It is becoming more expensive and complex for companies to operate globally, and firms need better access to money to keep their businesses afloat.

Inflation remains high and persistent worldwide, with a deeper impact on regions like Latin America and the Caribbean (LAC). Against this economic backdrop, businesses face a key challenge of optimizing their working capital and tackling high inflation. To do so, corporates from the LAC region showcase non-conventional approaches to support their planned business needs or growth initiatives that might influence more mature markets.

“2023-24 Growth Corporates Working Capital Index,” a report created in a PYMNTS Intelligence-Visa collaboration, examines the business conditions and working capital requirements of growth corporates across five industry segments and five global regions.

By growth corporates, the report refers to middle-market businesses generating between $50 million and $1 billion in annual revenue.

According to the study, 84% of growth corporates in the LAC region used working capital solutions last year, more than any other region worldwide. Additionally, only 4% could not utilize any working capital solution even if needed, compared to the global average of 8%. This highlights that the region offers a dynamic access to working capital, outperforming more mature economies like North America or the EU.

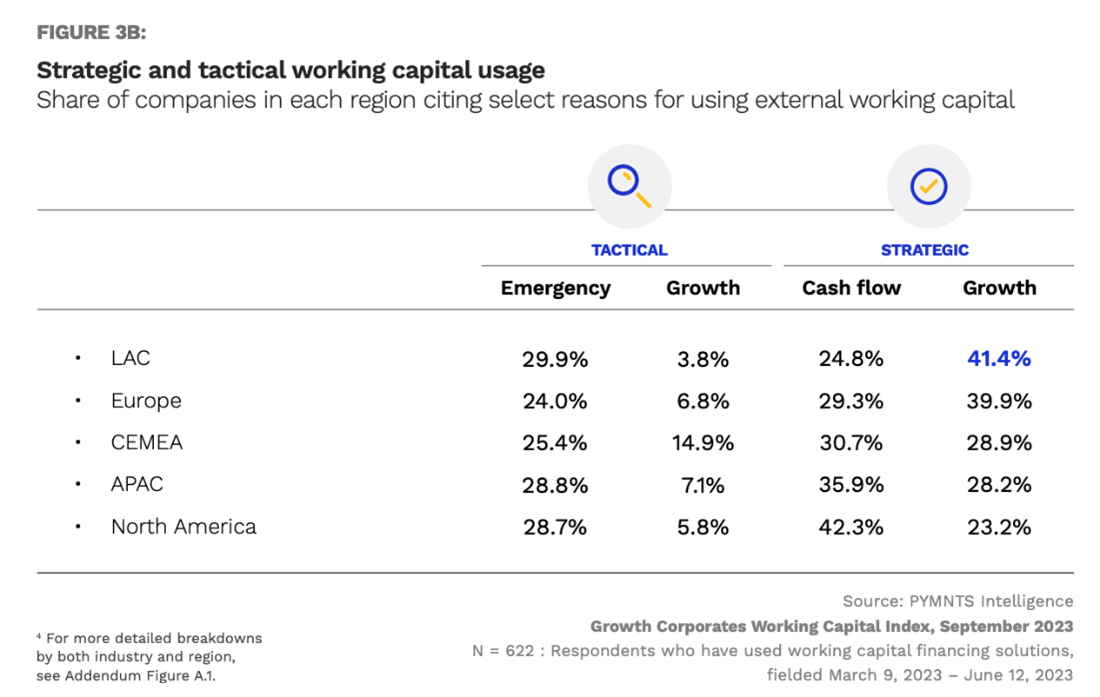

In the balance between strategic and tactical approaches, around half of the working capital solutions adopted by companies from LAC region were allocated to boost planned business growth, making it the region that most employed this strategy. They do this by carrying out planned investments, buying inventory, or replacing legacy systems, and they plan to keep doing it. The number of CFOs intending to use working capital solutions to foster growth next year is 20% higher than the present year.

Conversely, corporate growth businesses in the LAC region used working capital to cover emergencies more intensively than any other, at 30%, meaning using these assets to cover unplanned shortfalls and urgent situations that led to cash flow shortages.

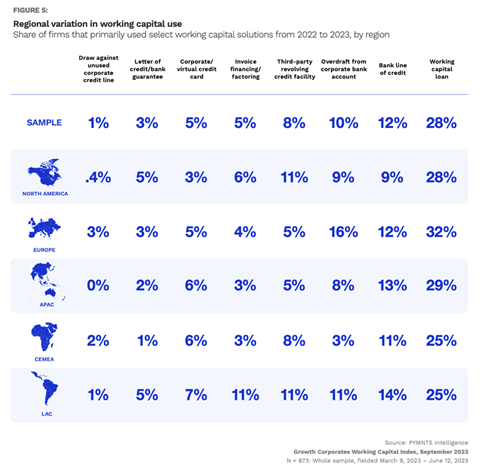

It’s also worth noting that, along with working capital loans, LAC leads the adoption of other less conventional solutions, such as third-party revolving credit facilities, virtual cards or invoice financing, which are versatile enough to serve both strategic and tactical use cases.

Third-party revolving credit facility solutions are used primarily for emergencies, while invoice financing is popular among CFOs who want to accelerate payment to strategic suppliers (unplanned growth). Virtual credit cards are the most popular for firms planning to fund growth initiatives.

LAC leads the global regions in the adoption of these solutions, balancing a minor use of working capital loans compared to other geographies.

The use and diversity of working capital solutions reflect the business maturity and versatility of an economy.

In the case of LAC, we observe a robust and innovative region when it comes to working capital availability, which can be found in the adoption of a diversity of solutions, including less conventional working capital alternatives.

Moreover, this trend seems set to continue, as CFO responses indicate continued use of most of these solutions next year.