The subscription commerce model holds appeal for companies, especially considering Amazon keeps growing Prime Members for a reliable stream of revenue. Vehicle subscription services are burgeoning and Uber got into the game last month with Uber Pass.

Is there room for new entrants?

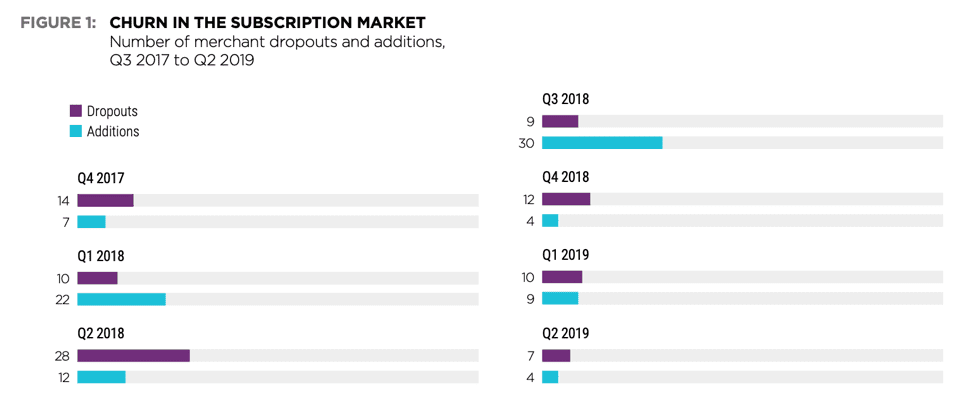

According to the Q2 2019 Subscription Commerce Conversion Index, competition is tight as ever. In the second quarter of this year, seven existing merchants dropped out and four joined the subscription market. The market saw more fluctuation earlier in 2018, though. There were 30 new entrants and nine dropouts in the third quarter alone. The current stability suggests that established providers are riding the wave, while upstarts are waiting on the sidelines.

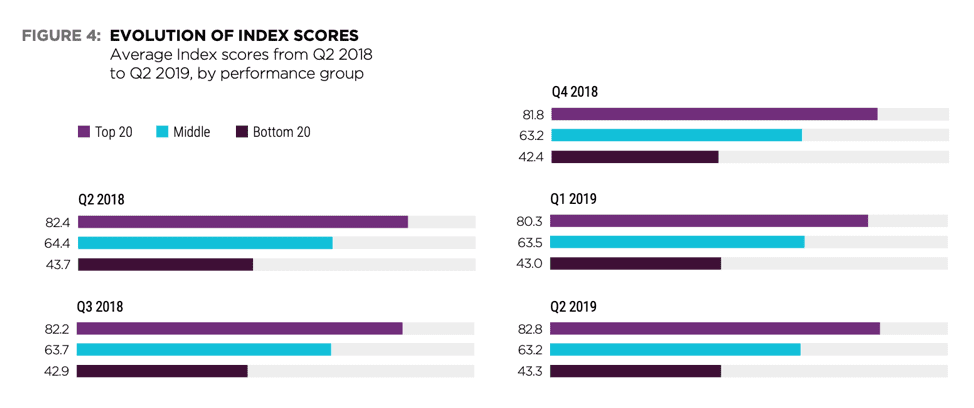

PYMNTS calculates index scores on a scale of zero to 100 based on the availability of 47 key features like plan options, messaging, cancellations and the time required to start a subscription.

It might make sense for players in a crowded market to try to differentiate themselves and improve performance. However, the average index score in Q2 2019 was 64.4, just a slight increase from the 64.1 in Q1 2019 yet also a little decline from Q2 2018 (65.1).

Meanwhile, the top 20 providers improved their scores, earning 82.8 in Q2 2019, up from 80.3 in Q1. In certain segments, such as streaming video, index scores have climbed past 90 points. Most providers have seen their scores decline or hold steady since Q2 2018, with the very notable exception of top performers. This suggests that leading companies are getting better, while the rest are becoming mediocre.

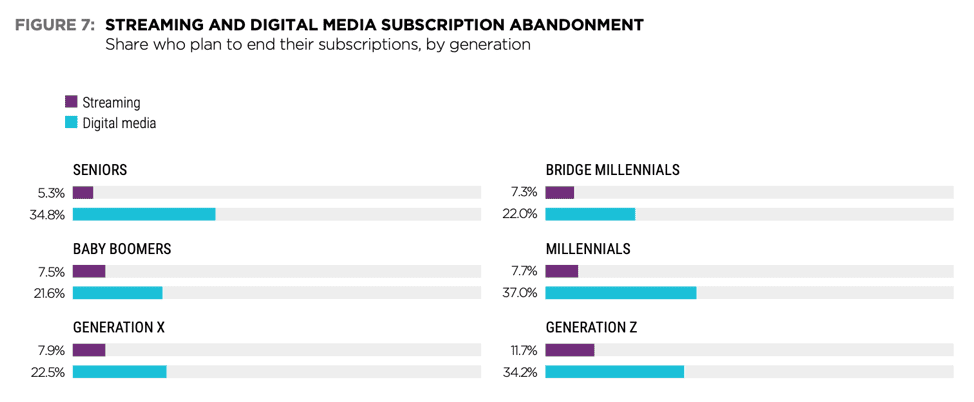

Age plays a significant role in satisfaction levels. Younger consumers are the most likely to abandon their digital content subscriptions, with close to one-third (34.2 percent) planning to abandon a digital content subscription, and 37.0 percent of millennials planning on the same. Generation Z is the segment with the largest intention of canceling a streaming subscription (11.7 percent).

