Main Street Business Success Tied to Online and In-Store Sales

High inflation and the threat of an imminent recession make it increasingly difficult for all firms, and the current economic landscape particularly curbs the optimism of Main Street small to midsized business (SMB) owners.

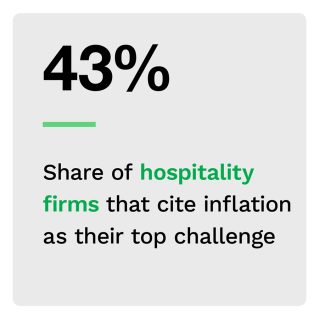

PYMNTS’ research found that two-thirds of Main Street SMB owners anticipate a recession and that about 40% of firms consider inflation their most relevant challenge. Firms in the construction segment are most likely to be worried about inflation: 55% consider it their most relevant challenge.

Twenty percent of firms expect revenues to decrease in 2022, up 10 percentage points from last year. Times are especially tough for small firms, as 27% of businesses annually earning less than $150,000 expect revenues to decrease in 2022.

Main Street SMBs make up much of the American business landscape, occupying town centers throughout the United States. Consequently, their performance typically serves as a good indicator of the market’s current temperature. Though some figures are worrying, our research also found reasons for optimism.  While just 56% of those selling primarily online and 46% selling mostly in-store expect revenues to increase, businesses with a mixed online and physical presence are most likely to be optimistic about 2022 revenues — at 62%.

While just 56% of those selling primarily online and 46% selling mostly in-store expect revenues to increase, businesses with a mixed online and physical presence are most likely to be optimistic about 2022 revenues — at 62%.

“Main Street Health Survey Q4 2022: SMBs Brace For A Recession” examines the current state of Main Street businesses. We surveyed 501 U.S.-based businesses between Oct. 10 and Nov. 2 to learn more about the obstacles they face in the current business environment and their perceptions of the future.

More key findings from the study include the following:

• Inflation continues to lead all drivers of concern, yet uncertainty about economic conditions is rising among Main Street SMBs. While 39% of all firms cited inflation as their most relevant challenge in October 2022, 23% did so at the beginning of 2022. A similar share, 22%, now say uncertainty about economic conditions is their top concern, up from 17% last quarter. Overall, uncertainty about economic conditions is more prevalent among professional services firms. Just 32% identified inflation as their top challenge, and 38% were most concerned about the uncertain economic landscape.

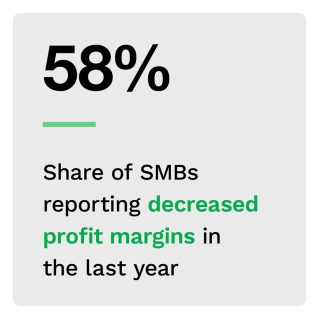

• Main Street SMBs were more likely to mark up prices and less likely to reduce costs to counter decreasing margins in October 2022. With more than half of Main Street SMBs already operating on narrower margins, most firms continue to deal with rising costs by marking up prices, while fewer are cutting costs. In October 2022, 58% of all SMBs said their profit margins decreased in the last year, a slight increase from 57% in July. Among smaller firms, 68% reported decreased profit margins in the last 12 months in October 2022.

• Main Street SMBs, on average, identify four areas of future technology innovations. Even with fewer firms looking to cut costs and increase productivity to deal with inflation’s effect on their profit margins, SMB owners identified four areas where they plan to innovate in the next 12 months. Construction firms reported the largest number of incoming innovations, averaging 5.2 technologies to be implemented in the upcoming 12 months. Firms in retail trade and personal and consumer services are the least proactive on innovation, planning an average of just three digital implementations. Firms reluctant to innovate digital capabilities cite lack of scale as a leading concern.

To learn more about how Main Street SMBs are dealing with inflationary pressure and bracing for a recession, download the report.