The love affair with grocery delivery subscriptions may be peaking, a trend that could benefit Walmart.

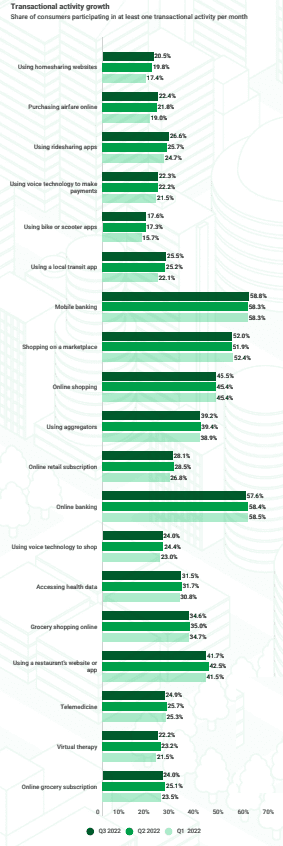

This, as PYMNTS’ report, “How the World Does Digital: Different Paths to Digital Transformation,” collected data from 30,174 individuals across 11 countries and showed a 4.5% sequential reduction in grocery subscription engagement in the third quarter of 2022 versus the second quarter.

This was the most pronounced “scale back” across all pillars that we measured, outpacing the roughly 2% declines seen in consumers’ use of telemedicine and restaurant apps.

The implication here is that people are taking more of their daily activities to an in-person setting, going to restaurants and doctors’ offices more often. And to the grocery store too.

The recent news that Instacart’s valuation (Instacart has non-subscription and subscription offerings) has been ratcheted down four times in the span of a year speaks volumes to how investors view possible speed bumps ahead amid the great reopening, and amid a general eCommerce slowdown.

To be sure, the delivery space is crowded and still popular. Instacart is jousting with the likes of Uber Eats and DoorDash to gain consumer mind and wallet share. And a number of partnerships struck in recent weeks have shown, for example, Target investing in grocery delivery as Shipt saw orders increasing 11% year on year.

But for the providers that are relying on subscriptions, the aspiration for wallet share may have to be tempered a bit. Consumers have less disposable income, and inflation continues to pressure what can be spent on even life’s essentials, including putting food on the table.

Walmart a Beneficiary

While subscription use may be pressured, brick-and-mortar stands to benefit. Walmart has seen a notable uptick in foot traffic and in spending in the proverbial aisles. The company noted in its recent earnings call that there has been strength in its grocery business, in stores and online, in key markets like the United States and Mexico. Higher income consumers have been visiting the stores more often, too, according to commentary on earnings calls.

Walmart’s third-quarter presentation also noted that there was mid-teens percentage point growth in comparable sales in its grocery segments. Drill down a bit, and the company said that the food “units” purchased gained ground year over year, and consumables such as pet and personal care items also grew, which seems to indicate that consumers are finding a broad swath of what they need in the aisles.

The pivot toward in-store visits may help Walmart in its perennial battle for consumer spend versus the likes of Amazon. Earlier in the year, Walmart dominated the food and beverage segment, with roughly 18% market share compared to Amazon’s roughly 2% share. The Connected Economy data cited above — where subscription use has been pressured a bit — also signals that Amazon and others may see less outsized growth here than competitors with lower-cost, offline offerings.

There are a few wildcards in the mix — such as weather, the specter of tripledemics, and gas prices — that could cause consumers to click on buy buttons to get food delivered to the doorstep. But all else being equal, the urge to get out and about and find our daily bread (literally) seems to be winning.