion Small Business Seller Opportunity

The pandemic has Main Street businesses turning to online marketplaces to boost sales. But for sellers dealing with cash-flow shortages, marketplace payout speeds aren’t cutting it – and more than 60 percent of small sellers will switch marketplaces for real-time payout options. PYMNTS’ new Marketplaces As Retail’s New Front Door report, in collaboration with Visa, surveyed 1,049 small sellers and found that real-time payouts can translate into a $129 billion market opportunity for online marketplaces that offer it.

The year 2020 has seen a boom in the U.S. eCommerce innovation space.

The year 2020 has seen a boom in the U.S. eCommerce innovation space.

Not only are businesses large and small expanding their digital offerings far beyond what had ever been seen in the past, but U.S. consumers are also flocking online to shop more than ever before, whether they are buying retail goods, groceries or food for delivery.Digital marketplaces have become central to this new, digital-first economy. Whether it is businesses selling on Amazon, Walmart and Poshmark, or individuals selling arts and crafts or hand-me-downs on Etsy, Craigslist and eBay, sellers across the U.S. are using these marketplaces to offer new and used goods to shoppers nationwide as a primary or secondary source of revenue.

Reaching eCommerce consumers is only half the battle, however. Many sellers know all too well that receiving payments for marketplace sales can be a hassle. Marketplace businesses wait an average of 3.3 days to receive payouts, while individual sellers wait an average 2.5 days. Waiting for funds to deposit can greatly strain sellers’ finances. This is especially true during the pandemic, during which three-quarters of the small- to medium-sized businesses (SMBs) on Main Street USA have experienced cash flow shortages.

How many marketplace sellers would be willing to switch platforms if it meant faster access to sales proceeds, and where can marketplaces add value to prevent their sellers from taking their business elsewhere?

In Marketplaces As Retail’s New Front Door: What Sellers Need To Thrive In This New Digital World, a Visa collaboration, PYMNTS surveys 1,049 businesses and individuals selling on digital marketplaces to learn what they sell, how they are paid, how long it takes to receive payouts and just how interested they would be in switching marketplaces to receive faster payouts.

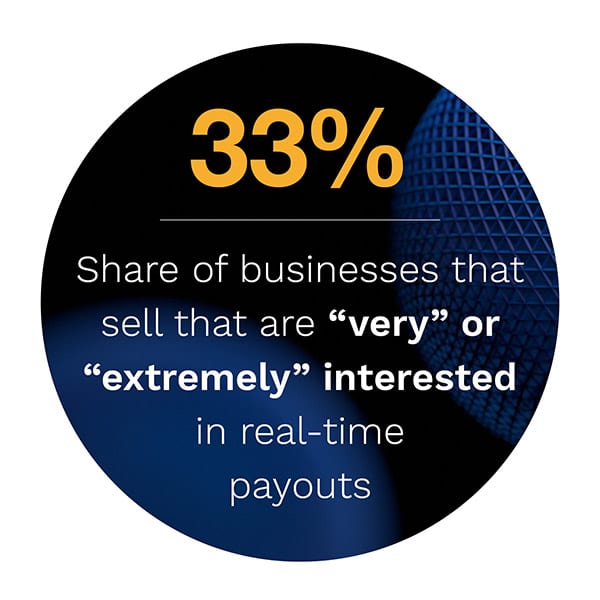

Our research reveals an underlying frustration with how long it takes to receive marketplace sales proceeds. Eighty-three percent of large businesses would be anywhere from “somewhat” or “extremely” interested in leaving their current marketplace platforms for another that could deliver real-time payouts, in fact.

So, just how big is the opportunity that marketplaces could see if they adopted real-time settlement options?

If our survey sample is representative of the U.S. population at large, then it is estimated digital marketplaces could draw anywhere from 80,000 to 150,000 new sellers that might be interested in using them to sell — if they can provide them with digital payout options. This translates into an $82 billion to $141 billion opportunity that marketplaces are missing by not offering real-time settlement options.

If our survey sample is representative of the U.S. population at large, then it is estimated digital marketplaces could draw anywhere from 80,000 to 150,000 new sellers that might be interested in using them to sell — if they can provide them with digital payout options. This translates into an $82 billion to $141 billion opportunity that marketplaces are missing by not offering real-time settlement options.

As big of a difference as real-time settlement offerings can make, they are just one of many ways in which marketplaces can add value for their sellers. To learn more about the complex relationships between marketplaces and their sellers, download the report.