It wouldn’t be completely accurate to characterize the propensity to cancel a subscription as a younger vs. older consumer trait, though. Generation Z and seniors had very similar levels of canceling a digital media subscription, and when taking the youngest and oldest segments out of the equation, the four remaining generations had nearly identical plans for canceling a streaming subscription — from a high of 7.9 percent for Generation X to 7.3 percent for bridge millennials.

Streaming services like Netflix and Hulu have created more loyalty than digital media services like Audible and Scribd. Over one-quarter (26.7 percent) of digital media subscribers and 7.3 percent of streaming subscribers plan to terminate their subscriptions within a year.

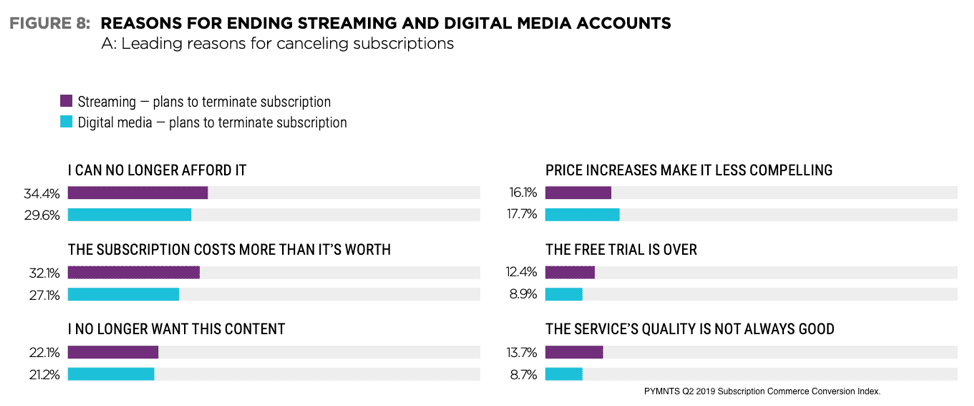

Price was cited as the top reason for cancellation for both streaming (34.4 percent) and digital media (29.6 percent). A similar number of users say that their plans are not worth it. Affordability could offer one explanation for why younger consumers are more likely to give up their subscriptions. It’s not a stretch to imagine that Generation Z and millennials have lower earning power.

The study also finds significant shares of consumers intending to give up their accounts because their free trials are expiring, cited by 12.4 percent of streaming and 8.9 percent of digital media subscribers. Reasons related to price have more bearing than issues related to content.

Poor user experience, though, can be a true deal-breaker.

Users’ negative experiences with how digital content platforms operate correlate with greater likelihoods of account cancellation — and this starts with registration. A significant portion of subscribers who intend to terminate their subscriptions encountered difficulties both in the registration process and in using their accounts. A little fewer than half (42.4 percent) of those ending their streaming subscriptions consider their registration processes “somewhat easy” at best. Those keeping their streaming subscriptions were much more likely to characterize their registration experiences as “very” or “extremely easy,” with 88.3 percent having this view.

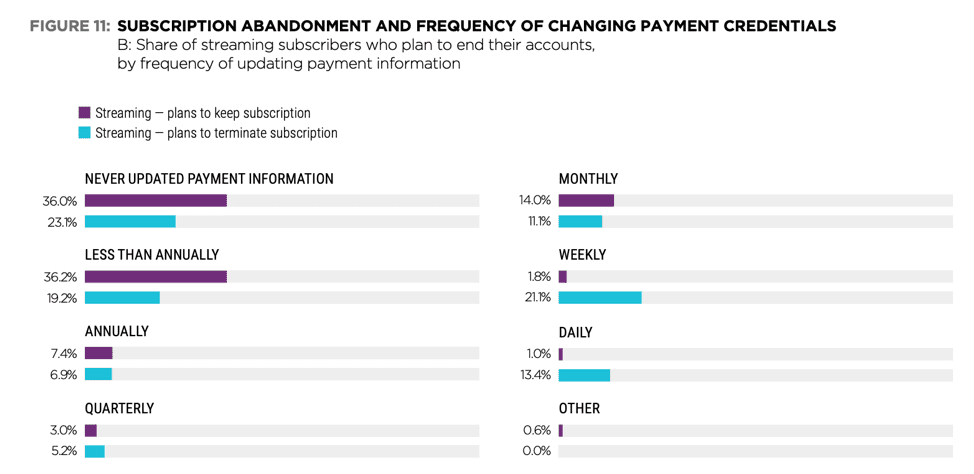

Once registered, the largest friction point centers around retention of payment information. Consumers who plan to end their subscriptions report having to change their payment credentials more frequently. Streaming subscribers who have never or rarely had to update their payment information are much more likely to want to keep their accounts.

Roughly three-fourths (72.2 percent) of those who plan to maintain their subscriptions have either never had to update their credentials or had to do so less than once per year. This compares to 42.3 percent for those who intend to cancel their subscriptions.

This shows just how sensitive digital content subscribers are to friction, both in registering for and using platforms, and how important it is for subscription-based businesses to offer smooth onboarding and payment processes.