For smaller businesses, the lending spigots are tightening — at least at traditional financial services providers, the big banks that now are cautious amid rocky macro trends.

And that’s spurring at least some SMBs to consider new financing avenues — including tapping their customer bases for capital. As related by The Wall Street Journal, the drive is on to sell bonds to the local community and to end customers.

In terms of the mechanics of it all, these companies — more than 1,300 since 2017 — are soliciting investments (the Journal noted the funding could be, on an individual level, as small as $10 a piece). The practice is known as regulation crowdfunding (and has been approved by the Securities and Exchange Commission). And there are debt fundraising platforms such as Honeycomb Credit and Mainvest that facilitate crowdfunding.

The push towards this credit channel — which we might term hyper-localized — spotlights the appeal of community-based lending and how smaller companies can monetize at least some of the goodwill generated among local clientele and through word of mouth.

And it also spotlights some of the pressures seen up and down Main Street, across a variety of verticals. As PYMNTS data has shown in a continuing series focused on the challenges and opportunities facing these smaller outfits.

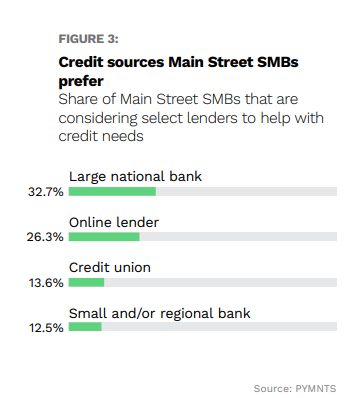

As recently as the end of last month, we found that 40% of SMBs remain more worried about inflation than one year ago. And about 15% have been concerned about the prospect of declining revenues. The report “Main Street Health Q2 2023: Credit’s Key Role in SMBs’ Plans,” a PYMNTS and Enigma collaboration, revealed that nearly half — about 48% — of Main Street SMBs plan to increase the amount of credit they use or to start using credit. PYMNTS finds that 34% of all respondents do not currently use credit and want to begin doing so. One-third of respondents said they’d use larger banks to get the credit they want.

But as the chart below shows, almost as many respondents, at 26%, would be looking to tap online lending sources — which signals an interest in platform models (and perhaps regulation crowdfunding, if that option gains wider exposure) to access capital.

In the meantime, in our coverage as reported here, and also here as reported by Biz2Credit, at the big banks, small business loan approval percentages have been in the mid-teens percentage points. That leaves some fertile ground for online options, for some less-conventional ways of bringing together small businesses that need capital and the folks who want to provide it.