It’s Labor Day, and so our thoughts turn to … not working.

In all seriousness, though, any holiday that is meant to honor the legacy and vitality of the U.S. worker must also pay homage to the flexibility of Main Street SMBs, that humble but mighty subset of the economy that, by PYMNTS’ estimates, accounts for about half of the nation’s workforce.

And if there’s anything the last 18 months has taught us, it’s that these smaller firms, the mom-and-pop shops that dot the urban and rural settings that we all call home, not only rise to meet challenges, but they adapt to them and emerge stronger — but different — on the other side.

We write these words at a time when the latest jobless claims are at a pandemic low, as unemployment benefits are running out and people are looking for work. The Labor Department’s tally of continuing claims is at recent low, too. The classrooms? Well, they’re open, at least for now – which means people can go to work while the kids go back to class, in person.

But we’re not out of the woods yet. The pandemic is still there, all around us, threatening to upend at least some portion of daily life. Many of these Main Street SMBs rely on physical storefronts and foot traffic to generate top-line growth. That’s a risk.

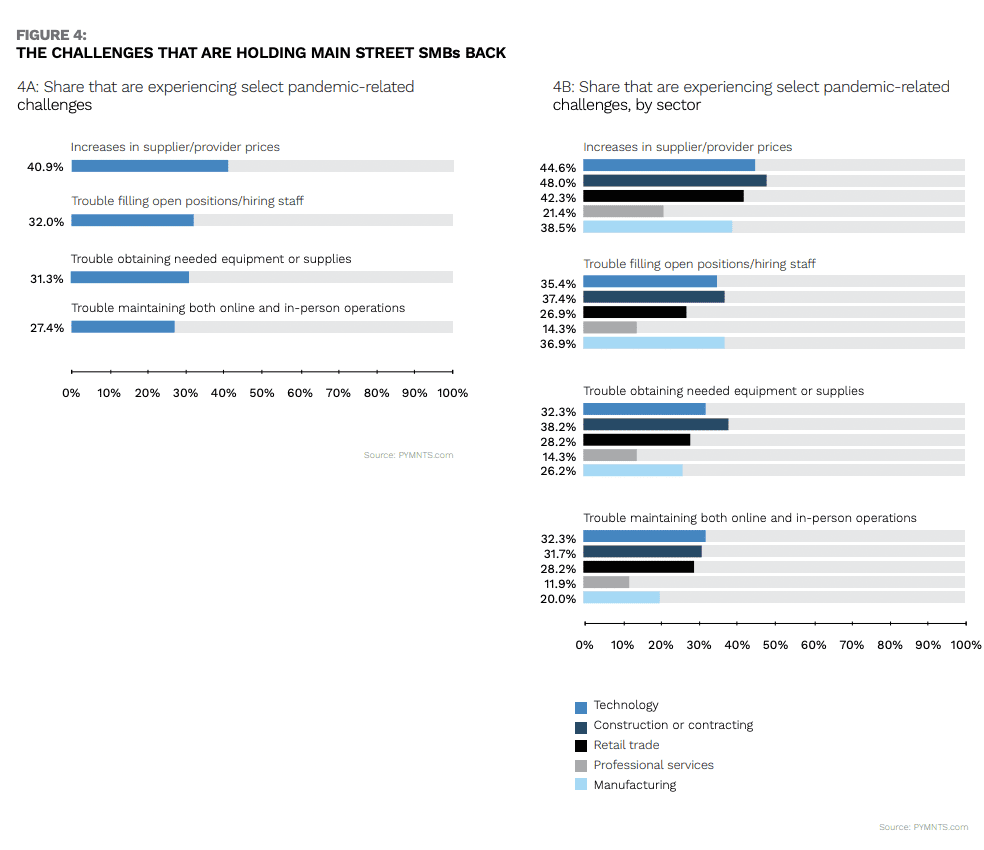

In fact, in one of the latest tallies of Main Street sentiment, this one on the digital transformation of Wall Street, there are still some roadblocks to recovery. About 73% of Main Street SMBs say that reopening at full operating capacity is critical for their communities to regain a sense of normalcy. Drilling down, there are some challenges to running at full capacity.

If 68% of these firms state that not having to worry about infection is important, it stands to reason that at least some people are not showing up on-site, which includes would-be workers.

The Labor Shortage

Roughly 32% of respondents have said there’s a labor shortage afoot.

They’re struggling to fill open positions. If the position is open, of course, that means end consumer demand for these restaurants, groceries, smaller suppliers or service firms is there, or on the horizon. The labor supply headwinds also have significant ripple effects up and down supply chains. You need to have staff on hand, after all, to keep up with inventory maintenance, shipping and invoicing.

They’re struggling to fill open positions. If the position is open, of course, that means end consumer demand for these restaurants, groceries, smaller suppliers or service firms is there, or on the horizon. The labor supply headwinds also have significant ripple effects up and down supply chains. You need to have staff on hand, after all, to keep up with inventory maintenance, shipping and invoicing.

In the midst of the staffing shortages, it’s not too far-fetched to think that, at least in some capacity, the ways in which these companies staff and run their operations might change.

That’s because of technology. Touchless payments have been among the seismic innovations that have helped Main Street SMBs regain some revenue momentum. PYMNTS research shows companies that have invested in contactless payments are 49% more likely to have seen their revenues increase, and so a significant number of firms have seen 2020 revenues exceed 2019 levels.

It might be the case that amid new and ongoing efforts to digitize operations, smaller firms will find ways to re-allocate staff, to bring them away from cash registers or even back offices and toward more consumer-facing roles, at least in stores. The companies that move more fully toward web pages and online marketplaces may find their staffing shift toward delivery or curbside interactions.

We’re a long way from the dark days of 2020. When the pandemic first hit during the spring, 46% of companies that were unsure whether they would stay open said they’d had to reduce payrolls, while more than 34% of companies that were sure they’d weather the pandemic had to do the same. Fast-forward to the end of the pandemic, and 26% of Main Street SMBs said they would plan to lay off workers if there was another round of lockdown measures.

But it is the flexibility of these firms and their embrace of technology that has helped them survive, and even thrive, through some of these challenges. Get ready for the next transformation.