Survey over 2,000 U.S. consumers about subscription experiences, and you’re bound to get illuminating answers. Like how much people love their subscriptions. Until they don’t.

The PYMNTS 2021 Subscription Commerce Conversion Index, a sticky.io collaboration, looks at the mushrooming direct-to-consumer (D2C) movement as it stands in year two of the pandemic.

In that time, “34 percent of all subscribers (14 million U.S. consumers) have signed up for at least one new plan since the pandemic began, on average. Sixty-two percent (8.4 million) of these consumers are subscribing for products and services directly from manufacturers, and the strong majority of these subscribers say they use such subscriptions to try interesting new products, get higher quality items or have fun,” the Index states.

That’s great news for D2C brands especially, but fears of a post-COVID subscription bubble burst lurking just out of sight have companies looking for ways to keep subscriptions fresh.

Into the breach are stepping features from subscription pause to personalization as platform tech makes the work of keeping straying subscribers on the path of recurring payments.

Food And Grocery Leading The D2C Pack In 2021

Among a wealth of insights from the 2021 Subscription Commerce Conversion Index is the sheer scale of and velocity of subscription commerce in over a year of rolling lockdowns.

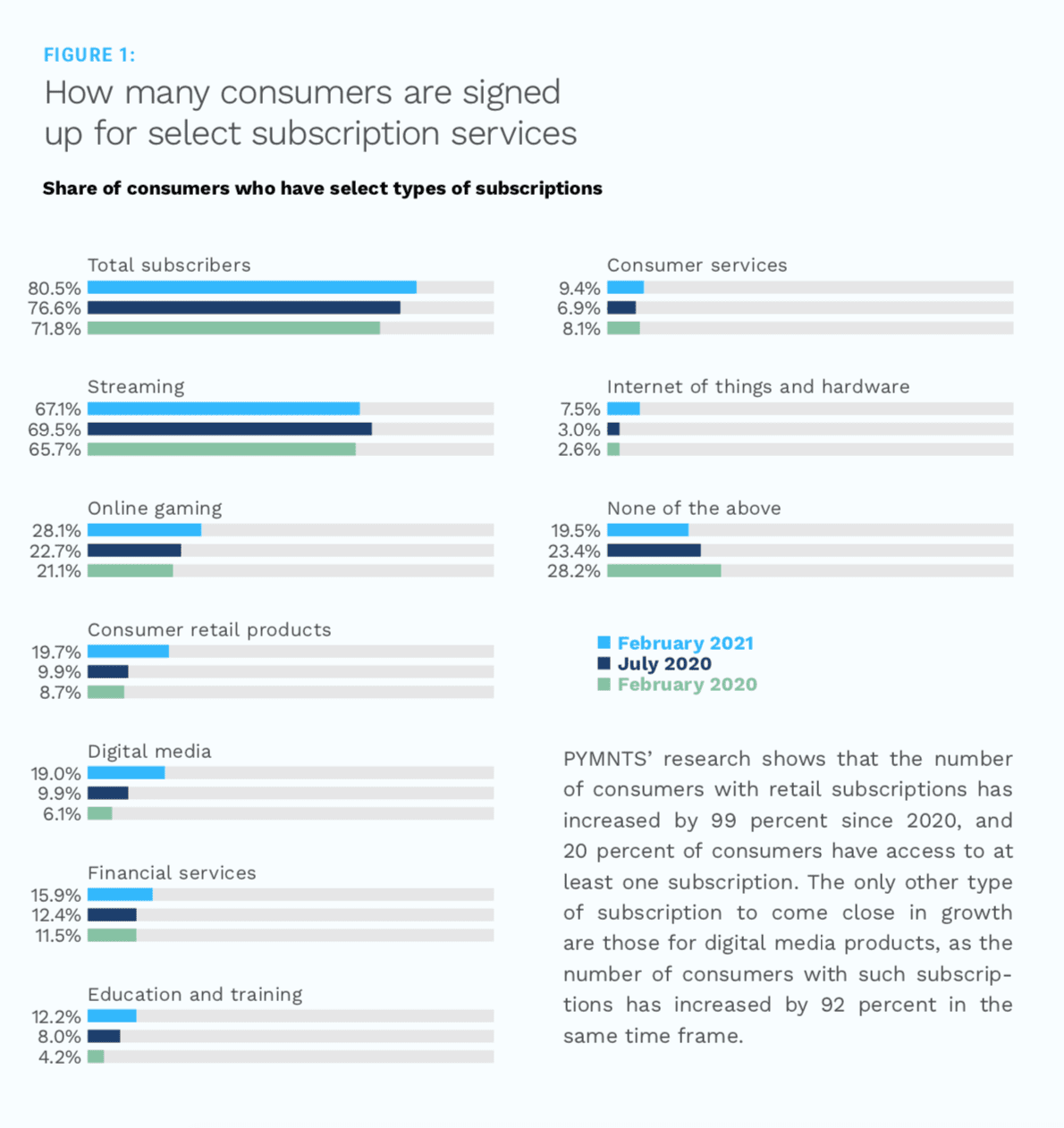

Per the Index, “PYMNTS’ research shows that the number of consumers with retail subscriptions has increased by 99 percent since 2020, and 20 percent of consumers have access to at least one subscription. The only other type of subscription to come close in growth are those for digital media products, as the number of consumers with such subscriptions has increased by 92 percent in the same time frame.”

