Subscription services are getting a boost as consumers seek out ways to experience new products and services as they hunker down at home to stay safe and reduce exposure risks during the pandemic.

PYMNTS’ Subscription Commerce Conversion Index found that nearly three-quarters of U.S. adults, or 182 million consumers, subscribed to at least one subscription service last July, up 9 percent from February 2020. Nearly half of these subscribers also said they will likely keep these subscriptions even after the pandemic has eased.

This is no time for subscription service providers to kick up their feet, however. The research revealed that more than 13 percent of subscribers, or about 24 million consumers, said they are “somewhat” or “very” likely to cancel their subscriptions. Merchants will need to work to engage and retain the subscribers they gained during the pandemic by offering seamless user experiences and fast, friction-free payments.

The following Deep Dive examines the importance of offering flexible subscription plans and a look at how businesses can avoid obstacles to provide seamless transactions in the subscription economy.

The Effects Of Payments Failures

One study found 78 percent of respondents have at least one recurring monthly charge on their credit cards and 40 percent have three to five. Consumers want transactions that are simple and frictionless, yet payment failure is widespread across the U.S.

Another online survey polling 700 payment executives at business-to-business (B2B) and business-to-consumer (B2C) firms on the state of recurring payments found that more than half of U.S. decision-makers said their payments failed 7 percent of the time over the last 12 months. Such payment failures create bigger roadblocks for merchants, such as customer churn, recovery costs, harmed profitability and bad debt. To prevent failed transactions, solutions leveraging advanced algorithms that do not disrupt the existing billing system, such as Vindicia Retain, can be integrated.

Payment frictions and failures can be catastrophic for subscription service providers. Two-thirds of U.S. payments decision-makers reported that 11 percent or more of their payment failures resulted in the loss of subscribers over the past year. Losing a single subscriber through passive churn not only represents the loss of one transaction, but also forecloses subsequent revenue opportunities that customer would have produced. These payment failures can drive customers to either cancel their subscriptions out of frustration or find that their plans were automatically canceled.

More than half of B2B and B2C decision-makers said the average cost of payment recovery exceeds 11 percent of the payment. Bad debt occurs when credit has been granted to a customer but cannot be collected. More than two-thirds of U.S. B2B merchants said that at least 11 percent of failed payments end in bad debt, and these failures directly impact profits. More than 40 percent of executives said profitability slips when payments fail, ultimately slowing growth. Failed payments therefore strain innovation, lower profits and chill customer goodwill.

Reducing Churn Rates

Merchants that offer smooth subscription experiences allow customers to quickly and efficiently customize their service plans and make intelligent choices. PYMNTS research shows that the major reason customers cancel their plans is their inability to make changes to their subscription services. This proved true for nearly 30 percent of those who subscribed during the pandemic and 15 percent who signed up before the pandemic. It is thus clear that service flexibility can help reduce churn rates.

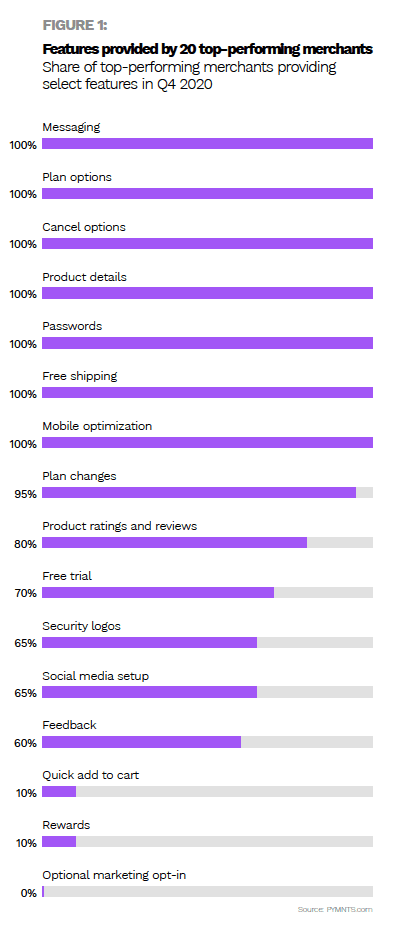

Merchants are fortunately getting this message loud and clear. Nearly 52 percent now allow subscribers to make changes to their plans and 75 percent provide plan options. This is in contrast to the 48 percent and 73 percent of merchants, respectively, that provided such features in Q3 2020. Research further shows that as much as 95 percent of top- performing merchants provide plan changes and 100 percent offer plan options.

The pandemic has fueled demand for subscription services of all types as consumers spend more time at home. Merchants hoping to cash in by transforming new subscribers into loyal, long-term customers will be best served by offering easier payment options and flexibility. The top subscription services not only simplify onboarding, but also offer flexible features that allow customers to customize plans and make the right financial decisions. Merchants unable to meet these demands will risk losing subscribers and may fail to attract new ones.