Meal subscription service sales surged during the early months of the pandemic, offering consumers a way to get their daily food needs met without the effort of grocery shopping. From services that provide recipes accompanied by pre-portioned and -packaged ingredients such as Blue Apron and HelloFresh to those that send fully cooked meals ready to heat up, demand soared over pre-COVID levels. Now, as different areas loosen and tighten their COVID restrictions in response to ongoing changes, many of these services are finding ways to make their products stick as consumers’ routines evolve and adapt.

You might also like: How The Pandemic Is Driving Subscribers’ Hunger For Meal Kits

Post-Pandemic Future Remains Uncertain For Meal Subscription Services

On Monday (Aug. 9), Nestlé-owned weekly food subscription service Freshly, which delivers cooked, ready-to-heat meals, announced its first plant-based line, which features six vegan meals. Looking ahead, the company aims to embed its offerings into more consumers’ daily routines and create more frequent use cases, debuting new menus and targeting different meals.

See also: Nestlé Buys Meal Delivery Platform Freshly For $950M

“A big part of our goal as we joined forces with Nestlé was really to expand our product portfolio on our product offering,” Freshly CEO and Co-Founder Mike Wystrach told PYMNTS in an interview. He pointed to not just the new plant-based line but a line targeting health- and exercise-focused consumers and another aimed at families, both of which have launched since the Nestlé acquisition. “As we look at the plant-based proteins and moving in there, so we’ll continue to reach more consumers, and then dayparts … breakfast, snacks, desserts, grab-and-go stuff,” he said. “Those are all areas that we look at the next year [or] two.”

Taking On The Aggregators

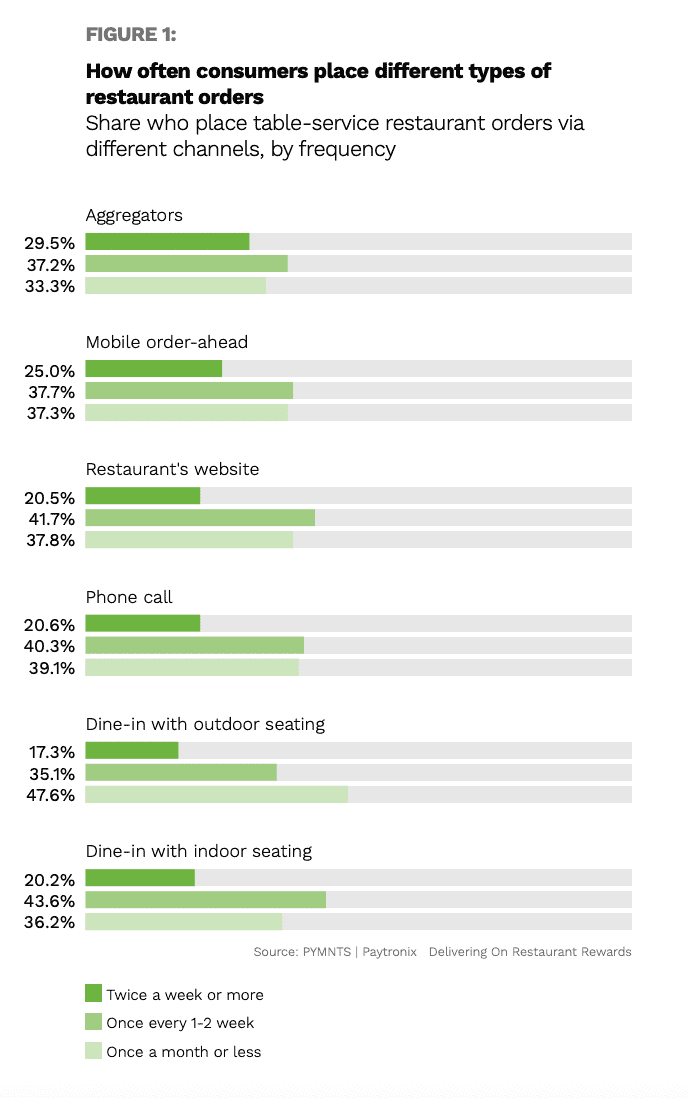

Of course, meal subscription services were not the only food delivery businesses that benefitted from consumers’ desire for socially distant food options. Third-party delivery services also saw sales skyrocket, and their customers are making these services part of their weekly routines. PYMNTS data from the July/August edition of our Delivering On Restaurant Rewards report, created in collaboration with Paytronix, find that 30 percent of restaurant customers ordering via aggregator do so at least twice per week.

Read more: NEW DATA: Two-Thirds Of Consumers Find Restaurant Rewards Impersonal

Despite Freshly preparing the food itself, it considers itself in competition not so much with restaurants, grocery stores, or other meal subscriptions as with these third-party delivery services.

“Our closest competitor is … probably your Grubhub, Uber Eats, your delivery guys,” Wystrach said. “They’re really focusing on convenience and how consumers get food when they’re at home and they don’t want to cook — I think that’s really the use case of our consumers [too].”

He added that Freshly’s customers opt for its products because of the healthiness of the foods and because the price of a Freshly meal is 50 to 60 percent lower than a third-party delivery order (including tips and fees).

In Process

While nearly all plant-based brands emphasize the environmental benefits of their products, Freshly aims to stand out by focusing also on health benefits. Specifically, while plant-based diets do have a reputation for being healthier, Wystrach noted that, somewhat counterintuitively, many of the leading alternative proteins tend to be highly processed, which can have a negative impact on their health benefits.

“So yes, you’re lowering the carbon footprint, but you’re also maybe not doing some of the benefits you’d like to do on health,” he said. “So what we really want to do is approach it as a win-win, where you can get alternative plant-based proteins, but leave behind all the processed stuff.”

While consumers’ interest in health foods is far from a new phenomenon, demand for nutritious options grew in the early months of the pandemic. PYMNTS’ June 2020 How We Eat report noted findings that 39 percent of consumers reported eating healthier since the start of the pandemic. Additionally, studies continually find that the health food market is growing mid- to high-single digits every year.

See also: New Report: Sam’s Club On Bringing The Digital Shift To Warehouse Stores

Reopening And Re-Closing

To some degree, every food seller is in competition with every other food seller — as consumers who do not want to cook return to restaurants, for example, services such as Freshly may lose a sale. Consequently, COVID restrictions can directly affect sales. In an April interview, Wystrach told PYMNTS, “We should anticipate that some people may not feel comfortable eating in any sort of restaurant setting for some time.”

Speaking to how the situation has changed with both the progress (and sometimes lack of progress) of the vaccine rollout and to the rise of the Delta variant, Wystrach said the only constant seems to be inconsistency.

While consumers have been “ebbing and flowing into restaurants and out of restaurants,” he said, it will be a long time before restaurants’ workday lunch occasion comes back to pre-pandemic levels, if ever, with the continuation of work from home and hybrid work trends.

Ultimately, he believes that that the online food delivery market will catch up to other eCommerce industries in the years ahead. He noted that the market soared during the pandemic from comprising 3 to 4 percent of consumers’ food spending to around 12 percent.

“I think that trend line is going to continue at that accelerated pace and get closer to where retail is,” he said, predicting that, as with retail, 25 to 30 percent of the category will be made up of online delivery orders. “I think you’re going to get to see parity in the food landscape.”