Big gainers in this mix include grocery and food subscriptions, logging the greatest growth among retail subscriptions, as 40 percent of all consumers with at least one grocery or food subscription are on annual plans. “Clothing and accessories and health and wellness subscriptions round out the top three as 38 percent and 36 percent of consumers with these types of subscriptions have signed up since March 2020, respectively.”

If one area stands out from the data as needing attention it’s the sign-up process. Unknown numbers of desirous subscribers are still bailing on bad (and slow) onboarding experiences.

By no means asleep at the wheel, D2C marketers went right at the problem.

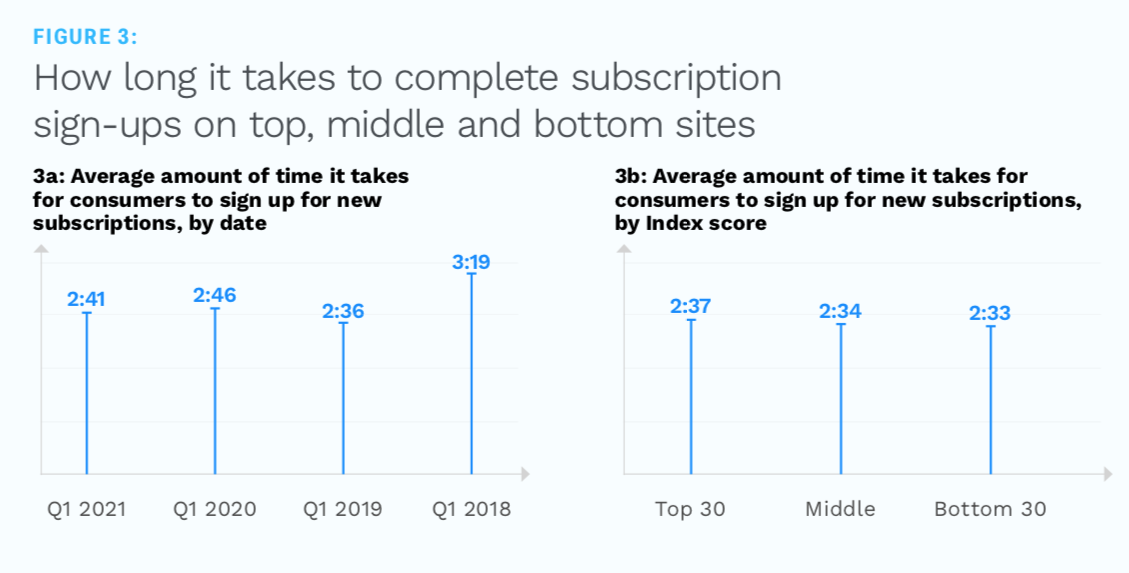

“PYMNTS’ research shows that subscription service providers are streamlining their online sign-in processes so that it takes less time for would-be subscribers to sign up for their services — a move that can help them convert more of these subscription-curious consumers. The result is that consumers can sign up for new subscriptions faster now than one year ago. It takes the average subscriber five seconds less to sign up for new plans in 2021 than it did in 2020.”

Trials, Plan Options, Pause Features Trigger The ‘Subscribe’ Impulse

The words “free trial” appeal to everyone, with the possible exception of criminals who pay off judges. In the D2C realm, free trials are powering lots of test runs. The trick is turning it into a longer engagement, and that’s where brands are having success changing up feature sets.

Per the latest Subscription Commerce Conversion Index, “Free trials are undeniably easy to abuse, but consumers also see them as an integral part of their subscription commerce experience. Free trials can provide them the chance to test new services that might pique their interest, allowing them to explore whether certain subscription products and services suit their unique needs and expectations. They therefore stand out as a rare and differentiating subscription feature that is more commonly offered by top-performing providers that are looking to establish strong relationships with their customers from the get-go.”

