The earnings cavalcade continues. For the FinTech IPO Index, gainers battled declining stocks to a draw.

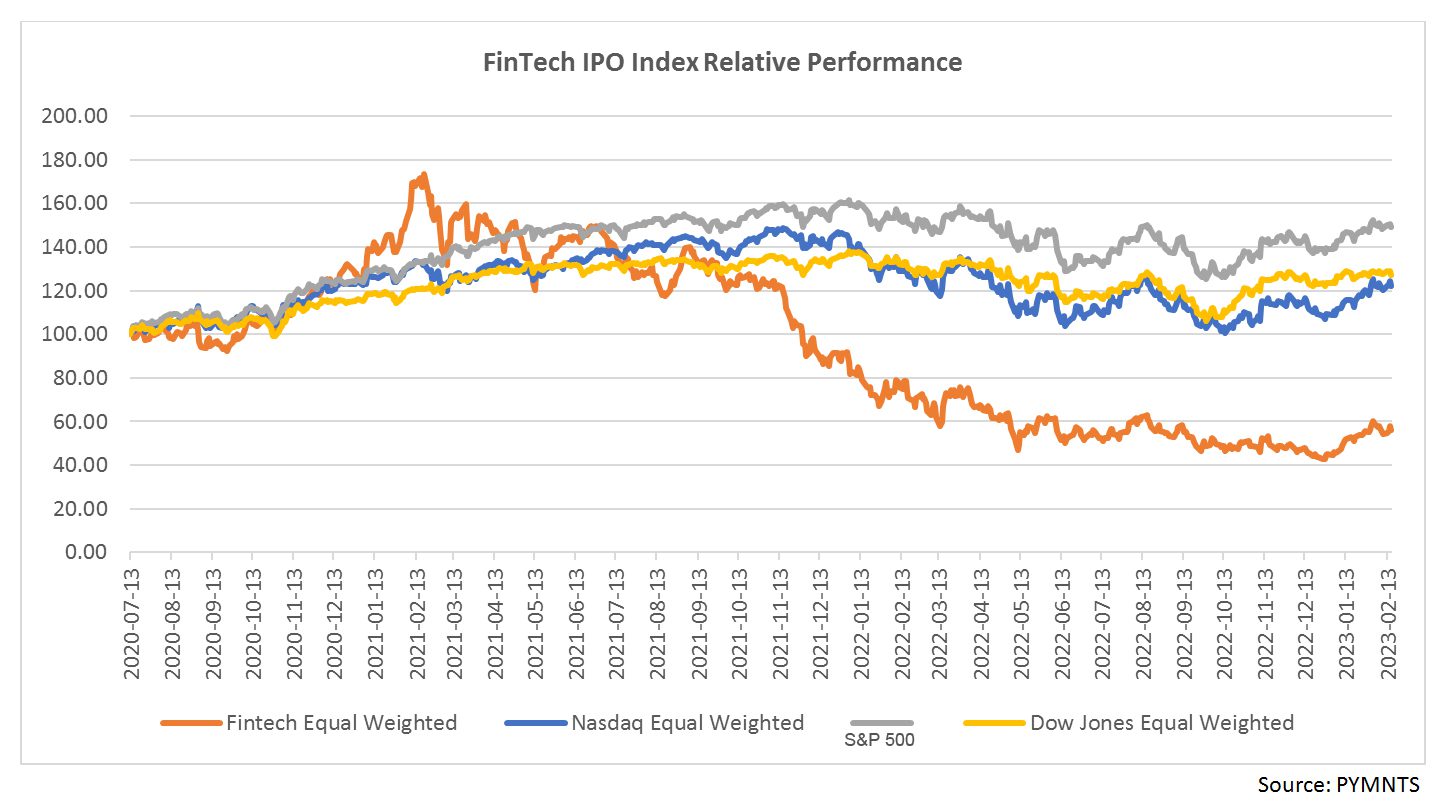

The overall Index inched up 1.2% through the past five sessions. February is shaping up to be a decent month, up roughly 6%, and the year-to-date performance stands at a positive 26%.

Nerdwallet surged 37.7% through the week, having posted results that showed overall revenues leaping 43% year on year in the December quarter to $142 million.

Nerdwallet surged 37.7% through the week, having posted results that showed overall revenues leaping 43% year on year in the December quarter to $142 million.

Drilling down a bit, credit card revenues were 52%, offsetting a decline in revenues gleaned from loans, which declined 24%. The company said that its average monthly active users were up 9% year on year to 20 million. The company guided to 30% growth in revenues in the current quarter, at the midpoint of a range that assumes continued contribution from credit cards, insurance and banking.

Upstart was up 14.5% in a week that saw the AI-driven lending platform report that fourth-quarter top-line growth was more than 250%. Supplemental and earnings materials from Upstart revealed that lending partners originated more than 154,400 loans, totaling $1.5 billion across the company’s platform in the fourth quarter, down 62% from the same quarter of the prior year.

We detailed in our coverage post-earnings that there remains pressure on lending platforms, at least as measured in terms of loan originations — particularly from institutional bankers and banks. And Dave Girouard, CEO, said on the call that 2022 represented a “perfect storm for our business model. The withdrawal of federal stimulus disproportionately harmed our borrowers, akin to a simulated recession where millions of mainstream Americans suddenly lost what had become their primary source of income.” And against that backdrop, he said, macro pressures are affecting lenders to the point where they “are slowing down or they’re pausing.” But management also noted a rising demand for small-dollar loans, spanning $200 to $2,500, and 12,000 of these loans originated in Q4.

Nu Holdings gained more than 10%. Nubank added 4.2 million customers in the fourth quarter that ended Dec. 31, to 74.6 million, up 38%. Deposits were up 55% to $15.8 billion. The monthly average revenue per active customer (ARPAC) increased to $8.2, expanding 37% over the prior year, according to the company’s reports.

“Nu customers now account for 44% of the country’s adult population, versus 39% in the previous quarter,” the company said of Brazil. The company said in its release that core products, which include credit cards, banking accounts and personal loans, reached approximately 34 million, 53 million, and 5 million active customers, respectively.

These gains were partially offset by the 12% loss in the week for Toast, whose shares plunged more than 22% on Thursday in the wake of earnings and an announcement that, as spotlighted here, it has acquired digital drive-thru signage company Delphi Display Systems to boost its quick-service restaurant (QSR) offerings.

“Drive through is a critical service model for QSR that has become even more important over the past few years,” Toast CEO Chris Comparato said on the earnings call. The company said its revenues were up 50% to $769 million. Gross payments volume was up 49% to $25.5 billion.

Looking ahead, Toast is focused on improving its ability to assist restaurants with pricing channels by expanding its back-of-house capabilities in areas such as procurement.

Paymentus was up about 3%.

Citizens Bank has chosen Paymentus to provide payment services for its retail banking customers. The partnership will see Paymentus offer its Bill Center and Loan Payments tools to Citizens’ customers, the company said in an announcement provided to PYMNTS.