Access to credit is a significant challenge for many small and midsized businesses (SMBs), leaving them vulnerable to closure. According to recent data, only 47% of SMBs generating annual revenues of $10 million or less had access to business or personal financing as of July 2023.

This lack of financing availability varies across different market sectors, as noted in “What’s Next in Credit: Why SMBs Prefer Corporate Credit Cards for Short-Term Financing” report, with professional services and personal and consumer services sectors being less likely to have access to financing. On the other hand, the construction or utilities industry and hospitality sector have relatively higher access to financing.

Another key finding detailed in the joint PYMNTS-Cross River study is that when SMBs evaluate potential financing sources, corporate credit cards are the top choice, with 52% of them contemplating using these business cards. “This share is more than other possible sources, such as business loans from online lenders, at 22%, or working capital loans from banks, at 21%,” the study noted.

In terms of benefits, 35% of SMBs using corporate cards do so to help grow their businesses. Using corporate credit cards as a working capital solution also allows SMBs to cover both expected and unexpected expenses. It provides interest-free access to working capital and offers flexibility in managing cash flows. Suppliers also benefit from instant payments and access to transaction data.

But access to corporate or virtual credit cards is not a given, as just 28% of smaller SMBs are able to obtain them despite having access to a multitude of personal and business financing options. From a sector standpoint, construction or utilities SMBs and retail firms have higher rates of usage compared to personal and consumer services and professional services firms.

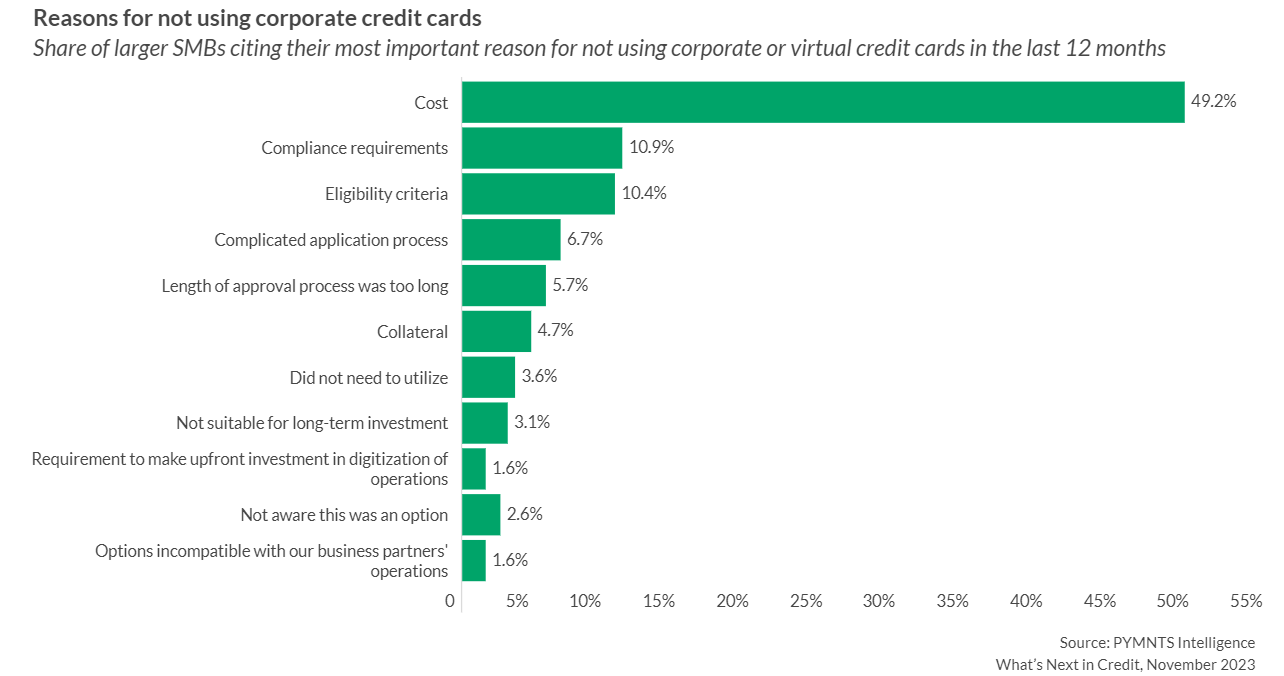

Examining the data further shows that there are several hurdles that hinder wider adoption of these cards. Nearly 50% of larger SMBs — those generating between $50 million and $250 million in annual revenues — cite cost as the most important reason for not using corporate credit cards in the last 12 months, followed by compliance requirements, eligibility criteria and complicated application process.

Financial institutions (FIs), especially FinTech companies, have an opportunity to fill the gap left by traditional banks and improve SMBs’ access to financing solutions while managing risk. Incumbent FIs that issue corporate credit cards, too, need to recognize the business opportunity they are missing out on and work toward easing SMBs’ access to these cards.