Payment Processors’ Data Analytics Key to Attracting Retail Clients

Most small- to medium-sized businesses (SMBs) across industries use some kind of payment processor.

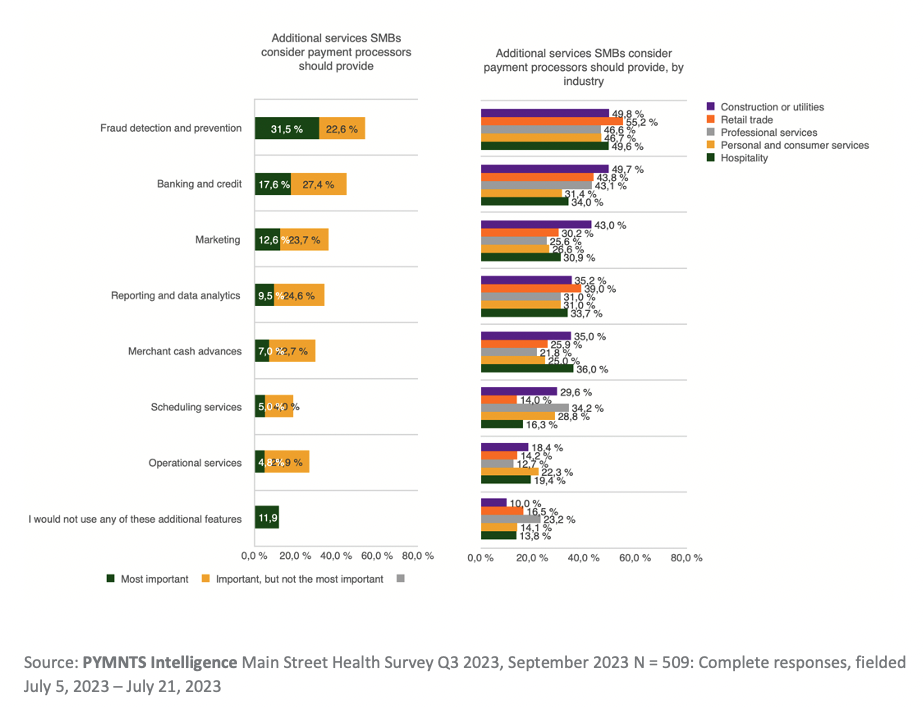

The most common providers are PayPal, Square and Shopify, which are chosen mainly for their ease of use or low processing fees. However, more companies are requiring their payment processors to provide additional features. The demand for these services varies according to the industry in which the company is operating and its business dynamics. Firms younger than 5 years old are particularly interested in these services.

Additional Features

According to “Main Street Health Q3 2023, Leading Payment Processors Satisfy SMBs,” a PYMNTS Intelligence and Enigma collaboration, reporting and analytics are the most important features demanded by retail firms, while hospitality companies are the most likely to cite merchant cash advances as a desired feature from payment processors.

These preferences relate to the strategic and operational interests of each sector. Retailers want to collect purchase data from their customers that they can use to create personalized offers for them in the future. Hospitality companies, on the other hand, use these systems to improve their cash flow management.

Switching Providers

Eighty-five percent of SMBs are very satisfied with their current payment processors, and 15% are considering switching in the next three years. This loyalty is higher for big names like PayPal and Square. However, having a differentiated offering is a determining factor in switching providers. Having a reputation in the market as a reliable provider capable of offering alternative services can help payment processors attract new customers.

About the Numbers

“Main Street Health Q3 2023, Leading Payment Processors Satisfy SMBs” is based on a survey of 509 SMBs with brick-and-mortar shops in commercial districts across the United States. It explores how satisfied Main Street SMBs are with their current payment processors and which features most appeal to them.