Our researchers also found that most of the Top 30 merchants are offering plan options, “enabling users to change the terms of their subscriptions to their liking, such as by providing new features or reduced prices.” And there’s the pause feature, popular with about 80 percent of the top 30 merchants, the Index states.

Of the major takeaways from the new research is awareness of the subscriber mindset.

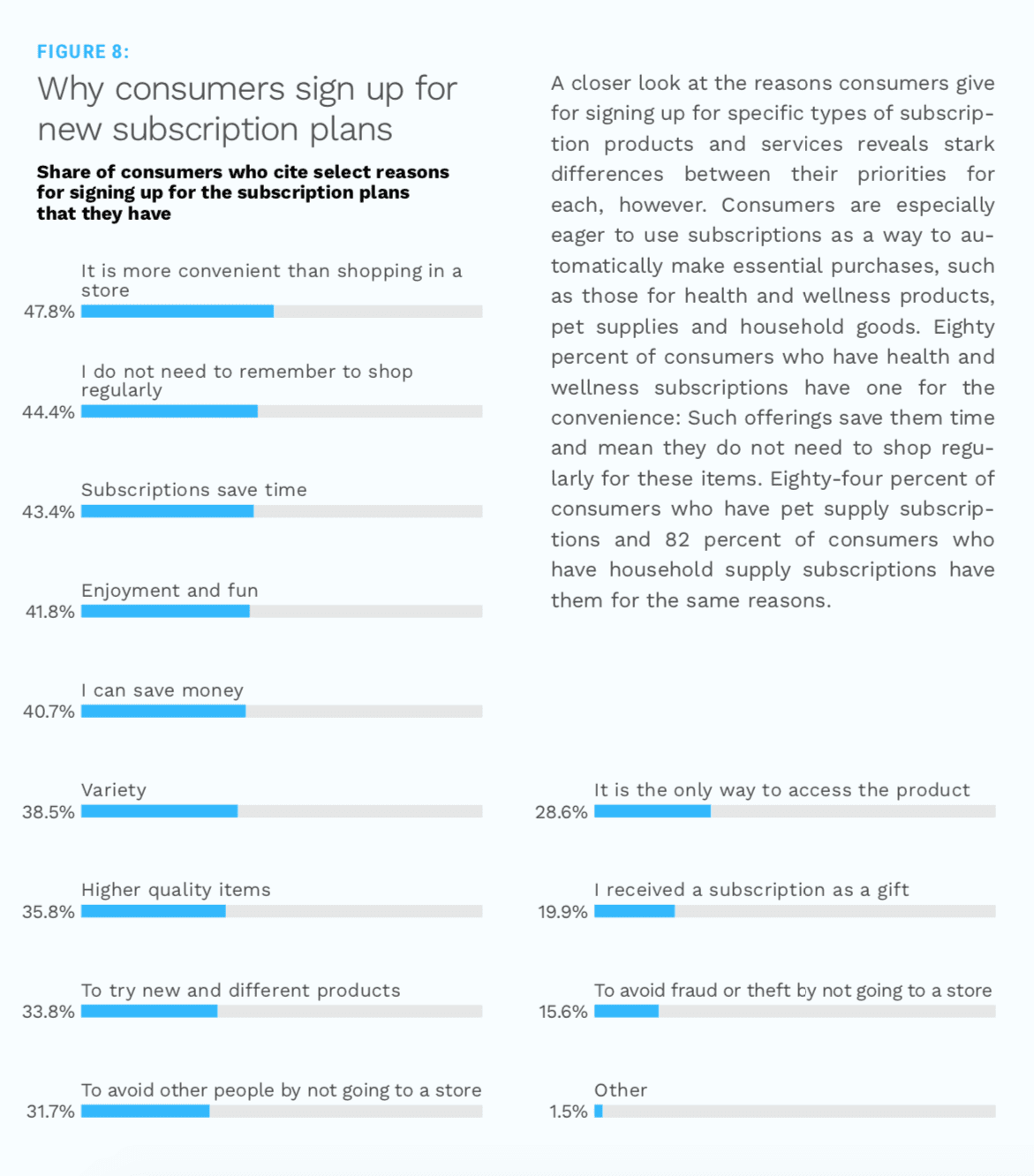

“Consumers … tend to see subscription products as either ‘must haves’ or ‘nice to haves.’ They also expect their providers to deliver very different subscription commerce experiences depending on which products they are purchasing,” per the Index. “Understanding the distinction between the experiences consumers want for their “must-have” purchases and their ‘nice-to-have’ purchases is critical to optimizing their user experiences, and it begins with a look at consumers’ expectations for subscription commerce as a whole.”