Smaller grocers are again caught between consumers and prices as major brands pass on their commodities costs.

Shoppers globally are expected to pay even more for branded food items in the coming year as packaged goods production expenses remain high, Reuters reported Wednesday (Feb. 8). Manufacturers, in turn, are projected to increase item prices until or unless commodities costs lower to the point that these companies’ margins ease.

Warnings about packaged goods prices remaining high came as late as last month from Mondelēz International, the parent company of brands that include Cadbury and Oreo. The snack and candy giant warned during its fourth-quarter earnings call that prices were set to continue rising.

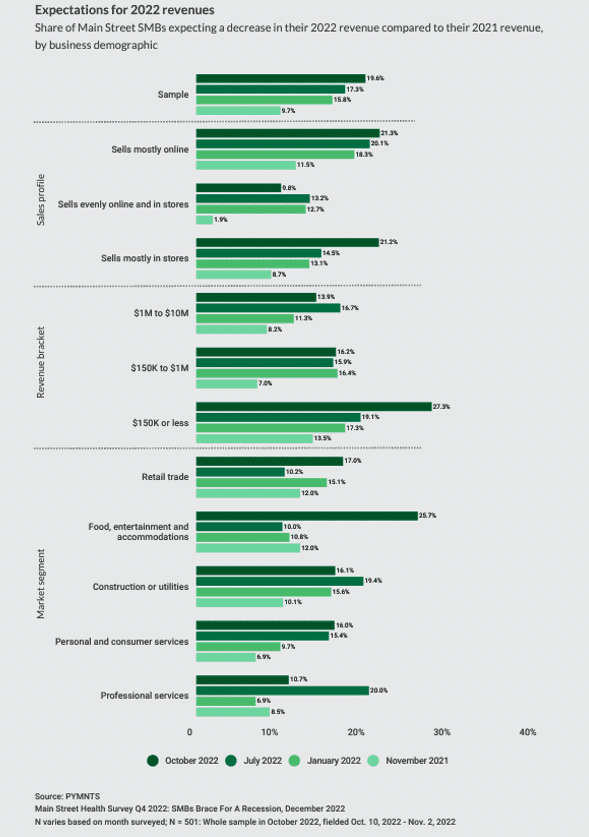

This is especially tough news for small chain and independent grocers, which have already been bracing for decreasing revenues. The PYMNTS report “Main Street Health Q4 2022: SMBs Brace for a Recession” noted that small- to medium-sized business (SMB) revenue expectations severely worsened in October for sectors involving food and retail. The share of food, entertainment and accommodations Main Street SMBs projecting decreased revenues for the entire year rose two and a half times to 26% from July.

In October, 39% of Main Street SMBs cited inflation as their greatest 2022 challenge. This most popular answer was followed by the related “uncertainty about future economic conditions,” cited by 22% of respondents. Giants such as Nestlé and Unilever turning the screws further on pricing likely won’t comfort smaller grocers.

This outlook matches the general sentiment about the economic landscape. PYMNTS’ research has found that consumers believe inflation will last into 2024 and are scrambling to cover bills and expenses with dwindling savings. Customers are responding accordingly, cutting costs on even items once deemed essential. And while inflation has been steadily declining, grocery costs are still up nearly 12% from the same time last year.

When it comes to lowering prices, major groceries have the private-label advantage. Both Kroger and Walmart reported seeing marked higher sales in this category, as shoppers increasingly trade brand loyalty for cost-cutting. On the food and beverage side, Procter & Gamble has no plans to change its sales strategy as a result of this potentially cheaper competition, while McCormick said shoppers are returning to name brands.

Smaller grocers that don’t have private-label sales to fall back on have mostly responded to inflation’s pressures by marking up prices, as fresh food price increases have disproportionally affected them.

“[It] has been the primary strategy to fend off inflation’s effects, with 31% of [Main Street] firms saying this was the most important action, up from 29% in July,” the Main Street Health reported found.

Price markups may become less and less viable for small grocers as global brands’ own price hikes hit the market.

For these sector players to survive, smaller grocers may have to renew their focus on customer-facing loyalty approaches. These could include targeted coupons, adopting a format to meet customer habits of smaller but more frequent purchases as well as expanded curbside pickup options.

Smaller groceries can’t do much about branded prices staying high for now, nor can they compete with private-label offerings. They can, however, turn to other, longer-term customer-facing loyalty approaches to try to maintain their market share.

Wayfair has reduced the time needed to curate product listings by 67%, saved hundreds of thousands of dollars and improved some conversion rates by 2% by deploying Google’s artificial intelligence (AI) technologies.

The online retailer shared these results in a Sunday (Jan. 10) press release emailed to PYMNTS announcing that it is using Google’s Gemini models on Vertex AI to enhance its product catalog and unlock “the next generation of retail experiences.”

“With Google Cloud, we’ve been able to efficiently scale and enrich our product catalogs, enabling us to support a more seamless and engaging shopping experience for our customers,” Wayfair Chief Technology Officer Fiona Tan said in the release.

Gemini on Google Cloud improved Wayfair’s time-to-market by automatically categorizing products across its 30 million product portfolio, delivered cost savings by eliminating the need to manually tag attributes like color and style, and improved conversion rates by increasing the accuracy of product attributes and improving the coverage of attribute tags in the retailer’s catalog, according to the release.

The technology also automatically catches errors in product dimensions and flags inappropriate materials, per the release.

Wayfair is also using Gemini for Google Workspace to boost employees’ productivity, according to the release.

The retailer is using AI features in this suite of productivity apps to draft and respond to emails, summarize and proofread documents, build presentation templates and gain expertise in new areas, per the release.

“By harnessing the power of Gemini and Google Workspace, Wayfair is not only automating complex tasks and boosting employee collaboration, but also creating more personalized and engaging experiences for every shopper,” Matt Renner, president, global revenue at Google Cloud, said in the release.

The rise of large language models (LLMs) has thrust generative AI into the driver’s seat of retail technologies, prompting brands to reassess their strategies, according to the PYMNTS Intelligence and AI-ID collaboration, “What Generative AI Has in Store for the Retail Industry.”

The report found that 92% of companies are using AI-driven personalization to drive growth and that 77% of business leaders rank generative AI as the most impactful emerging technology.