These are some of the conclusions drawn from the report “The Subscription Commerce Readiness Report: The Loyalty Factor,” a collaboration between PYMNTS Intelligence and sticky.io. According to the survey conducted for it, each consumer holds 2.2 retail product subscriptions on average, the lowest level recorded in two years. The share of consumers holding subscriptions of this kind has dropped by 10% this year, a decline in line with the one recorded in previous years.

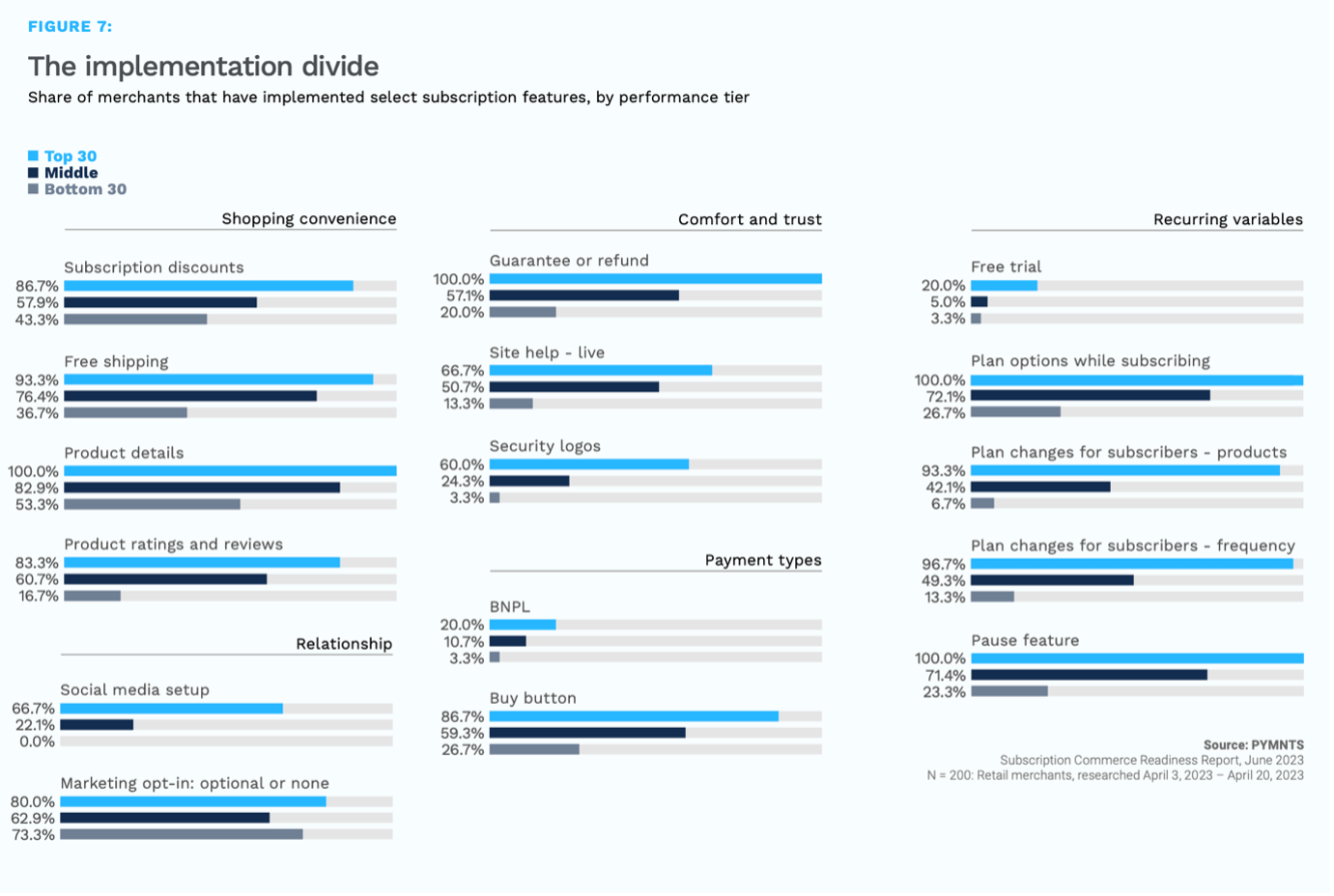

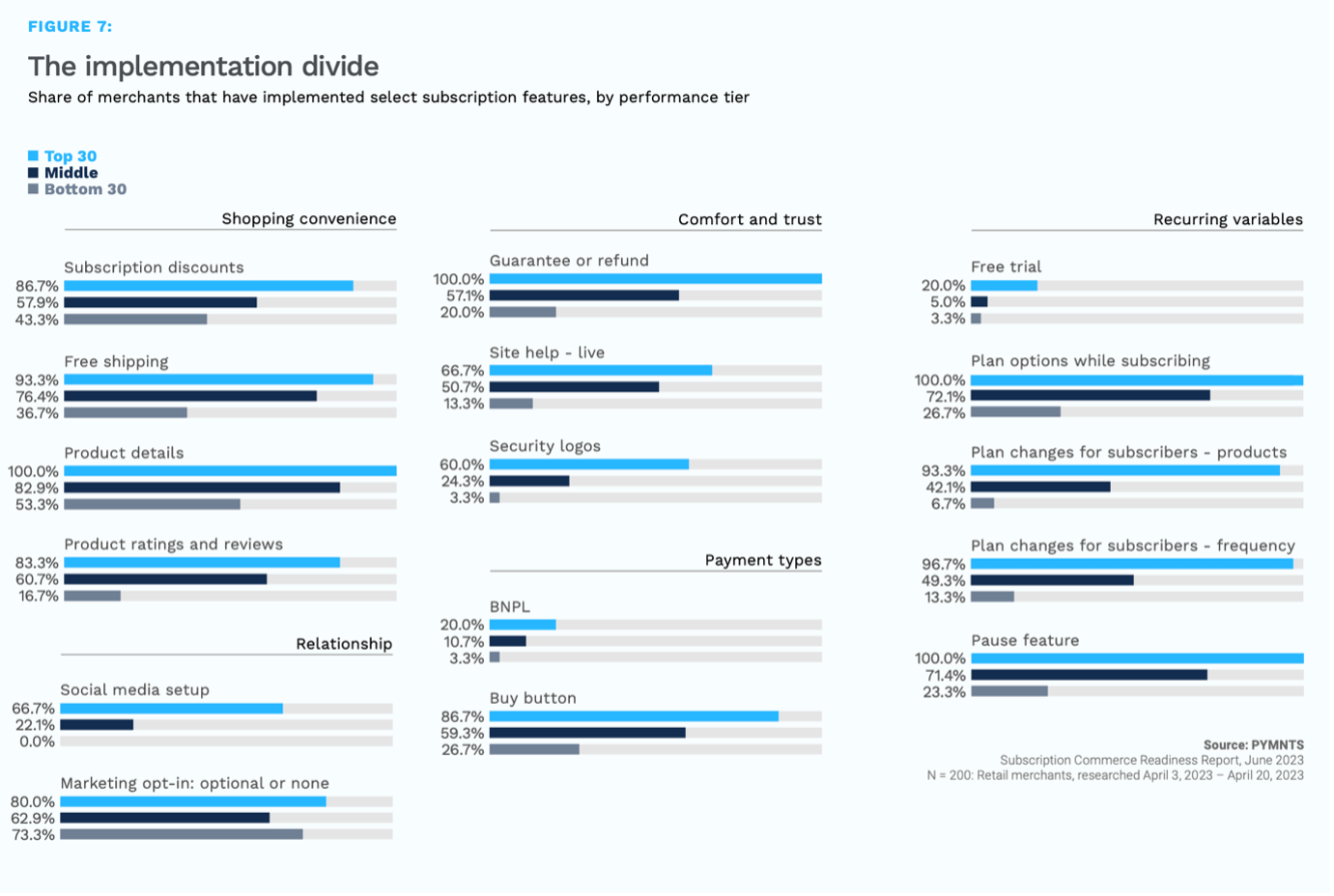

During this time, some merchants were more affected than others: BoxyCharm or Birchbox, for instance, lost half of their subscribers, while Amazon Subscribe & Save saw a reduction of 3.5 million subscribers in just one year. The primary reason for canceling a subscription is cost, cited by 6 out of 10 respondents who canceled. Surveys also demonstrate that discontinuing certain benefits in loyalty programs has a damaging effect on customers that translates into subscription cancellations, especially among holders of VIP subscriptions. The pronounced drop in sales has led some retailers to adopt more aggressive commercial strategies, including price discounts and free shipping, which are offered by almost all of the top merchants in the market.

In addition to promotion and price initiatives, retailers are also launching new service modalities aimed at stimulating demand. For example, Amazon is testing a new feature on its app — “Buy Again” — designed to prod users to repeat purchases. The final purpose of this initiative is to make clients think that, in the end, it is easier to pivot to Prime or the “Subscribe and Save” program so that items arrive regularly. It seems to be working: The company’s third-quarter results showed a rebound in subscription-related revenues of 14%.

Furthermore, merchants have directed their efforts toward offering greater flexibility to their customers by providing refund guarantees or allowing subscribers to modify their shipping frequency, and this is occurring in most retailers. By contrast, other initiatives focus on enhancing consumer experience and implementing key features impacting conversion and retention rates, such as placing orders through social media.

Some other strategies, however, have been underutilized, such as offering more free trials or BNPL options to facilitate customer payments. One in 10 consumers plan to cancel their current subscription program when it expires. For customers still deciding about continuing, having more payment flexibility and an enhanced product experience can help persuade them to stay. If some of the top merchants adopt innovative strategies to mitigate the loss of clients succeed, other players may follow them soon.

Advertisement: Scroll to Continue