Leisure and travel names showed serious stock market gains this past week.

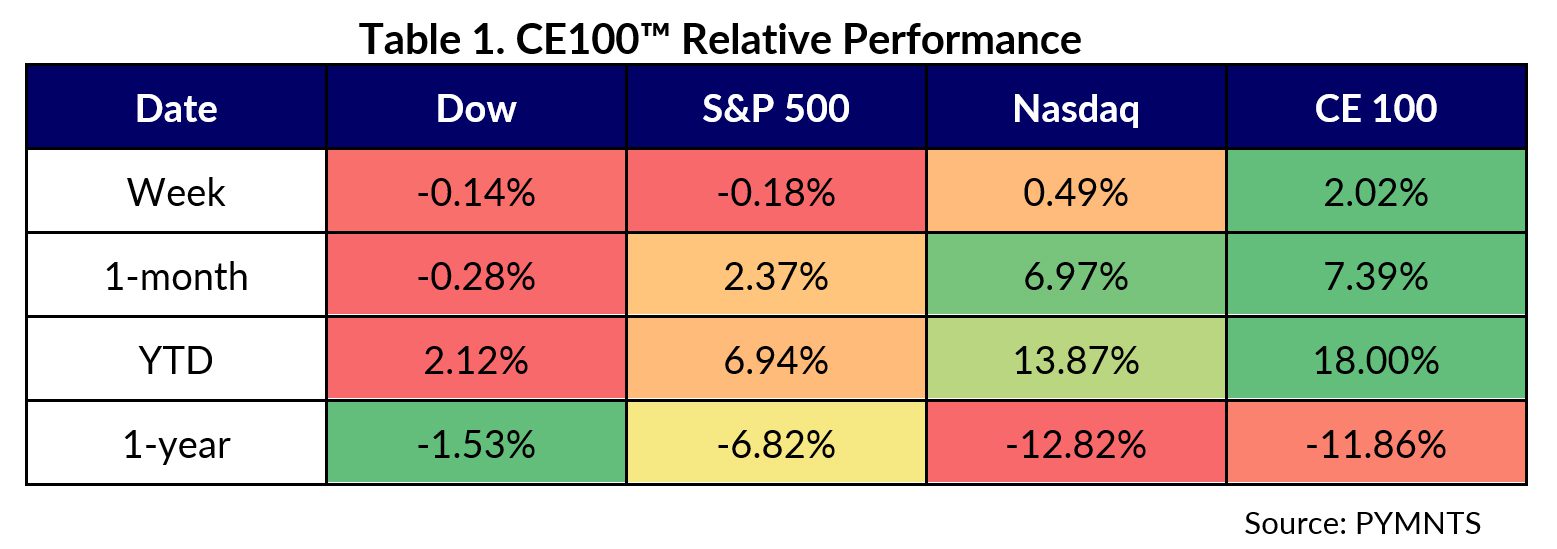

The CE 100 Index gained 2% last week — driven by the “Have Fun” pillar, which led advancing issues — as earnings season continued to dominate headlines and investor sentiment.

And, as measured year-to-date, the Index has gained 18%.

The “Have Fun” segment was up 6% overall.

DraftKings soared 28.5% through the week, buoyed by earnings and recent stats showing it was the most downloaded sportsbook during last week’s Super Bowl. As reported in our earnings coverage, DraftKing’s average annual retention rate over the past four years has been 87%, per management commentary. And as noted in its latest quarterly metrics, DraftKings ended the year with 2.6 million monthly users, a 31% increase compared to the previous year.

Roblox gathered 17.3%. The company reported last week that its daily active users (DAUs) jumped 19% year over year, and the tally stood at 65 million last month. The virtual platform’s global player community collectively visited more than 15 million experiences within the Roblox metaverse in 2022, while developers and creators published more than 15,000 experiences each day of the year on average. And the firm has estimated that creators now make more than 90% of items published in its Marketplace.

The metaverse platform’s user audience segment aged 17-24 grew more than 31% and accounted for nearly a fifth (22%) of DAUs over the fourth quarter. And in reference to demographics, more than half of Roblox’s users are now 13 and older, showing that the platform has been able to age up its historically younger user base.

Flutter Entertainment gained 10.8%. The firm’s stock rose in the wake of the news, as reported by sites including CNBC, that the company is mulling a listing in the U.S. In a similar fashion to DraftKings, the Super Bowl has been a key tailwind — and as the parent company of FanDuel, Flutter’s been reaping the benefits of sports betting. FanDuel said it accepted 50,000 bets per minute at its peak, averaging 2 million active users on its platform during the Super Bowl.

And as for travel-related names, we saw the “Move” sector move 5.2% higher, driven by Airbnb, which was up more than 20% through the week. As we wrote in the wake of the company’s earnings report, “at a high level, Airbnb’s earnings show that global travel remains buoyant, and cross-border travel in particular has been on the rise — with travelers flocking to cities as COVID-19-related lockdowns in Asia eased.”

The demand helped drive gross booking value up 26% year on year to $13.5 billion, excluding foreign exchange impacts.

The nights and experiences booked, the company said, were up 20% in the most recent quarter as measured against last year, to 88.2 million.

During the conference call with analysts, CEO Brian Chesky said, “We had our highest number of active bookers ever in Q4, demonstrating guests’ excitement for the travel on Airbnb, despite evolving macroeconomic uncertainties during the quarter.”

The surge in aforementioned names was more than enough to offset the 1.4% decline in the “Shop” segment.

Shopify lost 9.7% to lead the group lower. The company’s earnings and guidance showed evidence of slowing growth.

Management said that inflation is a headwind, even as consumers continue to move back to brick-and-mortar commerce – amid other signs that omnichannel efforts continue to pay off.

Shopify Plus merchants accounted for 27% of all POS activity, up 12% from a year ago. Details from the filings and the call show that Shop Pay — the company’s accelerated checkout option that lets consumers save their data with merchants — accounted for more GMV, at $11 billion in the most recent quarter, up 25% year on year.

Overall, GMV grew 17% on a constant currency basis, to $61 billion, outpacing U.S. retail growth in the quarter by 6%. But management also noted on the call that it sees “high teens” revenue growth and anticipates that inflation remains elevated. Consumers are continuing to gravitate towards discounted and non-discretionary purchases.