As the landscape shifts, a PYMNTS Intelligence report, “End the Wait: SMBs and the Protracted Challenge of Delayed Payments,” in conjunction with American Express, poses a question: Could a new wave of digital transformation signal the end of this chronic delay?

Perils of Payment Delays

For SMBs, delayed payments are not just an inconvenience, but a severe threat to cash flow and operational stability. Nearly one-third of SMBs still rely on manual processes for ad hoc payments, which make up a significant portion of their revenue. BILL’s survey reveals that 46% of SMBs without automated accounts receivable (AR) software consider delinquent payments their top concern.

In the U.K., more than 25% of SMBs face up to £20,000 in overdue invoices, with 36% of payments arriving late monthly. This issue is also prevalent in North America, where less than one-third of SMBs have fully integrated payments into their management software. Ineffective cash flow management, cited by 60% of SMBs as a major challenge, exacerbates the risk of business failure.

FinTechs to the Rescue

Facing manual processing constraints, many SMBs are turning to financial technology (FinTech) solutions. Despite a forecasted 50% surge in payment volumes and a 46% rise in invoicing over the next three years, many SMBs remain saddled with outdated systems.

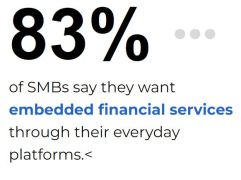

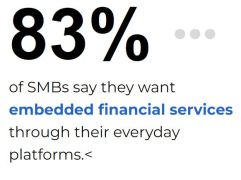

High costs and perceived complexity deter more than one-third from adopting automated solutions. But 64% are exploring tailored financial services through integrated software platforms. The shift toward cloud-based services is notable, with more than 80% of SMBs seeking these solutions to overcome inefficiencies.

Advertisement: Scroll to Continue

Cash Management: Path Forward

The adoption of digital tools presents a pivotal opportunity for SMBs to enhance cash management. Currently, 32% of U.S. SMBs are using instant payment methods to expedite transactions, which coupled with increased accounts payable (AP) automation, represents a strategic shift toward streamlined processes.

Artificial intelligence (AI) is increasingly integral, with 83% of SMBs leveraging it for data analytics and financial management. Consider 73% are consolidating cash management tools into unified platforms to boost efficiency and gain financial insights.

Jason Carlson, CFO of Mood Media, underscores the urgency of digital transformation. “Timely payments are crucial for sustaining operations, especially for SMBs that lack financial reserves,” he told PYMNTS Intelligence. Carlson highlighted that outdated payment systems contribute to inefficiencies and errors. He advised SMBs to consider digital solutions, such as direct debit and credit card payments, and to choose banking partners that offer tailored services.

Embracing digital and integrated solutions can transform a critical vulnerability into a strategic asset, positioning SMBs for sustainable growth and success in the digital age. The future of SMBs lies in harnessing the full potential of digital and integrated solutions. By overcoming the challenges of outdated payment systems, SMBs can turn a critical vulnerability into a strategic advantage, positioning themselves for sustainable growth and success in the digital age.